Is our rally getting tired already?

Is our rally getting tired already?

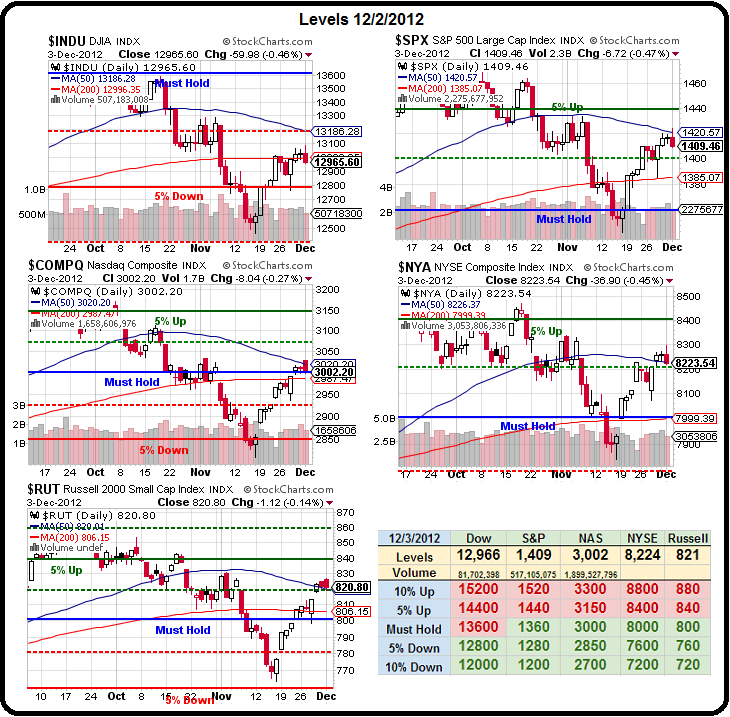

As you can see from our Big Chart, we're curling over right about our 50 dmas and we don't want to do that because those are declining 50 dmas and if we follow those down then we add negative data to the 200 dmas and, once they start curling down, we're pretty screwed.

So, we need something to boost the markets and it's not looking like it will be a sudden solution to the Fiscal Cliff and it's already December 4th so only 14 trading days until Christmas and I think we're going to need a miracle to pull this one out of a hat.

There's not much for data to move us this week – just Productivity, Factory Orders and ISM tomorrow, Consumer Comfort on Thursday and Consumer Credit and Sentiment on Friday. Next week we have the final Fed meeting of the year Tuesday and Wednesday and next Thursday we get Retail Sales and Industrial Production on Friday so, if we're going to have some kind of launch based on data – that would be the time for it.

Otherwise, we're adrift and counting on Congress to "fix" things in order to get the markets moving again. Dave Fry's SPY chart shows the relentless selling we got yesterday as soon as the bell rang in the morning – erasing all of the pre-market gains and dropping us back to just under 1,410 on the S&P.

Otherwise, we're adrift and counting on Congress to "fix" things in order to get the markets moving again. Dave Fry's SPY chart shows the relentless selling we got yesterday as soon as the bell rang in the morning – erasing all of the pre-market gains and dropping us back to just under 1,410 on the S&P.

We're still holding our strong bounce lines of Dow 12,950, S&P 1,400, Nasdaq 3,000 (barely), NYSE 8,100 and Russell 805 but the Dow is too close for comfort and, as I said last week – losing ANY of our levels at this point is going to be a very bad sign.

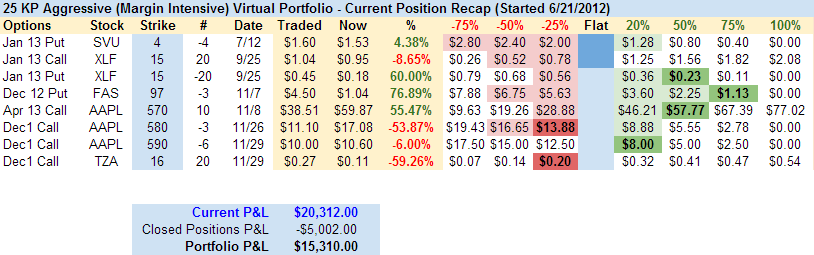

That's why we've held onto our TZA weekly $16 calls (now .12) in our virtual $25,000 Portfolio and why we are 9/10 covered on our AAPL spread as well. We took a lot of open bullish plays off the table last week as we approached this level test and, now that we may be failing it – we certainly aren't feeling more bullish!

Worst of all, we're having this spot of trouble at our levels while the Dollar is getting weaker – usually we can count on a weak Dollar to boost the markets but the rats are leaving this sinking ship and even gold, silver and oil are dropping along with the Dollar – those are bad signs!

So we're going to take breaches of our levels very seriously but we need to remain aware that this market is poised to rally on news of a Fiscal Cliff solution – whether real or imagined – and will be rumor-driven through the middle of next week. That's going to make it tough to trade and there's nothing wrong with going to cash into the new year. It''s been a good year – no reason to blow it! Our aggressive $25,000 Portfolio, for example, had a rough ride but is up 40% since 6/21 – about the same as our Apple Money Portfolio – although we only started that one on 10/21.

So we're going to take breaches of our levels very seriously but we need to remain aware that this market is poised to rally on news of a Fiscal Cliff solution – whether real or imagined – and will be rumor-driven through the middle of next week. That's going to make it tough to trade and there's nothing wrong with going to cash into the new year. It''s been a good year – no reason to blow it! Our aggressive $25,000 Portfolio, for example, had a rough ride but is up 40% since 6/21 – about the same as our Apple Money Portfolio – although we only started that one on 10/21.

And, of course, as 2012 draws to a close, we should check in on our "One Trade" for 2012. Back on January 5th we identified BAC as the one, single trade to make for 2012 and put it in our "One Stock Portfolio" – for lazy people who can't be bothered to play the market every day (or maybe just have a life!) and just wanted to pick one stock that they could bet it all on as a make or break trade. Our trade idea for BAC was:

Buying the stock for $5.75 and selling the Jan 2013 $5 puts and calls for $2.55 for a net $3.20 entry. In our example, we talked about putting $32,000 into 10,000 shares of BAC and selling 100 puts and 100 calls for a max profit of $18,000. 10,000 shares of BAC are now $98,000 and 100 Jan $5 puts are $2,000 and $100 Jan $5 calls are $48,000 for a net of $48,000 at the moment – a 50% profit on our One Trade for the year. That's better than we did on our $25,000 Portfolio in 6 months of rough trading!

Even deducting $1,500 for the FAZ hedge (in our more conservative suggestion) – it's a nice annual return and, while it's too early to call our One Trade for 2013 – we are beginning to look for candidates that are just as obvious.

The bottom line is – don't fear getting back to cash. Cash is good, cash is flexible, cash opens us up to opportunities that are difficult to see when we are juggling a book of trades. We had what is called "a moment of clarity" regarding BAC in early 2012 and 2013 promises to be a year that is going to be just full of opportunities – if we're ready to take advantage of them….