Time to worry about the cliff again!

Time to worry about the cliff again!

We took a few days off from worrying but comments from Senators Harry Reid and Mitch McConnell yesterday both indicated that little progress was being made on the ongoing negotiations and that was all it took to panic people out of positions yesterday afternoon, as we gave back most of Friday's ill-gotten (low volume) gains.

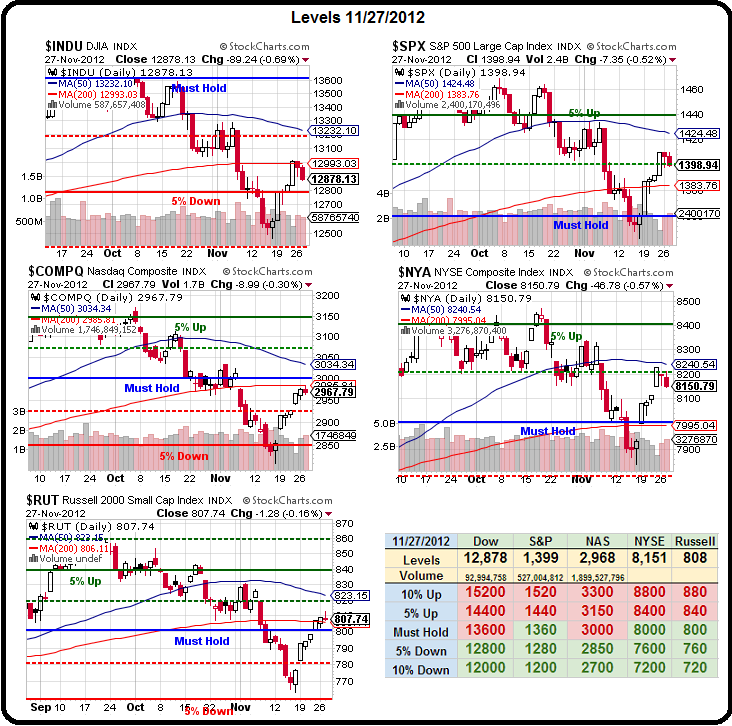

In context, we're still making good, bullish progress but yesterday's action pretty much takes a "V"-shaped recovery off the table and now we'll have to fight and claw tooth and nail just to get back to our strong bounce lines by the week's end. Anything less than that will not be a bullish signal into the weekend. Our levels remain:

- Dow 12,720 weak, 12,950 strong.

- S&P 1,375 weak, 1,400 strong.

- Nasdaq 2,900 weak, 3,000 strong.

- NYSE 8,000 weak, 8,100 strong.

- Russell 790 weak, 805 strong.

No serious damage yet but those paying attention to what's going on in China are becoming very concerned about the Shanghai Composite, which just spent it's 2nd day below the the very-critical 2,000 line – and that's down 16.66% since June.

So far, the Hang Seng has avoided the same fate – trading at 22,000 and that's up from 18,500 in January (18,9%) but it's going to matter a lot which one of these indexes breaks first to follow the other. So far, the drag is down, with the Shanghai finishing today down 0.9% at 1,973 and the Hang Seng dropping 0.62% to finish at 21,708. It's been a while since China has been a big concern but, if we finish out the month this way – expect it to be a big topic of conversation in December.

FXP is an ultra-short play on China and makes a nice hedge to Asian exposure (or commodities). At $21.48, I favor selling the Jan $20 puts for .65 and buying the $21/25 bull call spread for $1.05 so you net into the $4 spread for .40 with a 1,000% upside potential at $25. This is a nice hedge into the holidays if you're worried about Global Panic as we forget to solver the fiscal cliff by 12/31.

Chinese economic growth relies on excessively high and potentially destabilizing levels of investment, according to an IMF paper – catching up to news from 2 years ago. The investment is mostly funded by domestic savings – good news, say the authors, but likely only meaning the coming adjustment will look different than if the country relied on foreign capital.

Chinese economic growth relies on excessively high and potentially destabilizing levels of investment, according to an IMF paper – catching up to news from 2 years ago. The investment is mostly funded by domestic savings – good news, say the authors, but likely only meaning the coming adjustment will look different than if the country relied on foreign capital.

As you can see from the chart on the right, we still rely on those emerging markets for the majority of Global growth in GDP. With Europe in Recession, we can ill-afford to lose China in 2013 and, of course, that's assuming our own Fiscal Cliff nonsense doesn't throw the US into Recession as well.

This morning, in Member chat, I predicted $85 or less for oil on any kind of build in supply on today's inventory report. We didn't have to wait as it turns out, as oil has already hit $85.50 in pre-market trading – down $2 already from yesterday's $87.50. The problem facing oil is the same one facing copper ($3.50), silver ($33.16), gold ($1,712) and gasoline ($2.66) at the moment – people are losing faith in demand growth – especially in Asia.

We'll watch this story unfold very closely and we'll keep an eye on our levels.