Dow 14,000!

Dow 14,000!

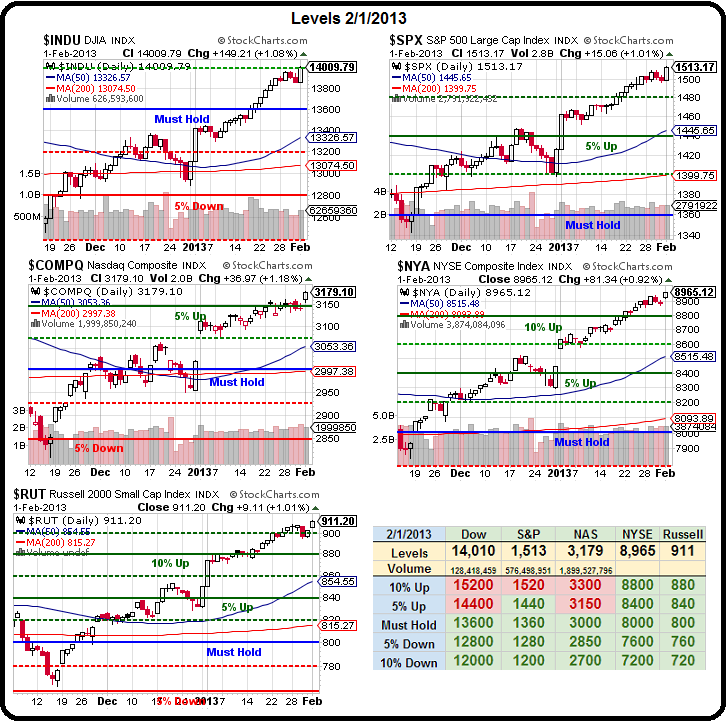

We're past goal on all of our major indexes with a strong finish to the week (and the Nas 3,150 box should be green on our Big Chart) – so now what? Clearly sentiment has turned more bullish but we're not at the stupid bullish levels we were at in 2008 with multiples for most stocks in the 20s or higher and oil at $140 natural gas at $14 and interest rates at 6% and housing prices 30% higher than they are now.

Do you take that into account when you are shown all those scary-looking charts along with predictions of a crash? We crashed because Europe blew up and it turned out our banks had over-leveraged too and there was a massive, cascading crisis that was, in retrospect, inevitable – but this is not that crisis.

What we certainly are, at the moment, is overbought in the short-term and we were just discussing this morning how we needed to cash out our Income Portfolio, which is 18 months ahead of schedule with a too-quick 20% virtual gain – far too much for a conservative portfolio and it's not so much that we fear a pullback, but that it costs too much to protect our ridiculous gains in what is supposed to be a very conservative portfolio.

In our aggressive, shorter-term portfolios – we're actually too short and our hedges and short calls have been burning us and all of our decisions at expiration were essentially to leave the protection in place for a long-overdue pullback.

It's not a question of IF we're going to have a pullback, but a question of when and how much. With such terrific profits in January already – why stick around in our long positions to find out when cash on the sidelines will do us quite nicely?

Last week we discussed that I thought the Dollar was bottoming around 79 and a move up in the Dollar is always bad for commodities and our indexes in the short run. That's why we went heavy on oil shorts last week and, in the conclusion of Friday's morning post, I reminded you to use the opening pop on Friday morning to stock up on those hedges we've been using.

This morning, already, the Dollar is up over 79.50 (0.5%) and the Futures are down 0.5% in response. Not a market sell-off – just a pricing adjustment to the rising Dollar. We got a nice blow-off bottom to the Dollar Friday morning as it dipped below the 79 line and we had played that one with our GLD play, which I tweeted out on Thursday afternoon with a link to this comment from Member Chat, where the trade idea was:

This morning, already, the Dollar is up over 79.50 (0.5%) and the Futures are down 0.5% in response. Not a market sell-off – just a pricing adjustment to the rising Dollar. We got a nice blow-off bottom to the Dollar Friday morning as it dipped below the 79 line and we had played that one with our GLD play, which I tweeted out on Thursday afternoon with a link to this comment from Member Chat, where the trade idea was:

Another fun trade for overnight is a do or die on the GLD Feb $161.50 calls at .35. It's a craps roll as it can easily vaporize but worth a toss as gold could pop back to $1,685 on a poor jobs report (more Fed easing expected) or on a good jobs report (more demand) so could easily double or triple if things go well.

Gold topped out at $1,683.60 on Friday but those GLD calls closed out at $1.25 for a 250% gain in 18 hours while, at the same time, we got our oil dip as well (also a pick from the morning post – aside from all week) from $97.50 back to $96.50 on the /CL Futures, which was good for yet another $1,000 per contract. This is what we can do with our sideline cash while we wait for the market to resolve itself – not so bad, right?

With plenty of earnings reports to go, we can easily amuse ourselves with sideline cash for another month and then, boom, it's time for Q1 earnings in late March – so what are we going to miss. As Stock World Weekly noted this weekend: "Phil advises Members to be conservative. “We have simply done too well to risk blowing it now. So we’re getting cautious as we start the new month. These are ridiculous one-month gains, so let’s protect them." Wise words indeed! My logic with Members regarding our Income Portfolio in our morning Chat was (in part):

"Having, in fact, looked over the Income Portfolio again – I will say my valuation alarms are flashing and I am very inclined to cash out as it's just not worth the risk to make what – maybe another $25,000 – when a $600,000 retirement account is on the table? The problem is there are no good calls to sell with the low VIX, so we can't really cover without just spending money on puts or other hedges and that then impacts our ability to gain. So the issue is, we need to protect $600,000 from a 20% drop so we buy insurance that pays us about $60,000 to cover a drop greater than 5% and let's say that costs us $15,000. So now we've given up $15,000 of potential gains and the market has to go up about 3% before we really make money and we're still going to get whacked for $30,000 on the way down.

Which means, the question is (since it's a 50/50 risk/reward) – do we feel that it's likely that the market goes up 10% (or even 5%) before it goes down 10%? If we're not at least 60% sure that it will go up – what's the point in making the bet?"

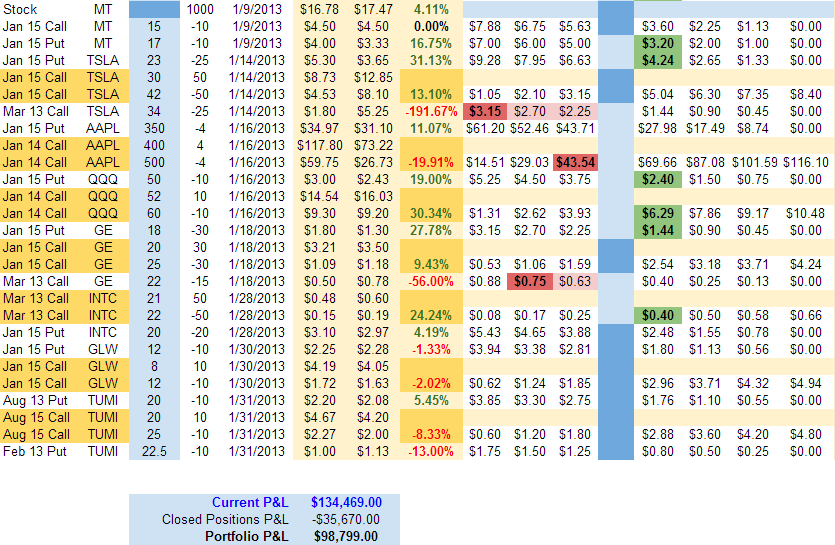

We're not going to literally get out of everything, of course, on the right is a snapshot of most of our January plays and TUMI, for example, was just tweeted out from Member Chat – from the same comment as that GLD play last Thursday – we certainly haven't turned sour on that!

We're not going to literally get out of everything, of course, on the right is a snapshot of most of our January plays and TUMI, for example, was just tweeted out from Member Chat – from the same comment as that GLD play last Thursday – we certainly haven't turned sour on that!

RIG, on the other hand, has been in our Portfolio since June 5th and we netted into RIG at about $28 with a call-away strike goal of $40 and now RIG is at $58 – so no point in not cashing out that one and setting up a new trade with the profits (and see Member Chat for a detailed discussion of that too).

On the whole, we're sticking to our levels from the top of Friday Morning's Post to give us our exit signals on our positions (if ever). Of course, with the Dollar down half a point, we're inclined to excuse a bit of pullback so we'll have to play it by ear as I certainly don't expect the Dollar to go "VOOM" (not even if we put 4,000 volts through it) – just to hold a floor around here as the situation in Europe is far from fixed. In fact, here's a nice comparative chart of various economies from ZeroHedge:

While growth over the past decade has (in economic terms) sucked, we have averaged 1.5% annual growth DESPITE the crash and that means that, on the whole, there's no reason the markets can't go 7.5% higher than they were 5 years ago, right? Obviously, there's a whole lot of "all other things being equal" bits to consider but, on the whole, we are simply not in a declining Global Economy – just a slow-growing one.

While that may worry those of you who are trading with short-term horizons, those of us who are making INVESTMENTS are perfectly fine – and we don't mind those little dips along the way.