Wheeeeee!

Wheeeeee!

We love it when a plan comes together. Oil just dropped a full $2,000 per contract below our $97.50 shorting target on the /CL Futures and the SCO trade we were kind enough to share for free in our morning post of January 30th (the Feb $36/37 bull call spread at .40) now has an excellent chance of finishing up the full 150% in 16 days. Actually, that same morning I discussed shorting oil as it popped up to $98 but, I was not specific about which USO puts we were using for our virtual $25,000 Portfolios in Member Chat and, unfortunately, our next free trade giveaway isn't until April as our Premium Chat goes back on wait-list shortly (what do you expect with these kinds of trade ideas?).

Speaking of good trade ideas, I am still tweeting a few to the cheap seats and we hit one out of the park yesterday when I called for closing the AAPL weekly $455 calls at $6 that we had taken (also noted on Twitter) at $1.55 the day before. That's up 287% in less than 24 hours – that's even better than the oil trade!

Our earnings plays for today (also tweeted as we wind down our free picks month) were from Monday's Member Chat, where we already had 10 of the CMG Jan $235/315 bull call spreads in our virtual Income Portfolio and we sold 10 short March $320 calls for $9 ahead of earnings, assuming high food costs and high expectations would keep us safely below the falling 200 dma ($325) on earnings (and we already have a massive, but unrealized, profit on our net $31.08 spread – which makes 157% in January if we hold $315). That one is perfect as CMG is down just slightly on earnings so we'll hopefully collect our bonus $9 (29% of the basis in 3 days) and we're still on track for the full 157% at the end of the year.

EXPE was a new spread we added to our aggressive $25,000 Portfolio (we have two flavors of virtual $25,000 set-ups, one for high-margin and one for normal margins) with the sale of 4 March $65 calls for $4 ($1,600 credit) and the purchase of 6 July $64.48/69.48 bull call spreads at $2 ($1,200 debit) for a net credit of $400 so, even if EXPE fell, we'd still get to at least keep the $400. Fortunately, we also had a buffer to the upside as EXPE shot up to $69 and that means we may have to give our callers their money back but we also get to keep all the gains on the long spreads – we'll make and adjustment in Member Chat later this morning.

Yesterday was more of a watch and wait day as we didn't find any earnings plays we liked but we did like EDZ (now $9.15) as another nice hedge against a market drop but we're still well above our bear levels (see morning post) so no rush and, of course, we have a clever way to spread the hedge so it's not a one-sided risk.

Yesterday was more of a watch and wait day as we didn't find any earnings plays we liked but we did like EDZ (now $9.15) as another nice hedge against a market drop but we're still well above our bear levels (see morning post) so no rush and, of course, we have a clever way to spread the hedge so it's not a one-sided risk.

As you can see from Dave Fry's Dollar chart, we're still being knocked around by currency fluctuations and this morning the Dollar is up 0.5% and the Futures are down 0.5%. I know it's hard to make the connection so I'll give you a moment….

So the question we ask ourselves as traders (this does not apply to our long-term INVESTING strategies) is – can the Dollar break over 80, which is pretty much that declining 22-week moving average on Dave's chart? Well, what factors influence the Dollar? Other currencies for one thing and the Euro fell from $1.36 to $1.35 (-0.6%) this morning while the Pound is pretty flat at $1.565 and the Yen was rejected at 94 to the Dollar and is a bit stronger at 93.40 so it's the Euro – again – that is giving us trouble and I don't even need to look at the news to know that Italy and Spain are to blame.

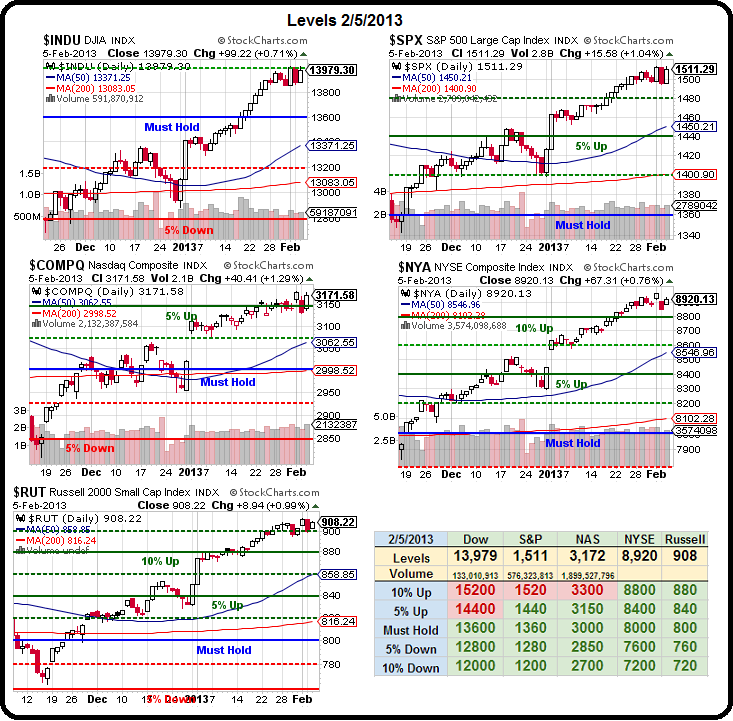

That means our only real concern with today's drop is that we hold Monday's lows and that would mean we're simply still consolidating for our next 5% Rule breakout on the Big Chart:

That's the 10% line on the S&P at 1,520 we're looking at – very, VERY impressive. The Russell is already well over their 10% line – as is the NYSE and those are our two broadest indexes while only our two narrow indexes – the Dow and the AAPLdaq – are truly lagging. As long as the Euro doesn't implode then I don't see the Yen going over 95 (weaker) too easily and that means there's no reason for the Dollar to be leaping higher and crashing the markets and, as was pointed out by Josh Brown last night – where the Hell else are you going to put your money, if not in US equities?

In fact, things are nowhere near as bad as they were in late 2008 or mid 2010 and QE2 had to go through the Fukushima disaster on March 11, 2011, which kind of held it back a bit. Our biggest concern with this round of easing is that it's way TOO MUCH and the Fed has misread the STRENGTH of the economy and is essentially overfilling the tub now and that spillover will begin to take the form of runaway inflation as all that money begins to slosh over the sides.

You will hear an endless parade of fund managers and the media lackeys they pay telling you to get out or stay out of the market and that makes perfect sense because – THEY MISSED THE BUS – and now they need you to get out so they can get in, so any little hiccup is being blown way out of proportion – like the Fiscal Cliff was in December. We ignored that nonsense and we'll have to ignore a lot more nonsense if we are going to stay bullish. As I pointed out to Members this morning, you are BETTER OFF flipping a coin than listening to your average analyst and, the more analysts you listen to – the worse the performance becomes.

You will hear an endless parade of fund managers and the media lackeys they pay telling you to get out or stay out of the market and that makes perfect sense because – THEY MISSED THE BUS – and now they need you to get out so they can get in, so any little hiccup is being blown way out of proportion – like the Fiscal Cliff was in December. We ignored that nonsense and we'll have to ignore a lot more nonsense if we are going to stay bullish. As I pointed out to Members this morning, you are BETTER OFF flipping a coin than listening to your average analyst and, the more analysts you listen to – the worse the performance becomes.

If you are in the market – of course you should have some hedges and, if you had runaway performance like we did with our Income Portfolio, of course you should take some profits off the table – because paper profits are only worth the paper they are printed on and ether profits even less. If you are NOT in the market, however, perhaps you should consider some upside hedges as you really don't want to miss out on another 37% Fed-fueled move up, do you?

That would make you as dumb as a fund manager – and you don't want that!