I love this part of a market.

I love this part of a market.

This is the part where the MSM begins to realize that Manufacturing is slowing down, stimulus won't create jobs, earnings are not going to be as good as expected, Europe is not fixed, housing is not as strong as expected and the stock market is being manipulated. Yep, all the stuff I've been telling you for months…

Last week I told you there will be a dip and we will be buying it and this morning, in Member Chat, Denlundy asked:

Phil: Immediately after Q3 was announced you discussed the possibility of a 3 to 4 percent drop before the Q3 injection would make its impact felt via rising indexes. Could this be what we are experiencing at present?

My answer to that was, of course, yes – this is it. So far, we're only down about 1.5% from the QE fever of less than two weeks ago but people are already freaking out like it's the end of the World as we know it. This is just what we expected to happen and also why we decided to hang on to the short positions in our $25,000 Portfolios after QE3 was announced – it doesn't really fix anything and the exuberance was irrational.

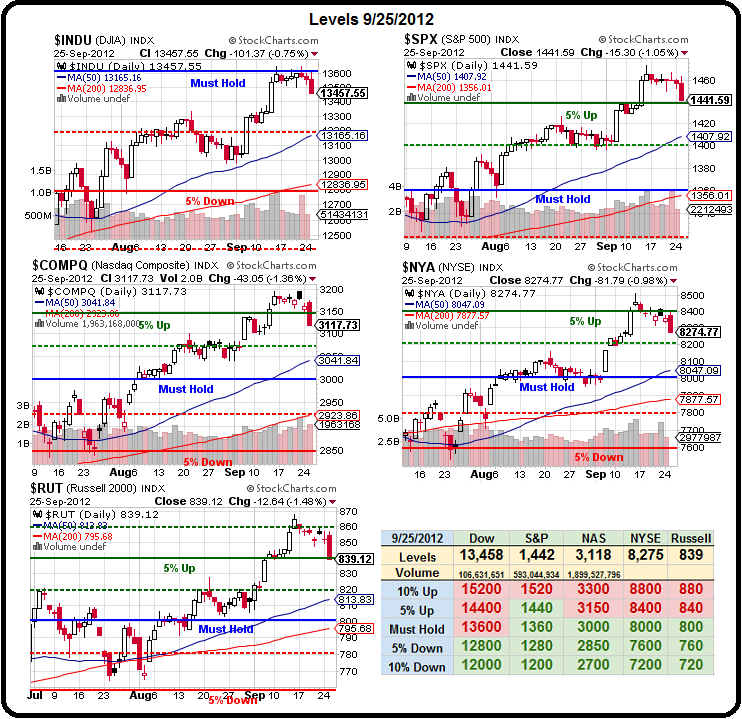

How far down is 4% – right to those rising 50 dma lines you can see in our Big Chart. That's what we're thinking the worst case should be as the Euro normalizes back below $1.30 and the Dollar normalizes back above 80 and THEN it's time for earnings and we'll be salivating over companies that have big sell-offs like FDX, CAT and JOY because it gives us a chance to get back into them 20-30% off the tops just in time for Global QE to begin to kick in (and it better happen soon – before China melts down – again).

We did a little bargain-hunting last week, in case there was no sell-off, but our main Income Portfolio is still less than 20% invested as we wait for those earnings "disappointments" to give us some good prices. Already we see analysts' expectations for earnings coming down sharply or, as we say at PSW – finally getting realistic…

I published a major portfolio update for our Members on Monday and, so far, it's looking like our TZA hedge (ultra-short Russell) is right on the money with the Russell diving from 865 to 840 (2.9%) since last week and still another 25 points away from the 50 dma at 815. Hopefully we won't end up testing those lines, but we do need to be prepared for it.

I published a major portfolio update for our Members on Monday and, so far, it's looking like our TZA hedge (ultra-short Russell) is right on the money with the Russell diving from 865 to 840 (2.9%) since last week and still another 25 points away from the 50 dma at 815. Hopefully we won't end up testing those lines, but we do need to be prepared for it.

Meanwhile, in pre-market (8:30) the Dollar is testing 80 and oil (/CL) is testing $90 so we hit that long on oil futures. This is the exact target we talked about last Thursday in the morning post, so no change in strategy – just a 2nd chance to execute it. The last one was good for a run back to $93 and that was a nice $3,000 per contract gain!

Also according to plan is the usual market sell-off into the 5 and 7-year note auctions. As I said to Members on Monday in reviewing the week ahead: "At least the Fed shuts up this week but 5 & 7-year notes Weds and Thurs often come with dips to encourage buyers." So we're right on schedule with TLT heading back to $125 as Treasury looks to peddle about $70Bn worth of paper today and tomorrow. The last round of auctions were a bit disappointing as we were rallying so we didn't expect "THEM" to let things slide twice in a row or soon it will be Americans taking to the streets and rioting as our country finally is no longer able to borrow $100Bn a month to pay its bills.

That's what was going on in Spain last night and what is going on in Greece this morning – kind of makes our own Occupy Wall Street movement look a little wimpy, doesn't it? Spain is looking more like Greece, as austerity protests and planned budget cuts shoot yields on Spanish 10-year bonds back near 6%. The Catalonia region announced snap elections for November 25th, which could lead to independence for Spain’s most economically important region and the IBEX is down 3.5% this morning on that news.

Don't forget they're even protesting in China now and the Shanghai Composite tested 2,000 this morning on a 25-point drop and barely held it at 2,004. Note that a significant deterioration in Chinese data is #3 on Zero Hedge's list of potential Global downside risks (great article) and is, I think, the most likely thing to tank the global economy. Unfortunately, I'd say it's not deterioration that worries me but the realization of the deterioration that is currently being covered up.

Don't forget they're even protesting in China now and the Shanghai Composite tested 2,000 this morning on a 25-point drop and barely held it at 2,004. Note that a significant deterioration in Chinese data is #3 on Zero Hedge's list of potential Global downside risks (great article) and is, I think, the most likely thing to tank the global economy. Unfortunately, I'd say it's not deterioration that worries me but the realization of the deterioration that is currently being covered up.

In some ways, that's good because I don't think China's economy has a lot further to fall – I just think it fell already and hopefully will begin to recover. What worries me is that, other than the CEO's of CAT and FDX – no one in the West seems to realize what a mess China is. The US fiscal cliff will be extended, Europe will muddle through, we discussed the inflation issue and how to hedge it on Friday, the sale of core bonds doesn't seem that likely as there's nowhere for the money to go but into stocks and that's why we like them long-term and protectionism is not too likely as our Global economy is now so entwined that those games should quickly end in ties.

We're still far from being gung-ho bullish – we're simply amused at how quickly others are turning bearish on the market's first dip in a month.