Non-Farm Payrolls are out at 8:30.

Non-Farm Payrolls are out at 8:30.

A mere 80,000 jobs are expected to be added due to the hurricane after 171,000 were added in the October Report, so it will be difficult for this report to disappoint. The real key is whether unemployment is back over 8% or not and we'll also be keeping an eye on Hourly Earnings – to see if we are finally getting some wage pressure (doubtful).

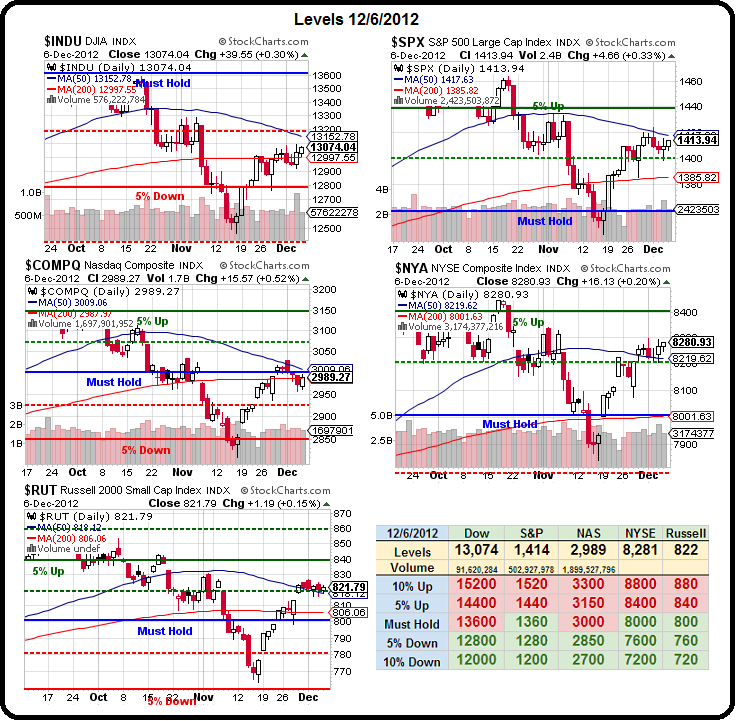

As you can see from our Big Chart – none of our indices are making any heroic moves as the mostly curl down to follow the declining 50 dmas, with the Nasdaq just days away from forming a very messy "death cross" that can give the bears a lot of encouragement to sell into the end of the year.

Of course, what the Nasdaq does is all up to AAPL and we got back to $550 yesterday and we'll be looking for our $555 target this morning on the same no particular news that took them down in the first place (see Wednesday's post for more AAPL commentary). On Wednesday, in Member Chat, we played the AAPL bounce by betting on the QQQ next week $64 calls at $1.50. They have, so far, gained just 10% and won't be worth risking over the weekend if we don't get a move up this morning.

A better bet was our oil play (see yesterday's post and Wednesday's Member Chat), where we picked up the USO Dec $33 puts for $1.10, for reasons I outlined yesterday, and we did get our drop that led us to take the money and run at $1.55, for a very nice 40% gain in 24 hours.

A better bet was our oil play (see yesterday's post and Wednesday's Member Chat), where we picked up the USO Dec $33 puts for $1.10, for reasons I outlined yesterday, and we did get our drop that led us to take the money and run at $1.55, for a very nice 40% gain in 24 hours.

We haven't been trading much this week but we've been picking our spots very nicely, at least. 20 of those calls in our virtual $25,000 Portfolio cost $2,200 and made a quick $900 – you don't need to do too many of those to really boost your performance in a small portfolio.

The Dollar continues to climb, now 80.53 in pre-markets, and that's putting downward pressure on commodities and equities but it's also building up a nice reserve of rally fuel for when (if) they solve that fiscal cliff in some way that weakens the outlook for the Buck.

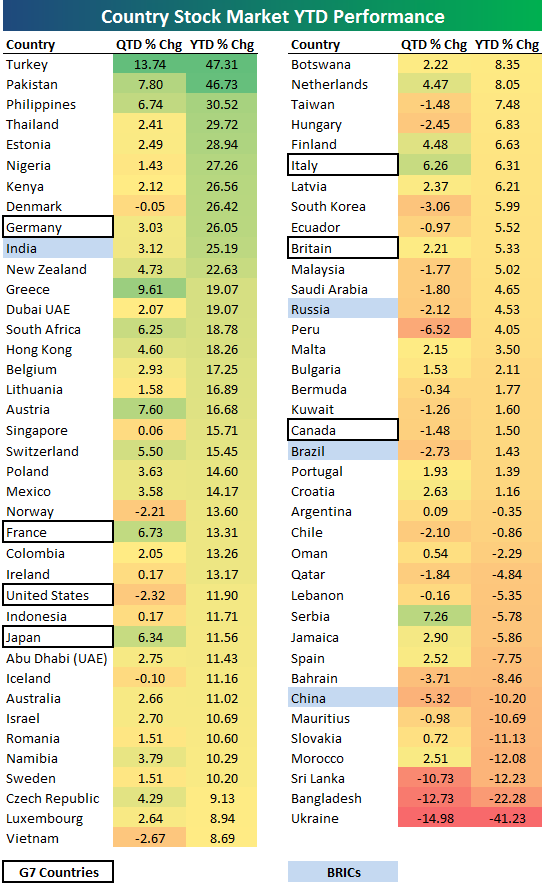

Notice in the chart on the left that our 12% gain for the year puts us near the middle of Global Market Performance and we're not doing much better than Japan with France beating us and Germany just leaving us in the dust. If that doesn't make sense to you – don't worry – it's not sensible – but it is the way the markets are so we need to consider that as we position for the new year.

In fact, the Bundesbank has warned this morning that Germany may be entering recession, saying that the economy could contract in FQ4 and FQ1. The bank cuts it 2012 and 2013 GDP predictions to +0.7% and +0.4% respectively from prior forecasts of 1% and 1.6%. However, the bank expects growth to recover to 1.9% in 2014. It also lifts its 2013 unemployment forecast to 7.2% vs 6.8% this year. The Bundesbank's deepening pessimism for the German economy, which follows the ECB cutting its eurozone growth forecasts yesterday, helped send the euro tumbling 0.3% to $1.2919 this morning and accounts for the move up in the Dollar (also, another earthquake in Japan).

Speaking of Japan, their Coincident Composite Index fell for the 7th consecutive month to 90.6 in October. That has the Government downgrading their assessment of the data to "worsening" – an indication that Japan is, once again, already in a Recession. Keep in mind that these are the countries whose markets are performing on par with our own. Should Japan and Germany be much lower or should US equities be trading much higher?

Speaking of Japan, their Coincident Composite Index fell for the 7th consecutive month to 90.6 in October. That has the Government downgrading their assessment of the data to "worsening" – an indication that Japan is, once again, already in a Recession. Keep in mind that these are the countries whose markets are performing on par with our own. Should Japan and Germany be much lower or should US equities be trading much higher?

Once we get past this fiscal cliff nonsense, I think we do have room to run as our numbers are certainly improving and, compared to Europe, Japan and China – we're golden!

8:30 Update: Speaking of golden – 146,000 jobs were added in November, 50% more than expected and, even more significant, unemployment dropped to 7.7% – the lowest reading since mid-2008. There's no spinning this one – it's a great report. You can't say the hurricane stopped people from filing claims as this is an EMployment report so, if anything, the hurricane would have stopped new jobs from being reported – not the other way around.

More jobs means more demand for Dollars (80.60) and maybe more demand for oil ($86.75) but not for gold ($1,688) or TBills (TLT = $124.42) and, of course, our futures are flying – up well over half a point across the board (and great for our QQQ play). More workers means more IPhones, of course, so should give AAPL a little boost as well and it's going to be a nice morning – now we'll just need to see what sticks….

A nice pop in the morning is a good chance to pick up some covers going into the weekend. We discussed a nice TZA spread in yesterday's Member Chat and we should get a very nice entry this morning as the Russell tests the 825 line. Hopefully, it will be insurance we never have to use but if we're not going to buy our insurance when the premiums are cheap – when will we cover?

Have a great weekend,

– Phil