This will be an easy one to call.

This will be an easy one to call.

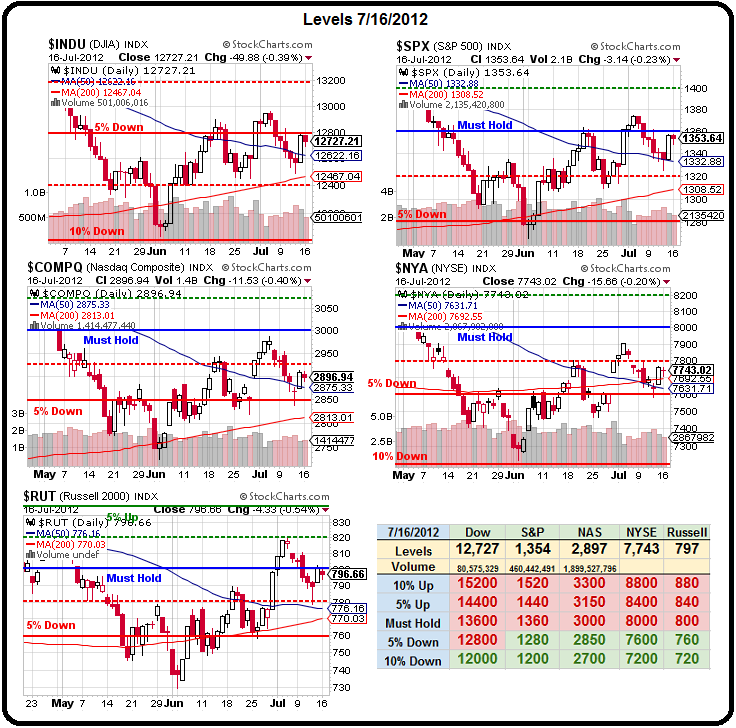

Other than our exciting spike up on Friday, we've been on a big downward spiral along the declining 50 dma lines and even our ill-gotten gains have only taken us to our expected resistance lines on the Big Chart. As usual, we have a pre-market pump job sending us higher but what matters is what sticks in actual trading and, as you can see – the volume is simply too lame to get us over significant resistance points.

Today is day one of Ben Bernanke's "Humphrey Hawkins" testimony on Capitol Hill where he will tell Congress the recovery is moving very slowly (but still recovering) and it's up to Congress, not the Fed, to step in and do something more.

Then the Congresspeople of each party will attempt to score political points for their respective parties and then the farce will end and we'll do it all again tomorrow – as if it matters. What really matters is tomorrow afternoon's Beige Book from the Fed along with a lot of housing data to finish the week and, of course, earnings – which have been a fairly mixed bag so far.

Goldman Sachs (GS) reported this morning with a substantial beat of .60, giving them $1.78 of earnings per $97.50 share – so a beat of low expectations buy 4x $1.78 is less than $8 and we've got a p/e of 12 for a company who's income has gyrated wildly – to say the least. STT also beat by a bit with MTB putting in a win as well. INTC is out later and that one will move the Nasdaq but expectations are a very low .52 per $25 share – about the same p/e as an investment bank.

Goldman Sachs (GS) reported this morning with a substantial beat of .60, giving them $1.78 of earnings per $97.50 share – so a beat of low expectations buy 4x $1.78 is less than $8 and we've got a p/e of 12 for a company who's income has gyrated wildly – to say the least. STT also beat by a bit with MTB putting in a win as well. INTC is out later and that one will move the Nasdaq but expectations are a very low .52 per $25 share – about the same p/e as an investment bank.

Earnings are nice but, as you can see from the chart on the left – it's ALL about the Fed. As we discussed last week – pretty much the entirety of our "recovery" since the March, 2009 lows has been based on anticipation of Fed action – the rest is just noise. This has been going on since the Fed went activist in 2001 and, as you can see – the effect has been magnifying since then as MORE FREE MONEY cures all ills – until it doesn't, of course.

To sum it up, the S&P is now 50% fluff, propped up by promises and expectations of easy money and the last time the punch bowl got taken away was a summer day just like this one in an election year just like this one when it finally became clear to investors that the stimulus train was reaching the end of the tracks. What a little temper-tantrum the markets had then!

Of course oil was $145 in July of 2008 and the Freddie, Fannie crisis was just beginning but no one (not even us) was prepared for the length and depth of the crash that was to come over the next few months. If I am too often "cashy and cautious" these days – it's because of the way I saw the markets act back in 2008 – there was no strategy to save bullish positions, other than taking a loss and waiting for them to drop another 30-40% and then HOPING that held.

Of course oil was $145 in July of 2008 and the Freddie, Fannie crisis was just beginning but no one (not even us) was prepared for the length and depth of the crash that was to come over the next few months. If I am too often "cashy and cautious" these days – it's because of the way I saw the markets act back in 2008 – there was no strategy to save bullish positions, other than taking a loss and waiting for them to drop another 30-40% and then HOPING that held.

Hope is, of course, not a valid investing strategy and we have been patiently sitting our the first two weeks of earnings, waiting to see if some sort of pattern emerges and, so far, there is none.

Last week's early reporters were a sea of red but this week is improving a bit (albeit against low expectations) while we wait for news from AIR, INTC, IBKR, MBFI, URI, WYNN and INTC tonight; BAC, BK, BLK, CHKP, FRC, HON, NTRS, PNC, BPOP, STJ, SWK, USB, GWW, AXP, CLB, EWBC, EBAY, IBM, KMP, NE, QCOM, SLM, and YUM tomorrow and another 100 on Thursday and over 1,000 more next week. THEN we'll have a pretty good idea of what the markets are doing, right?

So no need to rush into things today. I'm just back from vacation and will be catching up on things but let's not kid ourselves – if Bernanke doesn't wave the money wand (and we have no reason to think he will) for Congress this week – I don't think we're going to see earnings strong enough to take our indices to the promised land.