Put up or shut up time.

We had a very extensive discussion in this morning's Member Chat already, discussing the BOE, the ECB, China, Europe, AAPL vs. Samsung, China's draining of liquidity, etc. so forgive me if I'm not in the mood to cover that ground again.

What I do find worthy of more discussion is this nice breakdown of the Russell by Bespoke, which highlights how tough things are becoming for small business in America. Actually, these businesses aren't that small as they are public companies but compared to our top 1% Big Businesses – they are but dust in the wind.

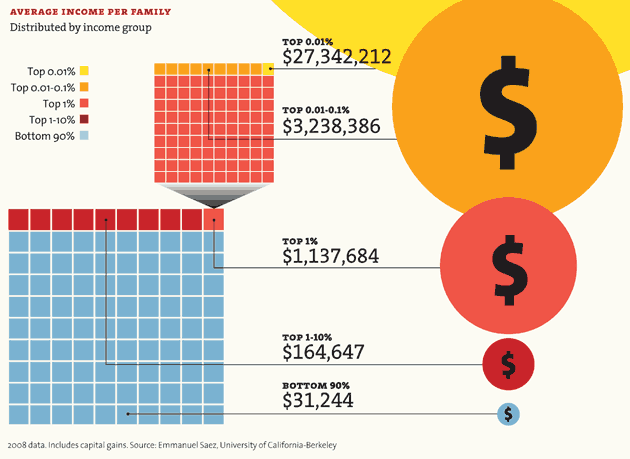

It's no secret that this country is now run for the sole benefit of the top 1% and the bottom 99% are nothing more than Matrix-like human cows – to be penned in and drained by the top 1% as they force them to work off a lifetime of debt that begins with the student loan they need before being "qualified" to get their first job and culminates in medical bills that wipe out whatever meager savings they were able to accumulate during their non-stop working lives (other than that 2-week vacation, of course!) and, of course, the massive bill for burying you when you die!

When you are in the top 1%, $200,000 for college and $20,000 to have a baby and $200,000 deposits on $1M homes and $1,500 a month medical insurance are just bills that get paid, leaving plenty of money on the side to speculate in rising food and commodity prices so we are actually PLEASED when we go to the gas station and pay $4 a gallon and PLEASE when each bag of groceries costs $50 because – although we pay $60 a tank to fill up along with the rest of you – we ALSO invest in companies that charge 200M other American drivers $60 a tank and $200 for groceries and we GET part of the profits on that $52Bn a week that even the bottom of the bottom 99% must pay for food and groceries.

We own the electricity and the cable companies and the gas companies and your phone company and, of course, the banks you pay those loans to. The 1% doesn't struggle during hard times – we just raise our fees!

We own the electricity and the cable companies and the gas companies and your phone company and, of course, the banks you pay those loans to. The 1% doesn't struggle during hard times – we just raise our fees!

Like the fees we're going to raise on the bottom 99%'s income taxes under the new Romney tax plan, in order to fund our 3-4% tax DECREASES because, after all – you don't want the "Job Creators" to suffer, do you? What would be the point of us suffering when you can all suffer for us? That's the natural order of things and you idiots vote for it – it's like the sheep are begging to be fleeced so who are we not to bring the little lambs to the slaughter?

This tax program will cost the US 4% of it's current tax revenues, just $100Bn a year because 99% of the people pay more while only 1% pay less so it's fair AND balanced! Don't worry about the $100Bn – it's just more debt and you guys can pay that later – just like the last $16Tn we dumped on you.

This tax program will cost the US 4% of it's current tax revenues, just $100Bn a year because 99% of the people pay more while only 1% pay less so it's fair AND balanced! Don't worry about the $100Bn – it's just more debt and you guys can pay that later – just like the last $16Tn we dumped on you.

If that debt ever becomes a problem down the road – I'm certain we can solve it with more tax breaks! We discussed in yesterday's post how Bill Gross pointed out that, in the past 100 years, the top 1% has already used the stock market to capture almost 1/2 of America's total wealth – these policies will insure the other half will be in good hands in the next Century and Mitt Romney will take us to that promised land, where ALL of the assets are in the hands of people who know how to create jobs – even if those jobs are working under the whip of an overseer building monuments to the greatness of the top 1%.

8:30 Update – We had no action from the BOE and no action from the ECB and now Draghi is saying the ECB "MAY CONSIDER" undertaking non-standard measures to boost the economy IF it continues to deteriorate……………………. ROFL!!!! That's it suckers – NO QE FOR YOU!!!

We are, of course, loving it as we dumped out longs and went short into the suckers rally. If you've been reading my posts for the past week, you can see how I built my case for this outcome and even this morning, the top 1% who play the Futures in our chat room were able to short the Dow (/YM) at the good old 13,000 line and Oil (/CL) at $89 and both positions are already on their way to $1,000 per contract profits in just 10 minutes (8:40) so please, don't fret about how a sell-off will hurt the job creators – we're fine and, by the way – due to the recent economic downturn – you're fired! Muhahahahah….

Oh dear, in the time it took me to find that video (8:44) we're now down to 12,861 on the Dow futures and oil is looking like it may fail $88. The Dollar flew back to $82.92 from 82.25 and the Euro plunged from $1.24 to $1.2274. We'll see if gold can hold $1,600 now that NO ONE is doing more QE. Silver is plummeting to $27, copper is a very lame $3.32 and natural gas (/NG) is down to $3.10. If oil falls below $88 then gasoline (/RB) becomes an interesting short below the $2.85 line.

Oh dear, in the time it took me to find that video (8:44) we're now down to 12,861 on the Dow futures and oil is looking like it may fail $88. The Dollar flew back to $82.92 from 82.25 and the Euro plunged from $1.24 to $1.2274. We'll see if gold can hold $1,600 now that NO ONE is doing more QE. Silver is plummeting to $27, copper is a very lame $3.32 and natural gas (/NG) is down to $3.10. If oil falls below $88 then gasoline (/RB) becomes an interesting short below the $2.85 line.

Draghi is still talking so the bulls haven't lost all hope yet but I can't see what there is left to be bullish about at this point – other than the fact that Uncle Mitt is going to cut our taxes by 4% and brilliantly balance it by taking "only" another 1.2% from the bottom 99%, who are not only too stupid to complain about it but they will actually (get this!) VOTE for this plan! It is F'ing BRILLIANT!

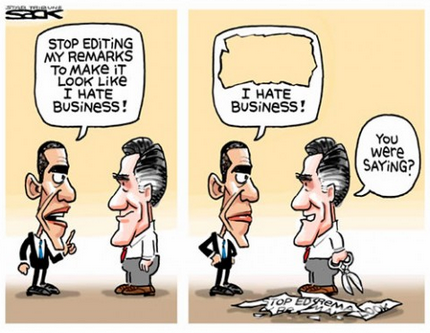

Obama wants to raise takes on the rich (including rich businesses, who pay almost no taxes) and lower them to the poor (including poor businesses, who pay ridiculous taxes) and – even worse – he thinks people deserve affordable health care! If the bottom 99% can afford health care, how do we keep them in debt to us? Ridiculous… Fortunately, all we have to do is call Obama a Kenyan Socialist and call Romney a Job Creator and half the bottom 99% march out and vote for their own tax increases – BRILLIANT!!!

Obama wants to raise takes on the rich (including rich businesses, who pay almost no taxes) and lower them to the poor (including poor businesses, who pay ridiculous taxes) and – even worse – he thinks people deserve affordable health care! If the bottom 99% can afford health care, how do we keep them in debt to us? Ridiculous… Fortunately, all we have to do is call Obama a Kenyan Socialist and call Romney a Job Creator and half the bottom 99% march out and vote for their own tax increases – BRILLIANT!!!

8:56 Update: 12,800 and that's goaaaaaaaaaaaaaaal for our $1,000 per contract on the Dow and $88 is goaaaaaaaaaaaaaaal for our $1,000 per contract on oil so our Egg McMuffins are paid for and now we expect a bounce and the question is how much of one will we get?

With a 200-point dump in the Dow Futures to 12,800 (12,850 in the regular index), we'll be looking for a bounce to 12,840 as "weak" and 12,880 as "strong" but we're not impressed at all until we're back over 12,900 (50% retrace), which should be 12,950 in the regular session. Without doing all the math, that will be 1,370 on the S&P, 2,900 on the Nasdaq, 7,800 on the NYSE and 770 on the Russell. I don't think we'll be making those but you never know what those crazy Trade Bots will do once they turn the markets on.

9:10 Update: Holy cow, Spain is now down 5% after being up 3% before Draghi's press conference. That's what you get for believing anything a guy from Goldman Sachs has to say! Mario just said that Spain will "almost certainly" submit for a bailout (becoming the next Greece with all the psychotic austerity measures and loss of sovereignty that entails) and let's not forget this whole mess started when GS helped Greece cook their books in order to join the EU and take on massive and unsustainable levels of debt. Now, conveniently, a guys from GS is pulling Greece's strings and will soon have his hooks in Spain as well.

Strap yourselves in folks – it's going to be a wild one and, if we're not down 2% or more by the end of the day, that would be a surprising show of strength.