“We have reached a profound point in economic history where the truth is unpalatable to the political class — and that truth is that the scale and magnitude of the problem is larger than their ability to respond — and it terrifies them.” – Hugh Hendry

Hendry also says: "Bad things are going to happen and I still think the closest analogy is the 1930s." I have said for a long time that the only thing separating us from the Great Depression is that, so far, we haven't had a massive drought.

Well – so much for that happy thought. The nation's widest drought in decades is spreading, with more than half of the continental United States now in some stage of drought and most of the rest enduring abnormally dry conditions. Only in the 1930s and the 1950s has a drought covered more land, according to federal figures released Monday. So far, there's little risk of a Dust Bowl-type catastrophe, but crop losses could mount if rain doesn't come soon.

Around a third of the nation's corn crop has been hurt, with some of it so badly damaged that farmers have already cut down their withered plants to feed to cattle. As of Sunday, the U.S. Department of Agriculture said, 38 percent of the corn crop was in poor or very poor condition, compared with 30 percent a week earlier. Climatologists have labeled this year's dry spell a "flash drought" because it developed in a matter of months, not over multiple seasons or years.

"We can't say with certainty how long this might last now. Now that we're going up against the two largest droughts in history, that's something to be wary of," Jake Crouch of the National Climate Data Center said. "The coming months are really going to be the determining factor of how big a drought it ends up being."

In northwest Kansas, Brian Baalman's cattle pastures have dried up, along with probably half of his corn crop. He desperately needs some rain to save the rest of it, and he's worried what will happen if the drought lingers into next year. "I have never seen this type of weather before like this. A lot of old timers haven't either," Baalman said. "I just think we are seeing history in the making."

Historical droughts are, of course, no surprise to those who have accepted the idea that Global Warming is bad and was bound to have these kinds of side effects. Now we can tally the economic cost of inaction – something the Global Obstructionist Party has been sweeping under the rug during a decade of denial. Last week, a 46 square-mile glacier broke off Greenland and fell into the sea after having been stable for the past millennium. "This is not part of natural variations anymore," said NASA glaciologist Eric Rignot.

Oil is back up at $90 a barrel and gasoline prices never did come back down. Add in spiking food prices or even food shortages as drought destroys our crops on top of already shaky conditions in many countries and we have the makings of a real disaster in the works.

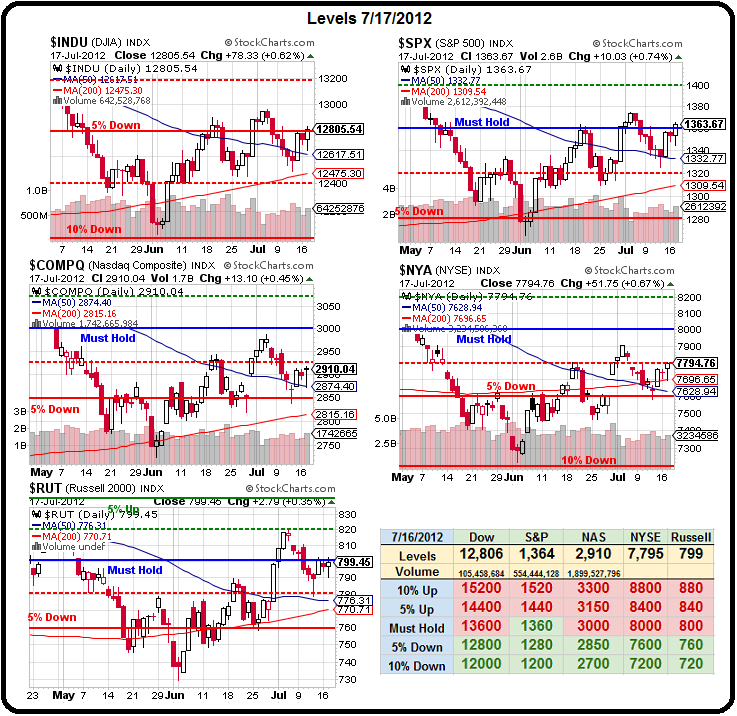

We had a big up and down day in the markets yesterday as the S&P dropped 1% at the open but then fully recovered into the day's end and added 0.78% for good measure, finishing at 1,363 but it was the only index over its 5% line for the day but the week ain't over yet.

We had a big up and down day in the markets yesterday as the S&P dropped 1% at the open but then fully recovered into the day's end and added 0.78% for good measure, finishing at 1,363 but it was the only index over its 5% line for the day but the week ain't over yet.

At 9:43 yesterday morning, I called shenanigans on the move up, pointing out to our Members that the volume was very low and the opening spike looked like a bear flush.

The NYSE fell right down to test it's 200 dma at 7,696 but held it, leading me to flip-flop at 10:55, saying to Members:

Since Bernanke is all bad news and we're down half a point – I think we now get a relief rally when he stops talking and the MSM can gear up their spin machine this afternoon.

That caught the day's low right on the button and it was all uphill from there but we flipped bearish again into the close, taking advantage of the S&P moving over our 1,360 target (but not in the Futures) to grab some SPY July (Friday) $136 puts at .60 – looking for a little pullback this morning as Benrnake heads back to the Hill to depress us some more.

Anyone would be depressed reading the Fed's 55-page Monetary Policy Report with no real signs of improvement on any of them. Lots of charts, lots of graphs but none say it better than these two charts from Zero Hedge (thanks Inkarri), which show us how the current US "recovery" is clearly not sustainable because it's not helping the working people in this country, nor is it adding to GDP – it's just top-down profit inflation paid for in declining wages for the Middle Class – an economic shell game in which the top 1% takes more from the bottom 99% at levels that are now 3 TIMES MORE than average.

Well of course the top 1% need to extend their tax cuts – you can't expect them to pay taxes on all those profits, can you? Let Labor pay the taxes – their compensation is hardly negative this year so it's about time they started pulling their weight, right?

Keep that in mind before you celebrate the next Corporate Profit report – it's easy to do well when your workers are paying you for the privilege of still having a job. We remain very cashy and cautious (and anxious to go short on oil at $90) ahead of Bernanke and ahead of the Beige Book at 2pm but keep in mind that's going to be pre-earnings and pre-drought so, for now, we watch those techincals for a break one way or the other:

Be careful out there!