4 more days!

4 more days!

This is much more exciting than Christmas. So exciting that President Obama and Congress have cut short their winter vacations to give us hope – right before they snatch it away again. Will it be a bad plan or no plan? I can hardly wait to find out…

We have a bit of data today with the usual Jobless Claims, Bloomberg's Consumer (dis)Comfort Index, New Home Sales, Consumer (lack of) Confidence, Oil Inventories and even a look at the Fed's Balance Sheet and the Money Supply after the markets close. Tomorrow we get the Chicago PMI and Pending Home Sales but none of it matters compared to whatever rumor comes out of Washington over the next 48 hours.

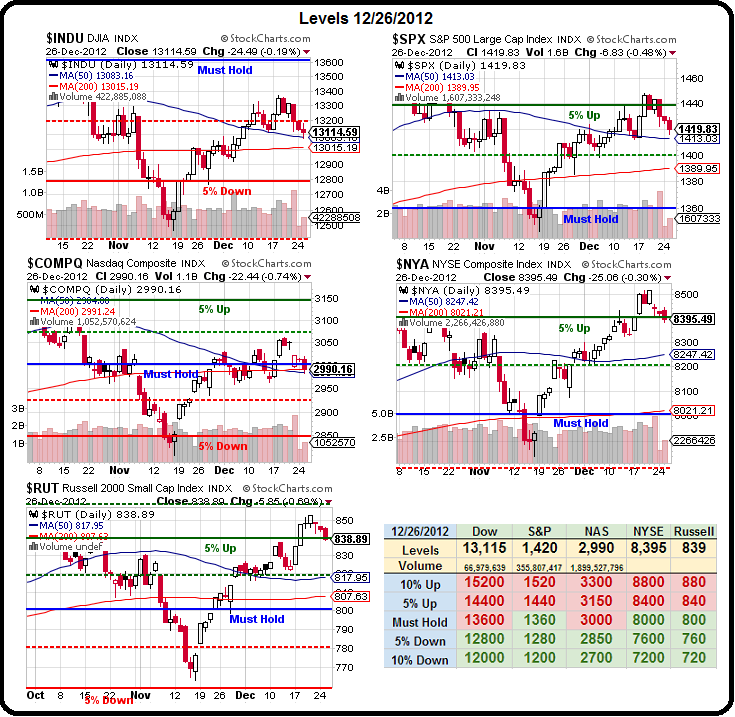

Meanwhile, we're focused on our technical levels and, as you can see from the Big Chart, we are right on the 50 dma of the Dow (13,083) and the Nasdaq (2,991) and not too far on the S&P (1,413) with the NYSE (8,400) and the Russell (840) testing (and failing, so far), their 5% lines.

Meanwhile, we're focused on our technical levels and, as you can see from the Big Chart, we are right on the 50 dma of the Dow (13,083) and the Nasdaq (2,991) and not too far on the S&P (1,413) with the NYSE (8,400) and the Russell (840) testing (and failing, so far), their 5% lines.

See my additional comments to Members in this morning's chat but, suffice to say, we need to watch these levels very carefully as well as the Dollar – which is right on the 79.50 line as the Euro attempts to get back over $1.33 and the Pound goes for $1.62 while the Yen remains extremely weak (and supportive of the Dollar) at 85.76 to the Dollar. As I said to Members:

Obama and Congress are back today. I don't expect an announcement this afternoon but, possibly, this evening or tomorrow if they are serious about not looking like they let the economy die. We also hit the mystical debt ceiling on Monday so much silliness over the next couple of days but, if there is a rumor of a solution – the markets could jump very sharply so be careful.

We also have an adjusted TZA spread that I suggested yesterday afternoon – just in case those levels don't hold up but we also found positive (but well-hedged) plays on SPWR, FTE and GDX yesterday and our HLF play from last week really kicked into gear as the stock has already jumped back from $25 to $27.50. That trade idea was from last Friday and made for a nice Christmas present as I said in Member Chat:

We also have an adjusted TZA spread that I suggested yesterday afternoon – just in case those levels don't hold up but we also found positive (but well-hedged) plays on SPWR, FTE and GDX yesterday and our HLF play from last week really kicked into gear as the stock has already jumped back from $25 to $27.50. That trade idea was from last Friday and made for a nice Christmas present as I said in Member Chat:

HLF May $30/40 bull call spread at $3.30, selling 2014 $22.50 puts for $6.40 for a net $3.10 credit for a net $19.40 entry on the $27.18 stock. Not that it means much as they've already fallen from $74 in April but I think it's a fun play and you could make $13.10 on a $3.10 credit with just $2.70 in net margin (according to TOS) for a better than 4x return in 12 months if HLF just comes back to $40 by May.

Our aggressive play paid off already with the May $22.50 puts falling to $4.30 and the $30/40 spread holding $2.70 for a very quick $1.50 profit off the net $3.10 credit (48%) in less than 7 days. As I said yesterday, this is how we trade the news and it looks like we caught a good bottom on that one!

Yesterday we talked about household formation and The Atlantic agrees with me, calling it "The Most Overlooked Statistic in Economics" and furthers my case that it's poised for a comeback in 2013. This chart from that article illustrates the tremendous amount of money that can be pumped into the economy if we do get a strong recovery but, even a mild recovery will be quite a boost (grey dots).

Yesterday we talked about household formation and The Atlantic agrees with me, calling it "The Most Overlooked Statistic in Economics" and furthers my case that it's poised for a comeback in 2013. This chart from that article illustrates the tremendous amount of money that can be pumped into the economy if we do get a strong recovery but, even a mild recovery will be quite a boost (grey dots).

I won't be around this morning but, as of 6am, we're flatlining in the futures. Barry Ritholtz pointed out two good reads this morning – We know nothing because we read newspapers (Fabius Maximus) and The media – a broken component of America’s machinery to observe and understand the world (Fabius Maximus) – both are good reads if you are in the mood to do some thinking.

Be very careful out there as the markets are in no mood for thinking – they are simply reacting (or over-reacting) to whatever the latest rumor is out of Washington. We should talk our levels seriously and hedge if we need to but cashy and cautious is the watch-word coming into the long weekend as this thing could go either way – sharply!