Is the Fed losing it's mojo?

Is the Fed losing it's mojo?

Perhaps we are just impatient. We were discussing this topic in Member Chat yesterday as the so-far weak market action we're seeing since the announcement of QInfinity is beginning to make people wonder how we should position ourselves over the holidays.

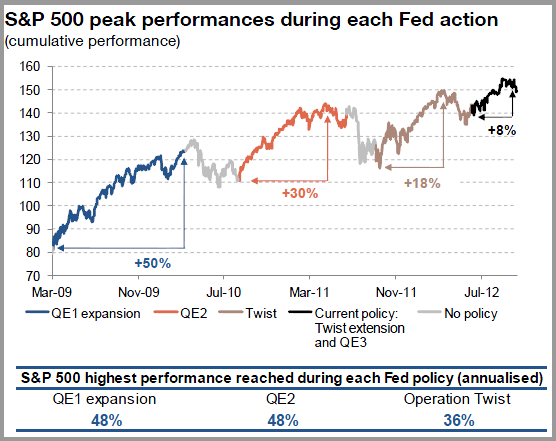

Clearly, so far, QInfinity is having much less effect on the market than it's predecessors but, measured over the short amount of time it's been in place – you can see from this chart that it's really not that far off track – yet. Also, the Fed naysayers fail to take into account that QE1 ($1.25Tn) was much bigger than QE2 ($600Bn) and that Operation Twist ($400Bn) was barely a stimulus at all but more a move to shift the yield curve.

Now we have QInfinity, where the Fed has committed $240Bn in Q4 and another $480Bn in 2013 and another $480Bn in 2014 and probably another $480Bn in 2015 so it's a huge amount of QE but it's also stretched over a long period of time so we shouldn't expect the markets to rocket on this type of stimulus but we can assume there's a floor being put in somewhere.

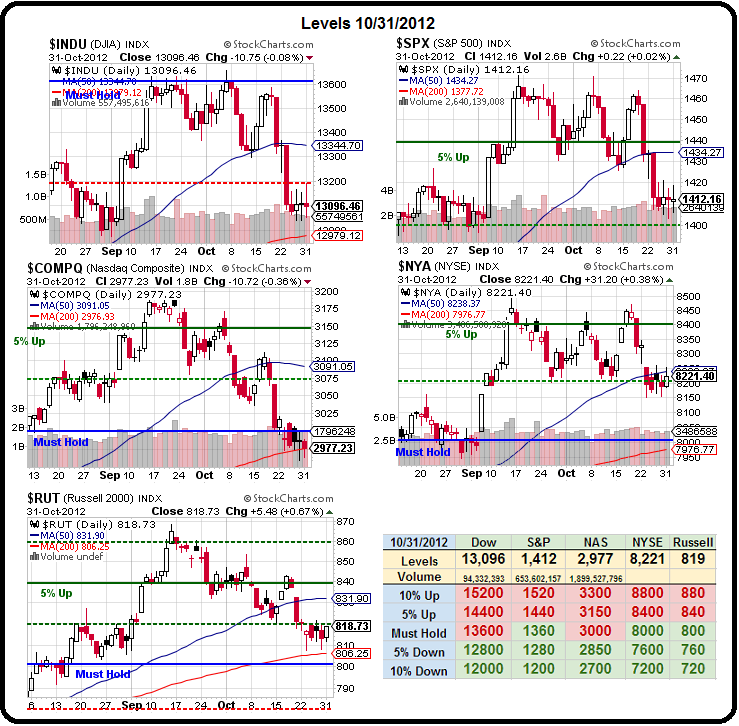

As you can see from the Big Chart, we are putting in a bit of a floor around those 200 dmas – which is what we expected when this drop began back in September and we used the same logic to not be drawn into false hopes as the market "came back" in mid-October – even after QInfinity had been announced. In fact, the TZA Jan $12/15 bull call spread at $1.50 I had suggested for overall portfolio coverage in that last post, is now 124% in the money with TZA at $15.74, so in-line for a 100% gain if the Russell can't get back over 830,

As you can see from the Big Chart, we are putting in a bit of a floor around those 200 dmas – which is what we expected when this drop began back in September and we used the same logic to not be drawn into false hopes as the market "came back" in mid-October – even after QInfinity had been announced. In fact, the TZA Jan $12/15 bull call spread at $1.50 I had suggested for overall portfolio coverage in that last post, is now 124% in the money with TZA at $15.74, so in-line for a 100% gain if the Russell can't get back over 830,

But we have gotten a bit more bullish – even as we take quick profits on bear plays, like yesterday's DIA Nov $129 puts, which we picked up for $1.10 in our virtual $25,000 Portfolio and later sold at $1.28 (up 16%) at 2:08, when we decided the Dow had bottomed out at 13,050. The Dow finished the day at 13,096 and we'll short them again if they struggle but, for now, we're looking to see what kind of bounces we can get off our indices.

According to our 5% rule – we're going to be watching the following lines for strong and weak bounces while, of course, 3 of our 5 "Must Hold" levels MUST HOLD:

According to our 5% rule – we're going to be watching the following lines for strong and weak bounces while, of course, 3 of our 5 "Must Hold" levels MUST HOLD:

- Dow – 13,170 (weak), 13,300 (strong)

- S&P – 1,418, (weak), 1,431 (strong)

- Nas – 3,010 (weak), 3,050 (strong)

- NYSE – 8,220 (weak), 8,280 (strong)

- RUT – 818 (weak), 826 (strong)

So far, we have the Russell right at that 818 mark and the NYSE closed yesterday at 8,221 so we'd like to see them hold those lines today while the other indexes, hopefully, catch up a bit. There's plenty of data today and Non-Farm Payrolls tomorrow and we have Auto Sales today, which should be encouraging as well as PMI, ISM, Consumer Comfort, Confidence and Construction Spending along with earnings from about 200 companies and, the way earnings have been going – simply not going down any more on earnings reports will be an impressive feat.

Wall Street was still in storm mode yesterday so I wouldn't put much stock in yesterday's action but today things get real again. Bush's FEMA director, Michael Brown is already criticizing Obama – for responding to Hurricane Sandy TOO EARLY. That's right, I kid you now, this completely oblivious ass-hat had the nerve to say to Denver Westword:

Wall Street was still in storm mode yesterday so I wouldn't put much stock in yesterday's action but today things get real again. Bush's FEMA director, Michael Brown is already criticizing Obama – for responding to Hurricane Sandy TOO EARLY. That's right, I kid you now, this completely oblivious ass-hat had the nerve to say to Denver Westword:

"One thing [President Obama's] gonna be asked is, why did he jump on [Hurricane Sandy] so quickly and go back to D.C. so quickly when in … Benghazi, he went to Las Vegas? Why was this so quick? … At some point, somebody's going to ask that question."

Brown had of course, been criticized for his complete an utter failure to handle hurricane Katrina but President Bush told him he was doing an "excellent job" and he'll take that to his grave, apparently, even though, in Emails he wrote the morning of the hurricane to FEMA's deputy director said "Can I quit now? Can I come home?" and "I'm trapped now, please rescue me."

Aside from NOT addressing Global Warming, the GOP/Romney platform seeks to eliminate FEMA, which may be why Chris Christie has suddenly become an Obama fan – now that he realizes his state would have gone bankrupt under a Romney administration from the latest storm.

Aside from NOT addressing Global Warming, the GOP/Romney platform seeks to eliminate FEMA, which may be why Chris Christie has suddenly become an Obama fan – now that he realizes his state would have gone bankrupt under a Romney administration from the latest storm.

Meanwhile, the climate deniers are out in force in the MSM with CNBC's Idiot Joe Kernan flashing "proof" this morning that Global Warming is a myth – some sort of conspiracy by Government scientists looking to destroy our American way of life – which seems to be somehow construed as polluting the environment without any regard whatsoever to the consequences while, at the same time, freaking out about how deficits will be bad "for our children."

How then, will this ridiculous double-standard be resolved when Big Business is now identifying Global Warming as a major long-term problem? From the New Yorker:

Munich Re, one of the world’s largest reinsurance firms, issued a study titled “Severe Weather in North America.” According to the press release that accompanied the report, “Nowhere in the world is the rising number of natural catastrophes more evident than in North America.” … While many factors have contributed to this trend, including an increase in the number of people living in flood-prone areas, the report identified global warming as one of the major culprits: “Climate change particularly affects formation of heat-waves, droughts, intense precipitation events, and in the long run most probably also tropical cyclone intensity.”

Insurers, scientists and journalist are beginning to drop the caveats and simply say that climate change is causing big storms. As scientists collect more and more data over time, more of them will be willing to make the same data-based statements. Unfortunately, the same can't be said about the GOP, who continue to practice voo-doo science to go with their voo-doo economics. Hopefully, the public can see through this BS and make the right choice on Tuesday but the GOP still seems enthusiastic about their chances: