$85,000,000,000.

Where does it all go? The key difference between last year's "Operation Twist" and this year's "QInfinity and Beyond" is the lack of what was called "sterilization." In Twist, the Fed bought the long Treasury notes while selling the short ones thus "sterilizing" the net effect on the money supply to keep inflation down. In December (when we were crashing – remember?) the Fed announced they would go back to making open-market purchases of long-dated treasuries AND mortgage-backed securities WITHOUT subsequent sales – ie. POMO – ie. MONEY FOR NOTHING!

Yesterday was a $3Bn day, today is $1.5Bn, tomorrow $1.25Bn, Monday $1.5Bn, Tuesday $3Bn, Wednesday $1.5Bn, Thursday $5.5Bn ('cause it's Valentine's day, I guess) and next Friday will be the first business day of the month that the Fed will rest ahead of the holiday weekend (President's day on the 18th) but then MORE FREE MONEY comes in every other day of the month.

As noted by Evil Speculator: "That is not the end of the story – there is another factor we need to consider and it’s the actions of the ECB on my side of the Atlantic. Draghi has been cooking his own stew of sterilized injections by swapping a portion of the ECB’s on-balance sheet exposure for an unlimited off-balance sheet commitment via the Outright Monetary Transactions program. He’s doing this by concurrently offering one-week deposits to the banking system. Banks bid competitively for the deposits, thus permitting the ECB to withdraw from circulation an amount of money equivalent to what it has spent via OMTs."

As I said on Tuesday, the tide is coming in and the Fed is adding water to the Ocean and THEY ARE NOT GOING TO STOP until we are all swimming in so much cash that our $20Tn debt (by that time) is only 1/2 of our GDP. Since our current GDP is $16Tn, that means the Fed is going to have to pretty much triple it through the end of the decade and that means we need China-like 10% annual growth and the way we get there is with our friend inflation.

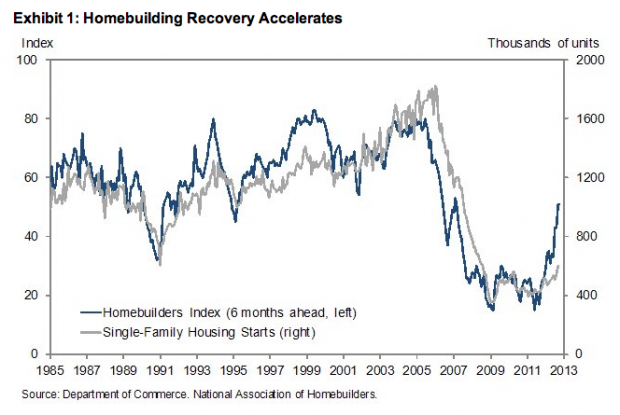

Sound like madness? Not really. Housing, for example, is 18% of our GDP and homebuilding activity is still down about 66% from it's early 2000's level. Millions and millions of jobs were lost in that sector and millions and millions of jobs will come back as it kicks back into gear. What happened to the S&P last time we recovered from a housing crash (Bush the 1st's S&L crisis, not to be confused with Bush the 2nd's Financial crisis)? We went from 350 in January of 1991 to 1,469 in January of 2000 – that's UP 320% in a decade!

Sound like madness? Not really. Housing, for example, is 18% of our GDP and homebuilding activity is still down about 66% from it's early 2000's level. Millions and millions of jobs were lost in that sector and millions and millions of jobs will come back as it kicks back into gear. What happened to the S&P last time we recovered from a housing crash (Bush the 1st's S&L crisis, not to be confused with Bush the 2nd's Financial crisis)? We went from 350 in January of 1991 to 1,469 in January of 2000 – that's UP 320% in a decade!

And how many jobs were added under Clinton during that time? 20M – a net of 2.5M jobs a year or about 200,000 jobs a month or just a bit more than the 196,000 jobs that were added in December or the 157,000 jobs that were added in the not-yet-revised January report last week.

Sure, you might say, Al Gore invented the Internet in the 90s and that kicked off a massive boom in productivity but we're in the middle of another boom the MSM is trying hard to ignore as AAPL (the stock we don't talk about anymore) sold 22,900,000 IPads in Q4 – one out of 6 computers sold in the World! They also sold 4.1M Macs and, for perspective, HPQ was 2nd with 15M and Lenovo (IBM's old PC division) about the same with Samsung selling a respectable (but not Apple-beating) 7.6M and AMZN 4.6M.

Typically research firms don’t count tablets as a PC, because they are quite different from traditional laptops and desktops. But when sales of these two categories are stacked side by side, the numbers give perspective for how quickly the tablet is dissolving the old-school PC. The Canalys report certainly makes the late Steve Jobs sound prescient. When he introduced the iPad 2 in 2011, he said tablet devices were ushering people into a “post-PC” era, an era that can be as transformative for our economy as the Internet was 2 decades ago.

Typically research firms don’t count tablets as a PC, because they are quite different from traditional laptops and desktops. But when sales of these two categories are stacked side by side, the numbers give perspective for how quickly the tablet is dissolving the old-school PC. The Canalys report certainly makes the late Steve Jobs sound prescient. When he introduced the iPad 2 in 2011, he said tablet devices were ushering people into a “post-PC” era, an era that can be as transformative for our economy as the Internet was 2 decades ago.

US GDP climbed 50% in the 90s and, at the start of the run – none of us knew we were in the middle of such a major change. There were plenty of bears at the beginning of the dot com boom and they had excellent reasons and were ultimately proven "right" about valuations – but as someone who was "right" when he said Yahoo wasn't worth $100 and then "right" when I said it wasn't worth $200 and still "right" when I said it wasn't worth $300 – I can tell you from experience I wish I was "wrong" and jumped in at $100.

The market crashed 5 years ago now and people have put off buying homes, cars, washing machines, sofas, having babies, having operations, taking vacations, buying new PCs (or post PCs), hiring staff, painting their homes, getting a new job AND – investing in the market – for long enough and what if this isn't just a little irrational run in the market but just the beginning of another decade of growth? What's your plan?

As you know, we have TRIED to get more bearish but our levels simply will not let us, so far and, even yesterday, we had to kill our NFLX short spread early in the morning (pointless with them included in the Nasdaq), and we cashed in our oil shorts (as planned at the $95 line, shorting again at $97 on /CL Futures) but we still liked long plays on HOV, ABX and RRD as well as reiterating our CIM longs – there's just nothing to short.

We did do a shortish spread on AKAM as our earnings play of the day and my comment to Members was:

AKAM is a good earnings play as you can sell 10 Feb $43 calls (up 5%) for $1.45 ($1,450) against the 10 May $43/46 bull call spreads for $1.10 ($1,100) for a net $350 credit and, if AKAM fails to reach $43, the short calls expire worthless and you keep whatever value remains on the long spread (probably half unless they bomb). Let's do that in the $25KPA.

AKAM dropped harder than we hoped but we keep the $350 credit regardless plus whatever little may be left on the spread so another quick winner on earnings. I can tell you now that we'll be jumping on IRBT as they take a nice hit from disappointing earnings. Next to TASR and the stock that cannot be named, IRBT is one of my favorite 20-year candidates.

We had a similar trade to AKAM set up for GMCR in our virtual $25,000 Portfolios where we shorted the Feb $50 calls for $2 and that's going to be money in the bank as GMCR drops like a rock this morning. Earnings season has been like shooting fish in a barrel so far this year and we have tons of fun still to come with AGNC, ATVI, CSTR, HAS, LNKD, OPEN and SPWRA this evening.

We had a similar trade to AKAM set up for GMCR in our virtual $25,000 Portfolios where we shorted the Feb $50 calls for $2 and that's going to be money in the bank as GMCR drops like a rock this morning. Earnings season has been like shooting fish in a barrel so far this year and we have tons of fun still to come with AGNC, ATVI, CSTR, HAS, LNKD, OPEN and SPWRA this evening.

As you can see from Dave Fry's Russell chart, as well as the Dow chart above, these old barriers don't mean much to a Federally-Funded Index on the rampage. I remember back in the 90s – we pretty much had to give up drawing lines on charts as they never held – the market just went up and up and up and up and, you know what – it was fun!

So stop listening to the Fund Managers who want you to sell them your stocks so they can get back into the market and stop listening to the sore losers on Fox and other Conservative media – who are forced to endure another decade of relative prosperity under Democratic rule – with any luck, we WILL pop our levels and then we can party like it's 1999 or, hopefully, more like 1993 – when we were still in the early stages of a prosperous decade.

Our general plan is to use a percentage of our ill-gotten gains on the way up to keep layering our hedges for the return trip. If the pullback never comes – then we'll have given up some of our potential gains but it let's us keep playing while the market keeps floating higher on the ever-rising tide of loose money that is, currently, lifting all ships (except AAPL – so far).