$85Bn a month!

$85Bn a month!

Oh boy was I wrong when I said Ben Bernanke wasn't crazy enough to ease into a bull market. Yesterday, he exercised the full power of the Federal Reserve to confiscate your wealth and hand it over to the bankers. That's right, by engaging in what many consider reckless money-printing practices and announcing there is no end in sight, Bernanke caused the Dollar to fall below 79, down from 84 (6%) before all this QE talk began.

That's like taking all $100Tn worth of US Assets – everything you worked for your entire life – and just devaluing them by 6%. Many of our Conservative friends decry the 1% tax on wealth imposed by the French – but at least they are honest about it. At least they debate it and vote on it. Not Bern Bernanke – the Federal Reserve Chairman simply decrees that you will contribute 6% of your dollar-denominated assets towards more bank bail-out and there's no cut-off if you are below the top 2% – this is a confiscation from every man, woman and child in America.

How far down will Dr. Bernanke take your Dollars? That's the beauty of it – there's no limit! He warned Corporate America yesterday that he will continue to give them FREE MONEY as long as they keep refusing to hire more workers. The less American workers they hire – the more money he will give them. Sure, they can hire and spend overseas (most are) because that won't affect US unemployment rates but, if they start hiring Americans – THAT's when he will begin to take away the punch bowl.

See how this scam works?

It is hard to see how another round of QE would help the economy. Long-term interest rates are already at historic lows. With rates this low, even if QE put effective downward pressure on rates — a dubious proposition — the economy would be unlikely to benefit. If a 3.5% mortgage rate is of little consequence, there is no reason to believe that a 3.4% or even 3.3% rate would suddenly produce results.

Nor would quantitative easing result in a burst of money creation, as per traditional monetary policy, because the Fed now pays a quarter-point interest on excess bank reserves. With little growth in the demand for private credit, banks have chosen to leave their additional reserves on deposit with the Fed, earning this paltry but completely safe return.

Nor would quantitative easing result in a burst of money creation, as per traditional monetary policy, because the Fed now pays a quarter-point interest on excess bank reserves. With little growth in the demand for private credit, banks have chosen to leave their additional reserves on deposit with the Fed, earning this paltry but completely safe return.

The real problem with QE — beyond increased near-term uncertainty — is that the Fed must at some point unload all these bonds it has bought. The Fed will buy bonds in soft markets and sell them when interest rates are already rising, pushing interest rates up further, faster. The problem, in short, is that the Fed will have failed to prop up the economy when it was weak only to risk killing the recovery once it really takes off.

We discussed this and some other concerns I still have in Member Chat this morning. Meanwhile, we have to play the hand we're dealt and, for the moment, we've been dealt two aces and we MUST play our hand. Keep in mind we have to make 6% just to keep up with the devaluation of the Dollar the Fed is causing. For those of us who have real estate assets, metals and other commodities and, of course, stocks as the majority of our wealth – All is well as The Bernanke is working for us (top 1%'ers). I happen to be in Las Vegas this week, helping rich people get richer with Real Estate and then it's on to LA, where we look at ways to allocate some long-term investments in this market.

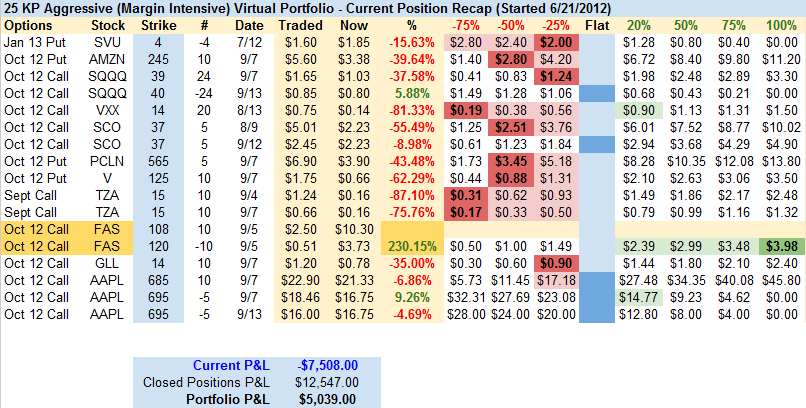

Also in Member Chat this morning (and sent out as an Alert to Members) we updated our uber-bullish Twice in a Lifetime List and we'll be taking a look at our long-term Bullish Income Portfolio this weekend. With virtual allocations of $500,000 in the Income Portfolio and $100,000 in the TWIL, our short-term $25,000 Portfolio was tasked with the job of protecting the rest. Thus we went aggressively bearish, but that was because we genuinely believed the Fed would disappoint the markets this week. Being wrong there cost us dearly as our virtual portfolio dropped from being up 60% just two weeks ago to now just up 20% since we began it in early June.

Also in Member Chat this morning (and sent out as an Alert to Members) we updated our uber-bullish Twice in a Lifetime List and we'll be taking a look at our long-term Bullish Income Portfolio this weekend. With virtual allocations of $500,000 in the Income Portfolio and $100,000 in the TWIL, our short-term $25,000 Portfolio was tasked with the job of protecting the rest. Thus we went aggressively bearish, but that was because we genuinely believed the Fed would disappoint the markets this week. Being wrong there cost us dearly as our virtual portfolio dropped from being up 60% just two weeks ago to now just up 20% since we began it in early June.

As you can see, we've made a lot of adjustments since last week but we haven't gone fully bullish yet, as we'd still like to see where we are next week before taking our losses on what's left of the short side. Not reflected here, of course, are our general bullish hedges like last Tuesday's 2 DIA Oct $135 calls at $1.23, selling 1 HPQ 2014 $15 put for $2.30 for net .16, now $2.05 for a quick 1,181% gain on cash – a very nice way to offset some losses on a few bearish plays. We have been picking aggressive offsets like this every Tuesday morning since the beginning of August and all 12 of them have exceeded their 300% return goals already.

Making money in a bull market is easy – especially with the low VIX giving us such cheap entries on long option contracts. Making 1,181% in 10 days is an excellent way to stay ahead of inflation (for now) and you don't need to make a major commitment to aggressive plays like this to keep a more conservative portfolio humming along. The FAS spread in our $25KP is one of those plays and already halfway to it's 500% upside.

Making money in a bull market is easy – especially with the low VIX giving us such cheap entries on long option contracts. Making 1,181% in 10 days is an excellent way to stay ahead of inflation (for now) and you don't need to make a major commitment to aggressive plays like this to keep a more conservative portfolio humming along. The FAS spread in our $25KP is one of those plays and already halfway to it's 500% upside.

So it pays to be patient and it pays to be cashy and cautious ahead of these events. Sure we may have missed some of the rally but now we can invest with a lot more confidence as we shift to a more bullish stance next week.

Have a great weekend,

– Phil