What a difference a day makes!

What a difference a day makes!

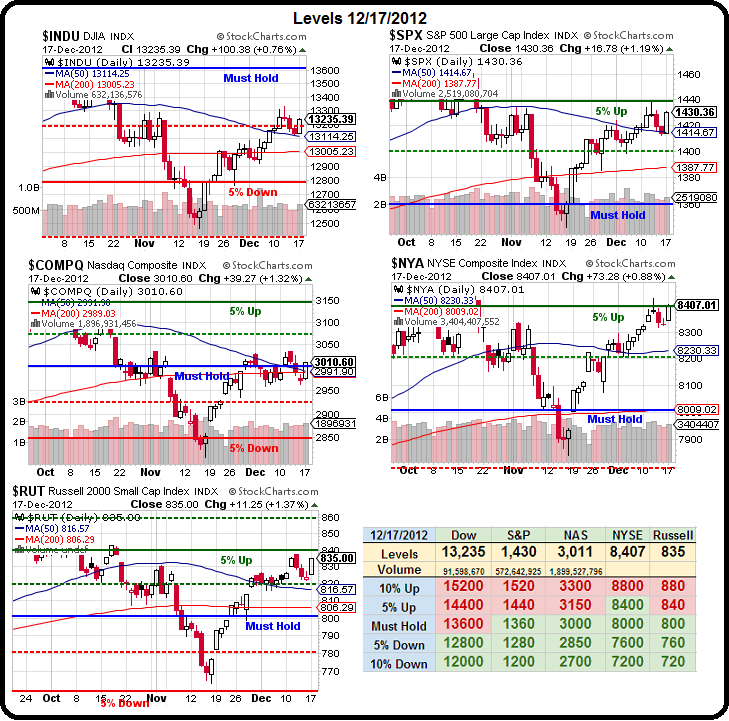

As you can see from our Big Chart, the technical picture has quickly turned around and, once again, a Santa Rally is a possibility and our S&P 1,450 goal for 2012 is in reach. As I said to our Members earlier this morning:

How quickly things reverse. Still, don't mean a thing until we top those last week highs and break over 1,440 on the S&P (5% line) and 8,400 on the NYSE (already there) and 840 on the RUT (5% line). That puts the Nas 5% behind the others and the Dow 7.5% so if we get a bullish break on our 3 broad indexes – it would be good to play the Nas and the Dow to catch up but first – we need to break those 5% lines.

So, that's what we'll be watching this morning as well as our beloved AAPL (see David Fry Chart), which popped back to $520 yesterday, on the way to our $528 initial target (as noted in yesterday's Morning Alert). We had hoped to hit it yesterday but we settled for the $16 move we did get and we expect to see $528 this morning or our premise is blown and we'll pull our aggressive short-term bets.

So, that's what we'll be watching this morning as well as our beloved AAPL (see David Fry Chart), which popped back to $520 yesterday, on the way to our $528 initial target (as noted in yesterday's Morning Alert). We had hoped to hit it yesterday but we settled for the $16 move we did get and we expect to see $528 this morning or our premise is blown and we'll pull our aggressive short-term bets.

We are, in theory, making progress on our Fiscal Cliff negotiations but Dave Fry notes there is a more important macro driving us forward at the moment:

Beyond all of this is what the Fed wants you to do—buy stocks. After all, they’re providing nearly $100 billion a month in QE activity. This money will find its way into markets and will force you to buy stocks even if you don’t want to. Why? Because the alternatives are negative yields in bonds and sideline cash.

The same holds true with other central banks in Europe and Asia as its raining fiat currencies.

Not to be outdone, Japan’s election provided a large win for the LDP led by the conservative Shinzo Abe where “economic recovery and overcoming deflation” are top priorities. This means more stimulus and a much weaker yen as John Mauldin explains well-enough in this video and article.

What could go wrong with this scenario? Markets and bond vigilantes could balk at buying more debt even as central banks print money to support deficits thru QE. The disaster scenario for all developed countries would be if interest rates rose given massive debt levels.

The US has $35Bn in 5-year notes to peddle this afternoon and Japan got a bit of a shock at demand was off sharply on the sale of 1.1Tn Yen worth of 20-year Government Bonds with the bid-to-cover ratio falling from 3.67 to 3.11 and interest rising to 1.737%. China is also suffering as Foreign Direct Investment fell for the 12th consecutive month despite renewed buying from Japan (which may reverse again as Abe rekindles the island dispute). Spanish Banks are also suffering as bad loans rose over $10Bn in October – to 11.23% of the portfolio.

The US has $35Bn in 5-year notes to peddle this afternoon and Japan got a bit of a shock at demand was off sharply on the sale of 1.1Tn Yen worth of 20-year Government Bonds with the bid-to-cover ratio falling from 3.67 to 3.11 and interest rising to 1.737%. China is also suffering as Foreign Direct Investment fell for the 12th consecutive month despite renewed buying from Japan (which may reverse again as Abe rekindles the island dispute). Spanish Banks are also suffering as bad loans rose over $10Bn in October – to 11.23% of the portfolio.

Where is all the money going then? Well, $274Bn went into Corporate Buybacks in just the first 3 quarters of 2012 as US companies forgo capex spending and hiring and goose their EPS the easy way, buy decreasing the amount of shares their earnings are measured against. $274Bn is more than US Corporations paid in taxes and enough money to have hired 5.5M $50,000 workers – it's a good thing our "job creators" have their priorities straight…

We're gathering data in our annual PSW Holiday Shopping Survey and please add your observations if you get a chance. This weekend is "Super Saturday", the biggest shopping day before Christmas and, last year, 24% of all holiday sales were rung up in the last 10 days before Christmas – which is a trend of late buying our survey is also picking up for 2012. Another trend we're noticing is steep discounting, which may translate into revenues hitting their targets but profits falling short in the end – another good reason for the buybacks to keep revenues up (relatively).

Unfortunately, this morning on CNBC, Senator Bob Corker said there would be no fiscal cliff deal this week. Corker has been saying there would be no deal all month but saying it this morning took the wind out of the Futures and we've turned down sharply since then. We'll see what sticks but there's nothing NEW in the news from Corker – just stating the obvious as it's super-unlikely a deal is passed in the next 72 hours – surely this is not a surprise to professional investors.

Our goals are clear for today – we really can't afford to be rejected again at our 5% lines and we will have to move a bit more bearish (see yesterday's TZA trade idea) if the Russell can't hold 820 at this point. It would be very bullish for the markets to shake off Corker and resume the up move it was having in the Futures. The Dollar certainly isn't holding us down – still weak at 79.53 and below that 79.50 line will provide a little extra push to the upside – maybe enough to put gold back over $1,700.