Now what?

Now what?

Yesterday we talked about the accounting shenanigans in the US Transportation bill and this morning the EU Finance Ministers are rushing delivery of the $125Bn of Spanish bank aid that was promised last month (which rallied the markets then) to begin in July (now) and are giving Spain an extra year to get thier budget deficit back in line, which essentially guarantees the delivery of the whole $125Bn (actually $123Bn now as the Euro drops more every day) with no strings attached.

This is not new stimulus, it's faster stimulus! This is like having a patient who needs 4 pints of blood and you only have two pints of blood but you make up for it by sticking two tubes in him to deliver it faster – it's STILL NOT ENOUGH and I just warned our Members this morning that the pre-market "rally" (up 50 on the Dow) looked like a futures shorting opportunity to me.

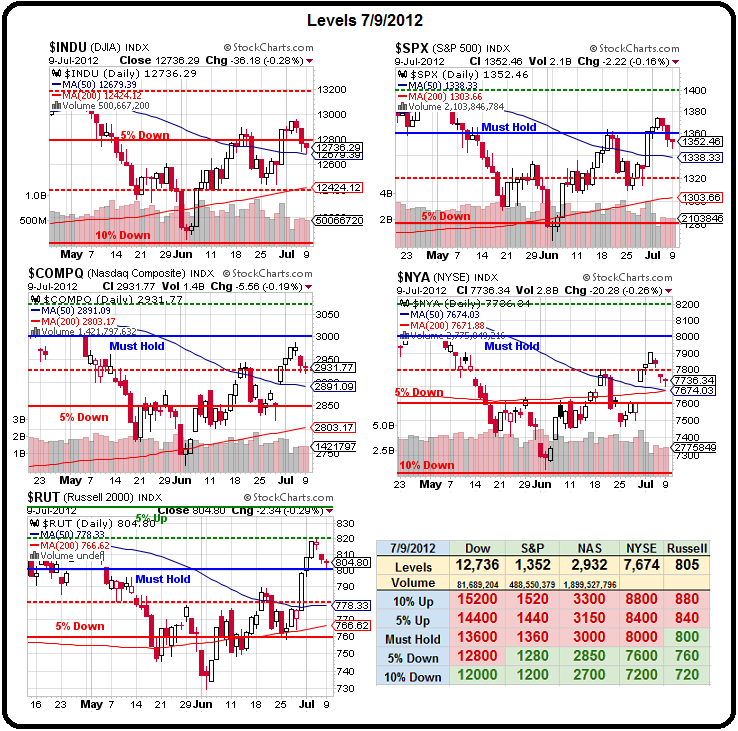

As you can see from David Fry's S&P chart, long-term, we are still forming a very nasty "M" pattern, where the right side top of the M at our 1,360 line (Must Hold on our Big Chart) is consolidating at lower highs than the left top and there's a very real danger here of a drop all the way back to the 2011 lows at 1,100 if we fail to hold support at 1,280, which is our -5% line.

As you can see from David Fry's S&P chart, long-term, we are still forming a very nasty "M" pattern, where the right side top of the M at our 1,360 line (Must Hold on our Big Chart) is consolidating at lower highs than the left top and there's a very real danger here of a drop all the way back to the 2011 lows at 1,100 if we fail to hold support at 1,280, which is our -5% line.

We simply do not have enough stimulus yet but we can't count the market out because we are getting more – lots more. As David notes:

Bank of Japan apparently is ready to increase its QE (bond buying) efforts as the Bank of England has increased theirs. The Peoples Bank of China (PBOC) has joined the easing activities by lowering rates and of course the ECB has been at it for some time in the eurozone.

At some point we enter uncharted waters since we’ve never experienced this amount of money printing without positive effect. After all can anyone really say it’s actually working or has worked? Liquidity injections by most evidence have had only ephemeral effects at least in boosting stock prices over the short-term. When then is pushing on a string finally going to be just that?

"The Fed is running out of balance sheet," says hawkish St. Louis Fed President Bullard following a speech in London this morning. Monetary policy is appropriate, he says, with no current need for QE3, although his Global outlook is gloomy, to say the least:

"The Fed is running out of balance sheet," says hawkish St. Louis Fed President Bullard following a speech in London this morning. Monetary policy is appropriate, he says, with no current need for QE3, although his Global outlook is gloomy, to say the least:

Recent readings on the global economic outlook have been tepid. Europe taken as a whole is in a recessionary state, and the uncertain effects of the ongoing sovereign debt crisis continue to weigh on the medium-term outlook. Global investors are dividing Europe once again into member states, a sort of market-based disintegration of the continent.

The U.S. is growing, but at a sluggish pace. Recent data from China suggest a slower pace of growth than might have been expected earlier this year. Commodity prices have fallen to lower levels during recent months in part in response to the slowing global economy. Inflation readings have generally been lower. This constellation of data is causing considerable unease in global financial markets and in policymaking circles. Much of the unease can be traced to the increasing realization that the European sovereign debt crisis may be more traumatizing and more intractable than previously understood.

Well, isn't he just a ray of sunshine? Small wonder the NFIB Small Business Optimism Index dropped -3.0 to 91.4, which was even below the gloomy expectations of 92.0, down from 94.4 in May. The report is a clear indication of slow growth with 23% of owners cites weak sales as one of the most important business problem. How the Russell is holding that 800 line is anyone's guess.

Well, isn't he just a ray of sunshine? Small wonder the NFIB Small Business Optimism Index dropped -3.0 to 91.4, which was even below the gloomy expectations of 92.0, down from 94.4 in May. The report is a clear indication of slow growth with 23% of owners cites weak sales as one of the most important business problem. How the Russell is holding that 800 line is anyone's guess.

Speaking of gloomy expectations, let's not read too much into AA's earnings beat yesterday as the .06 vs. .05 expected only works because, over the past 90 days, estimates came down from .09 to .05.

Europe is up strong this morning (about 1.25%) ahead of the US Open on all the excitement over the Spanish loan and AA's earnings. Our Futures took a brief dip with the Dow giving back all 50 points it had gained but now it has gained it back again for another test of 12,750 to short from (/YM in the Futures), which should be roughtly 12,800 at the open so we'll call that the day's critical line – along with 1,360 on the S&P, 2,950 on the Nasdaq, 7,750 on the NYSE and 815 on the Russell.

Anything less than that and we're not going to be terribly impressed with the latests sugar high.