Say what you will about it, but this is one Hell of a rally!

Say what you will about it, but this is one Hell of a rally!

After a very low-volume sell-off to close the year, we are now up about 7.5% since New Year's Eve and January ends on Thursday and could be one of the all-time great starts to a year if we hold it together for 4 more days.

On Thursday, the Wilshire 5000 stock index, the USA's broadest market gauge, which includes almost 3,700 stocks, briefly topped its Oct. 9, 2007, record high of 15,806.69 before closing 21 points shy of a historic peak. Since the bear market ended in March 2009, stocks have generated paper gains of nearly $11 trillion, says Wilshire Associates. The Dow Jones industrial average and Standard & Poor's 500 stock index are just 2.4% and 4.5% below their respective peaks.

In Member Chat this morning, we discussed "The Mothers," the Japanese index of small-cap stocks, which have launched like a rocket from just over 400 at the end of December to just under 550 last week – an unbelievable (and unsustainable?) 37% run in 30 days. To some extent, this Global re-pricing of equities simply reflects a waning of the crisis mentality we've had for the past 4 years – keeping prices depressed in what should be a forward-pricing mechanism. As the massive volume of free money pumped out by the Central Banks finally begins to circulate through the economy – inflation becomes more certain down the road and that includes inflated stock prices.

Another huge factor keeping prices down has been lack of retail participation in the markets as consumers struggled to repay debt and the 2008 crash left a lot of people feeling singed by the markets. However, those who stuck it out now have it all back and they are sitting around the office saying "I just left it all in my 401K and now it's back". That's a great commercial for long-term investing (our favorite kind) and a great incentive for those who still have jobs to start putting some into the markets again.

Another huge factor keeping prices down has been lack of retail participation in the markets as consumers struggled to repay debt and the 2008 crash left a lot of people feeling singed by the markets. However, those who stuck it out now have it all back and they are sitting around the office saying "I just left it all in my 401K and now it's back". That's a great commercial for long-term investing (our favorite kind) and a great incentive for those who still have jobs to start putting some into the markets again.

As noted in this USA Today graphic, trade volume is rising, portfolios are back to 2007 levels (for those who stayed invested), money if flowing back into the market, bullishness is on the rise and fear is way, way down – probably too far down, as I warned last Friday, along with my hedging ideas, to be used if we can't hold our key levels.

Meanwhile, we're just amusing ourselves with earnings plays. Friday it was CRUS, which we played in Member Chat on Thursday as my reply to a Member's question on them was:

CRUS/Willie – Fabless semis are all about the contracts and CRUS is a bit beaten-down of late and down 7.5% this morniing and not for any good reasons I can see. With earnings tonight and expectations so low, I'd play them bullish by selling 3 Feb $27 puts for $1.90 ($570) and covering with 2 June $23 puts at $1.90 ($380) for a net $190 credit plus you get to keep whatever is left on the June puts. If CRUS drops to $25, for example (down 10%), all you're doing is paying the short puts back and keeping the gains on the long put. Anything up or flat is a winner. Let's do that one with 4 longs and 6 shorts in both $25KPs.

CRUS did even better than we expected, popping 10% higher to test $30 on earnings and the short Feb $27 puts dropped quickly to .55 while the June $23 puts are still $1.45 so our initial $380 credit stays in our pocket and, if we were to cash in now, we have another $580 in value on our 4 June puts and we can leave the 6 Feb $27 puts to expire worthless because we were bullish on CRUS in the first place and this only confirms our desire to buy them below $27. So $1,060 in our pocket after setting up a $380 credit spread is up 180% in 2 days – earnings are fun!

I discussed our other earnings plays on GOOG, IBM, FFIV and AAPL earlier in the week and all goes well, except AAPL, of course but we've got a long view on AAPL and, as you can see from this excellent Dan Frommer breakdown, it's still our One Trade for 2013 as a ride back to $555 – even if we don't visit $400 first, is going to be a nice 26% up from here.

I discussed our other earnings plays on GOOG, IBM, FFIV and AAPL earlier in the week and all goes well, except AAPL, of course but we've got a long view on AAPL and, as you can see from this excellent Dan Frommer breakdown, it's still our One Trade for 2013 as a ride back to $555 – even if we don't visit $400 first, is going to be a nice 26% up from here.

$555 hardly seems unreasonable for a company that was trading at $638 with even lower earnings last spring and, of course, AAPL had $48Bn less cash last year so that, alone, should be good for a 10% bump in the stock price. And, guess what, next year they'll have ANOTHER $48Bn in the bank and that's AFTER paying out a 3% dividend AND buying back more of their own stock at a TRAILING P/E of 8.6.

That's going to be my last commercial for AAPL. Possibly, if they do test $400, we'll have another round of buying but, if not, we won't need to discuss them until it's time for "I told you so" at the end of the year.

Oh, and I guess, to be fair, I should remind you that this year's Dec quarter had 1 less week (7%) than last year's – so the comps are much better than they look – especially if you take into account the late November roll-out of the IPhone 5 and IPad Mini – AAPL's two biggest sellers missing the first two months of the quarter that was already a week handicapped. Now I'm done…

On to other things. We still have tons of earnings ahead with just about 1/4 of the S&P reporting so far so look forward to another week of fun earnings plays in Member Chat as well as some very lively action Thursday and Friday as we get a ton of key economic reports including the Big Kahuna – Non-Farm Payroll, on Friday. 180,000 jobs are expected to be added in January and that will keep our unemployment rate at 7.7%, or about 1/3 of Greece or Spain's.

AAPL's (oops, was trying to move on) 26.7% gain in revenues, as measured by the S&P standard quarter, makes up most of the S&P's 3.8% reported gains so far. While other reports have certainly been less than exciting – the market was preparing for much worse with the Christmas sell-off and we can expect a continued relief rally if earnings continue to simply not suck.

AAPL's (oops, was trying to move on) 26.7% gain in revenues, as measured by the S&P standard quarter, makes up most of the S&P's 3.8% reported gains so far. While other reports have certainly been less than exciting – the market was preparing for much worse with the Christmas sell-off and we can expect a continued relief rally if earnings continue to simply not suck.

As you can see from this Reuters chart, Q1 2013 expectations are worse than Q4 2012 so don't let the MSM tell you that forward guidance is disappointing – it's old news! This, in theory, is our trough to earnings and the market is beginning to look ahead to that 2nd half of 2013 – all the way out to the Fed's QEAtLeast target of 2015. Nothing to do but grow, Grow, GROW for the next 2 or 3 years unless there is hard evidence to the contrary.

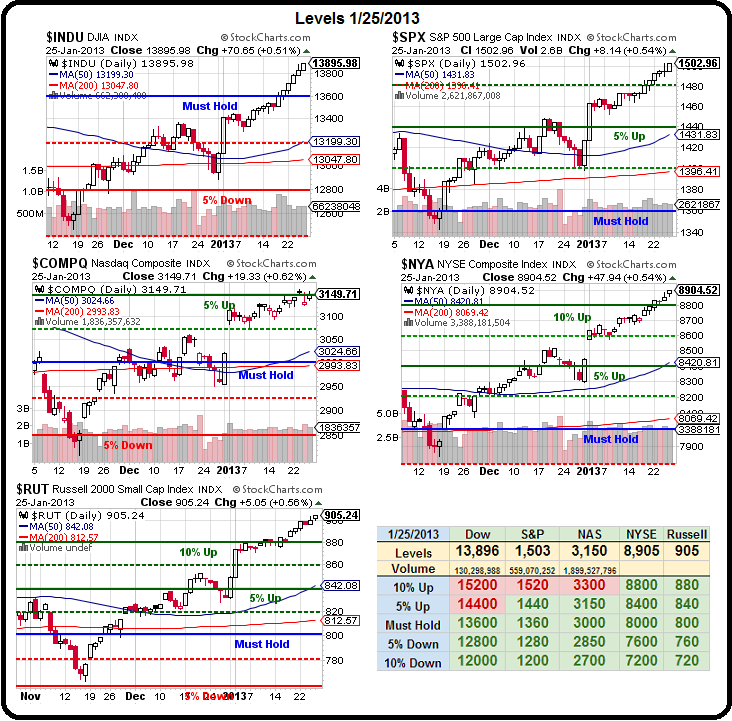

We're not going to get overly excited about the market until we see these moves up sustained. After all, these are nothing more than the targets we set back on Jan 11th and, as predicted that day: "For the Nasdaq to cross over 3,150, it's going to need AAPL to move up – or at least stop dragging it down." That's still the case and hopefully AAPL has finally found a floor so we can see what the Nasdaq is really made of (finishing Friday at 3,149.71 – so I was off by 0.39 two weeks ago). Of course, I also said about AAPL in that same morning's post:

We're not going to get overly excited about the market until we see these moves up sustained. After all, these are nothing more than the targets we set back on Jan 11th and, as predicted that day: "For the Nasdaq to cross over 3,150, it's going to need AAPL to move up – or at least stop dragging it down." That's still the case and hopefully AAPL has finally found a floor so we can see what the Nasdaq is really made of (finishing Friday at 3,149.71 – so I was off by 0.39 two weeks ago). Of course, I also said about AAPL in that same morning's post:

"Maybe they still go to $400 and maybe it lasts another 6 months – you shouldn't care, you should be thrilled to OWN AAPL at that price. But if you keep betting for a short-term pop, you can go broke while you wait."

Unfortunately, people only remember our $555 target and seem to think that, if we didn't hit that level days after earnings – then the prediction must be a failure. The same goes for the markets – it's the beginning of a long year, and we're off to a great start – just don't let your expectations get too far ahead of you.

“There was a long, hard time when I kept far from me the remembrance of what I had thrown away when I was quite ignorant of its worth.” – Charles Dickens, Great Expectations