European shares are following Asian stocks down this morning as EVERYONE is freaking out over the US Fiscal Cliff while trying to deal with troubles of their own – notably Japan's total debt approaching 1 Quadrillion Yen (1,000,000,000,000,000), possible property taxes in China, the ongoing Greek crisis, rising inflation, declining confidence (Germany's ZEW survey was way off), implementation of Basel II (not by the US, we are putting it off indefinitely) and declining global oil demand.

And that's just this morning's headlines!

That's quite a wall of worry we're building here but I will point out that, back home, the NFIB US Small Business Optimisims Index is up 0.3 to 93.1, not fantastic but back to levels on the way back to where we were in the early part of this century, despite being dragged down by a record number of businesses who are concerned about future conditions (23%).

That's quite a wall of worry we're building here but I will point out that, back home, the NFIB US Small Business Optimisims Index is up 0.3 to 93.1, not fantastic but back to levels on the way back to where we were in the early part of this century, despite being dragged down by a record number of businesses who are concerned about future conditions (23%).

Of course, if you listen to the MSM (or even look at the picture at the top of this page), you'd be concerned about future business conditions too. The bottom line is that small businesses are generally bullish about their current business – they are hiring, they are planning to make capital outlays, they have job openings to fill, they feel it's a good time to expand – even earnings are improving…

But they are SCARED. They are scared because they are told to be scared by the media and, as investors, we need to separate the reality of improving conditions from the fantasy of the end of the World as our Congress takes us over an imaginary cliff.

But they are SCARED. They are scared because they are told to be scared by the media and, as investors, we need to separate the reality of improving conditions from the fantasy of the end of the World as our Congress takes us over an imaginary cliff.

Investors are scared as well, scared of the unknown – one of the consequences of electing people who do not have a clearly detailed plan for what they will actually do if they get (re)elected. Will taxes go up, will capital gains go up, will rates stay low..? In absence of clear answers, investors are easily stampeded one way, then another by rumors as they scramble to find the "right" position.

Dividend-paying stocks are being hit especially hard as there is fear that taxes on dithe Bush Tax Cuts are completely rolled back. the high-yielding telecom sector’s forward P/E was 17.5, and it has now fallen to 16.6. Utilities, the market’s worst performers Monday, are now trading on a forward price to earnings ratio of 14 and consumer staples are near 15. The overall market is at 12.2 times 2013 earnings.

“Even though they normally trade at a premium to the market because of their consistent earnings and dividend growth, they do look relatively expensive,” Same Stovall, of S&P Capital IQ said. “At the same time they do offer a good dividend yield. Telecom is close to 5 percent, utilities are 4.5 percent, and consumer staples at 3 percent. … It’s almost twice as good as a 10-year note yield.”

In the past month, the S&P 500 is down about 2.3 percent, but some of the dividend paying sectors were down more. Utilities are by far the worse, down 7.2 percent for the month, and down nearly 6 percent year to date. Telecoms were down 2.7 percent in the past month, but up more than 11 percent for the year.

In the past month, the S&P 500 is down about 2.3 percent, but some of the dividend paying sectors were down more. Utilities are by far the worse, down 7.2 percent for the month, and down nearly 6 percent year to date. Telecoms were down 2.7 percent in the past month, but up more than 11 percent for the year.

As we discussed yesterday at our PSW conference, as investors head for the exits, they are unfairly treating REITs and MLPs just as they are corporate dividend payers. The dividend income from REITs and MLPs is nonqualified and taxed at the individual tax rate. AMLP is and ETF that tracks the sector and is taking a dive on unfounded fear – could be an interesting opportunity down around $15 with it's 6% dividend and diversified base.

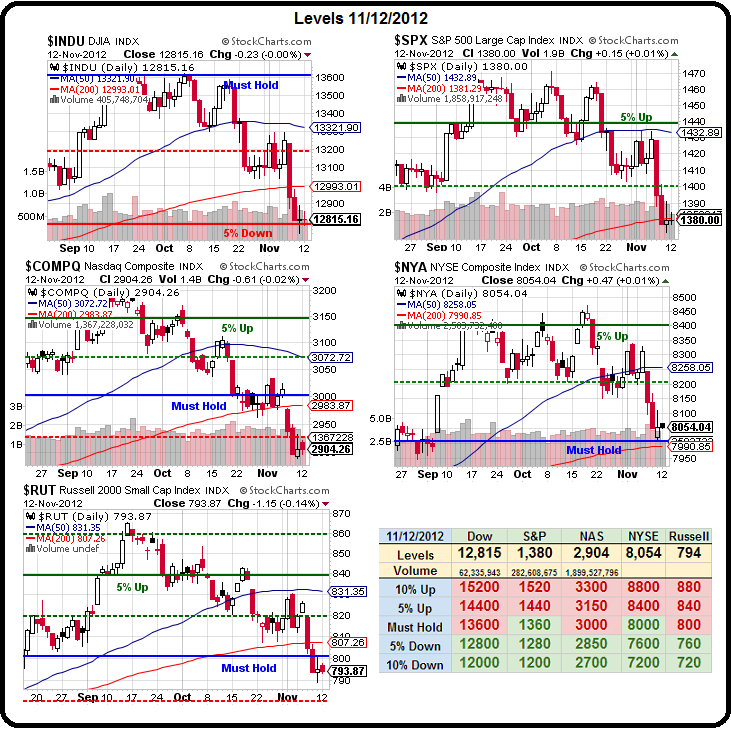

Speaking of bases – it looks like we'll be testing ours this morning as our futures are down over half a point and we'll be testing the Must Hold line of 8,000 on the NYSE and 1,360 on the S&P (possibly). If 1,360 fails, it will be time to layer our disaster hedges for the next leg down. It doesn't matter whether the market is selling off for good reasons or bad reasons – we're stuck in the market with all of the sheeple and there's no point in fighting the tide – although we will be doing plenty of bottom-fishing down here.

Speaking of bases – it looks like we'll be testing ours this morning as our futures are down over half a point and we'll be testing the Must Hold line of 8,000 on the NYSE and 1,360 on the S&P (possibly). If 1,360 fails, it will be time to layer our disaster hedges for the next leg down. It doesn't matter whether the market is selling off for good reasons or bad reasons – we're stuck in the market with all of the sheeple and there's no point in fighting the tide – although we will be doing plenty of bottom-fishing down here.

As we discussed this weekend in Las Vegas – we don't have to pick the exact bottom of the market when we are able to give ourselves 20% discounts on our long-term entries. Unless we feel the S&P is going back to 1,100 – there's no reason not to grab some of the discounts we're being offered down here.

We discussed many stocks that were good opportunities yesterday – especially in the Dow, where it's very easy for us to hedge our bets with DIA puts of we fail to hold 12,700 but, on the whole, the market is simply realizing the things we have been discussing all summer, when we weren't buying the S&P move over 1,400. Now that our concerns are being realized by the general market – we are happy to take advantage of the price discovery – especially going against the grain of all this ridiculous hype about the fiscal cliff.

We discussed many stocks that were good opportunities yesterday – especially in the Dow, where it's very easy for us to hedge our bets with DIA puts of we fail to hold 12,700 but, on the whole, the market is simply realizing the things we have been discussing all summer, when we weren't buying the S&P move over 1,400. Now that our concerns are being realized by the general market – we are happy to take advantage of the price discovery – especially going against the grain of all this ridiculous hype about the fiscal cliff.

The country is not likely to commit fiscal suicide and, even if it does – it's going to be a long, slow decline and not an actual cliff. More attention should be paid to the very positive earnings and raised guidance from Home Depot today, who see the US housing markets clearly on the rise – housing is the cause of 50% of the nation's unemployment and, if it does come back – so will the US economy – very quickly.

We have some data coming up this week: Retail Sales tomorrow along with PPI and Business Inventories and then Fed Minutes in the afternoon. Thursday we'll get the usual Jobless Claims along with CPI, the Empire Manufacturing Index and the Philly Fed – both of which have been awful and have negative expectations and then another bad oil report, delayed by yesterday's "holiday" (does anyone get Veteran's Day off anymore?) and then Friday we get Industrial Production and Cap Utilization so small clues as to how well the economy is actually doing – as opposed to the constant hype of how bad we could be doing if all of our "leaders" are unable to come to an agreement.