Are we ready to rally?

Are we ready to rally?

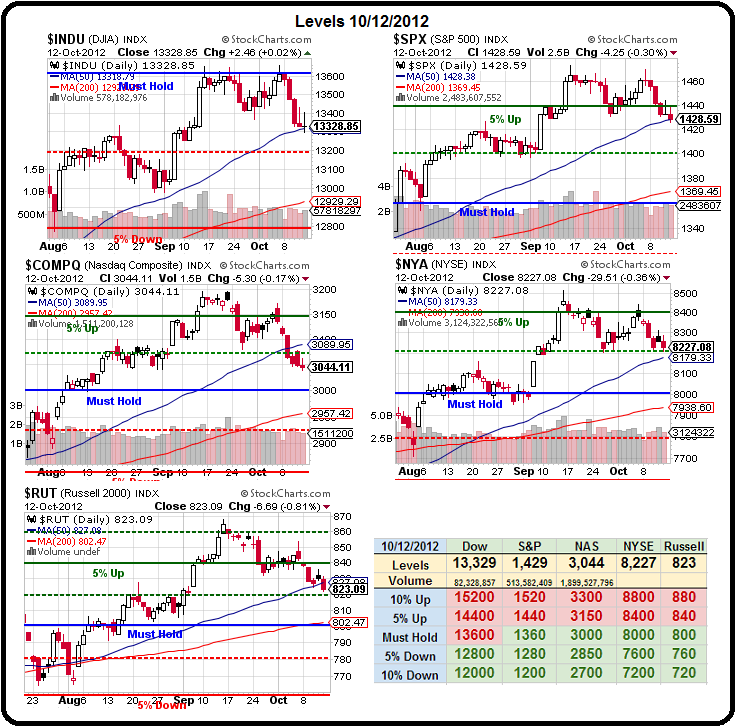

We certainly build enough bricks into our wall of worry over the past week as the markets gave up ALL of the QInfnity gains from 9/13 but, so far, as we expected – we're holding those 50 dmas – except on the APPLDaq, which has been shredded by the 10% decline in AAPL, which put a 2% additional drag on the index. As you can see from our Big Chart – the Nasdaq is, in fact, 1.5% below it's 50 dma so it's ALL APPL's fault.

Other than the Nasdaq, we're looking at 2.5% corrections (after a 13% run) in the S&P, NYSE and not even that much in the Dow (and that's a 20% retrace for those of you playing at home) and a 5% drop on the more volatile Russell but that hasn't stopped the TA fan-boys from declaring the World about to end – mostly because of the textbook "head and shoulders" pattern that seems to be forming on our indices.

I don't disagree with the Rorschach fans – we all see what we want to see and there's no denying that IF we fail the "neckline" – which is, effectively, the 50 dmas – THEN we do have serious problems with no real support until we drop at least another 2.5% to our Must Hold lines and, in the case of the Dow – it has yet to beat their Must Hold line at 13,600 – the line that's always kept us from getting too bullish.

I, for one, was extremely encouraged by Friday's Consumer Sentiment Index and we'll see if today's Retail Sales Report gives us an upside surprise (+0.7% expected) to confirm that consumers are putting their money where their sentiment is. Since we are living in the Appleconomy, we have to consider that the IPhone 5 went on sale in the last week of September and 5-7M IPhones at $500 each was probably $3Bn worth of ADDITIONAL spending that last week because I doubt the people lining up for IPhones were saying "I'm going to eat mac and cheese tonight so I can afford this."

I, for one, was extremely encouraged by Friday's Consumer Sentiment Index and we'll see if today's Retail Sales Report gives us an upside surprise (+0.7% expected) to confirm that consumers are putting their money where their sentiment is. Since we are living in the Appleconomy, we have to consider that the IPhone 5 went on sale in the last week of September and 5-7M IPhones at $500 each was probably $3Bn worth of ADDITIONAL spending that last week because I doubt the people lining up for IPhones were saying "I'm going to eat mac and cheese tonight so I can afford this."

So, unlike "leading economists", I'll say we hit 1% or so in this report and it will be nice to have an upside surprise, for a change, that ISN'T due to high gasoline prices. We also get the Empire Manufacturing Index at 8:30 this morning and that has deservedly low expectations of -2.8 and tomorrow we see CPI as well as Industrial Production and Capacity Utilization but, don't forget – consumers have to clear the shelves BEFORE the manufacturers get called upon to restock them so we're comparing leading to lagging indicators here.

Industrial Production took a 1.1% dive in August and, while that's not great for Corporate America, it's great for American labor as it indicates that there are no more gains to be had from cutbacks and efficiency interests and it may be time to start hiring.

Industrial Production took a 1.1% dive in August and, while that's not great for Corporate America, it's great for American labor as it indicates that there are no more gains to be had from cutbacks and efficiency interests and it may be time to start hiring.

Of course, the Non-Farm Payroll Report for September already suggests that's exactly what's happening but it was immediately called a fraud by the Conservative Media so what would normally have been a very market-positive event had almost the opposite effect in the recent turmoil.

Notice on the chart that Capacity Utilization is rising steadily – that indicates more machines are turned on more often so, of course, someone needs to be hired to push that button. This is, of course, one of those nasty "fact" things that Conservatives like to ignore – especially when it doesn't prove Obama is a Socialist so many of the people who draw their conclusions from reading the Generally Conservative Financial Media are unwilling to accept the possibility that our economy is actually improving in a fairly meaningful way.

JP Morgan crushed earnings on Friday and the Financial sector dropped 2% despite Dimon's bullish comments on housing. WFC was in-line and also participated in the drop. We mentioned the issue of charge-offs in Friday's post and that's keeping us cautious until we get past BAC and C's earnings but, on the whole, I'm still enthusiastic about the Financials in general (Dave Fry's chart left) – just as I was at the beginning of the year when we were shorting oil at $103 and long on XLF at $13.50. I suggested that there was no need to play the markets this year as simply playing BAC to win should give a nice total return without all the fuss. Our "One Trade" for 2012 was:

JP Morgan crushed earnings on Friday and the Financial sector dropped 2% despite Dimon's bullish comments on housing. WFC was in-line and also participated in the drop. We mentioned the issue of charge-offs in Friday's post and that's keeping us cautious until we get past BAC and C's earnings but, on the whole, I'm still enthusiastic about the Financials in general (Dave Fry's chart left) – just as I was at the beginning of the year when we were shorting oil at $103 and long on XLF at $13.50. I suggested that there was no need to play the markets this year as simply playing BAC to win should give a nice total return without all the fuss. Our "One Trade" for 2012 was:

BAC is still $5.75 and you can buy the stock and sell the Jan 2013 $5 puts and calls for $2.55 for a net entry of $3.20/4.10. So putting $32,000 into 10,000 shares of BAC and selling 100 puts and calls can make a profit of $18,000 (56%) in 12 months if BAC holds $5 (13% down from here) through next January’s expiration.

BAC is now $9.12 and the Jan $5 puts and calls are $4.13 for net $4.99 so just one penny under the full return already for a cash value on 10,000 of $49,990 off a $32,000 (56%) investment in 10 months. We don't do a "One Trade" every year – that one was just too good to pass up and, on Friday, we were once again naked and long on our "FAS Money" Financials play as we cashed out our short callers on the dip down to $15.80 on XLF and I said to Members in the Morning Alert that I couldn't see selling anymore XLF calls until we hit goal at $16.50. If we get past C and BAC without too much drama – I may still raise that target.

BAC is now $9.12 and the Jan $5 puts and calls are $4.13 for net $4.99 so just one penny under the full return already for a cash value on 10,000 of $49,990 off a $32,000 (56%) investment in 10 months. We don't do a "One Trade" every year – that one was just too good to pass up and, on Friday, we were once again naked and long on our "FAS Money" Financials play as we cashed out our short callers on the dip down to $15.80 on XLF and I said to Members in the Morning Alert that I couldn't see selling anymore XLF calls until we hit goal at $16.50. If we get past C and BAC without too much drama – I may still raise that target.

In Friday's chat we also added aggressive longs on TNA (ultra-long Russell) over the weekend but we conservatively covered our AAPL calls as that stock faltered at our critical $633 line. Generally, we've been more interested in bargain hunting so far and that remains true as long as those 50 dmas hold up but we'll have to see what news the morning data brings…

8:30 Update: No surprises in the data release (for us, leading economists – on the other hand – are dazed and confused) as the NY Manufacturing Index (lagging) is at -6.2 (but better than -10.4 in September) while the Retail Sales Report came in at a very healthy 1.1% and especially the Ex-Transport, Ex-Gasoline number was up 0.9% vs 0.4% expected so, as we figured – stuff is selling again.

C reported a big 88% drop in profits this morning but mainly as a result of a $4.7Bn write-down against it's stake in MS as well as the charge-offs we expected. Even so, they made $468M for the quarter or .15 per $35 share but, excluding he one-time charges, revenue was actually up 26% on Investment Banking, up 63% on Fixed Income and up 76% on Equity Markets Revenue for $5.136Bn in profits – even better than JPM! Needless to say, many savvy investors are peering past the headlines and taking C up 2.5% pre-market.

We'll be watching earnings closely this week to see which companies are doing well but we're guessing the game plan will be to stick with the companies that do most of their business in the US, Canada and Mexico as North America seems to be the best area of the World economically at the moment. Europe is still a total mess and, if they melt-down – it won't matter how good you feel about the US economy – we'll go down with them while my impression of China after reading up this weekend is they stand ready to support their economy at all costs – even going into debt for it.

Gee, I guess they are getting to be a little more like us every day…