OK, cheating a bit here.

OK, cheating a bit here.

I started this article on Friday and we were reviewing Anthony Mirhaydari's list as it's an excellent jumping-off point for contemplating the current market situation. I ran out of time on Friday, as I hadn't intended to get into such a major topic at first, so we're going to finish the list off this morning and discuss on this market holiday below (also, there was lots of good stuff in weekend Member Chat – see the end of Friday's comments):

Since it is Friday Monday Tuesday, and a holiday weekend, let's review something we discussed in yesterday's Member Chat – which was an article by Anthony Mirhaydari titled "10 Big Worries About This Market."

Now Anthony's a smart guy so I review this out of respect but we all need to keep in mind that a lot of people are "bearish" for a lot of the wrong reasons and, since this is a list of 10 good ones – it's worth taking a hard look at them.

Before we begin, I just want to mention another smart bear who is being backed into a corner today – poor Bill Ackman is being taken to the woodshed for daring to piss off Carl Icahn, who disclosed a 13% stake in HLF today and sent the stock flying up 22% pre-market. There is nothing worse than a short squeeze when you are bearish and the worst part is, to get out of the trade you have to capitulate by BUYING the stock you hate – thereby adding to the run-up.

Before we begin, I just want to mention another smart bear who is being backed into a corner today – poor Bill Ackman is being taken to the woodshed for daring to piss off Carl Icahn, who disclosed a 13% stake in HLF today and sent the stock flying up 22% pre-market. There is nothing worse than a short squeeze when you are bearish and the worst part is, to get out of the trade you have to capitulate by BUYING the stock you hate – thereby adding to the run-up.

While we all know Bill Ackman has a litany of very good reasons to be short HLF – who cares if more people are buying than selling – especially when one or two of the buyers are so big they totally overwhelm the sellers? The whole market is like that – it's all about sentiment – until it isn't. Our job is only to know when the wind is changing so we can get out. We're not here to fight the battles with the big boys.

"Can we rally on?" asks Mirhaydari – and he acknowledges the Fed and other Central Banks as the primary driver of the rally but he also premises his outlook on what he believes is a coming Global Recession (or the continuation of one we only papered over so far) and I gave my view on what's going on in Europe in yesterday's post.

Indeed "Too Much Faith in Cheap Money" is Miraydari's worry #1 and yes, we are kicking the can down the road but, even in laying out his concern Anthony points out Japan is 230% of their GDP in debt. That means that the US, Europe and China have a very, very long road ahead to kick their cans down before we're in the same situation as Japan (which is to say up 40% in the past 6 months on the Nikkei).

What if kicking the can is the correct strategy? What if we have faith in cheap money because it works – the same way fireman have faith in water to put out fires. Will things get wet and even damaged from all the water? Sure they will, but it beats getting burned – right Japan? So let's give worry #1 a grade of C – it's a religious argument at best – Keynes vs. Hayeck – and we're not going to solve it here.

What if kicking the can is the correct strategy? What if we have faith in cheap money because it works – the same way fireman have faith in water to put out fires. Will things get wet and even damaged from all the water? Sure they will, but it beats getting burned – right Japan? So let's give worry #1 a grade of C – it's a religious argument at best – Keynes vs. Hayeck – and we're not going to solve it here.

Worry #2 is "Investors are Way too Optimistic" and we'll skip that since it's silly. They are only too optimistic if they are wrong and, as I often say to Members – sometimes the reason 99% of the people are on the same side of a bet is simply because it's obvious. When the Fed stops dropping $85Bn a month into the Economy and 150,000 people a month aren't being hired and when Corporations stop reporting record earnings – DESPITE the recession in Europe – THEN I would say Investors are too optimistic but not buying into your bearish premise does not make me an optimist – maybe just a realist.

Worry #3 – "The Economic Data Are Stalling Out." In Europe, yes, in Asia, no, in the US, no way. In fact, the long-suffering Empire State Manufacturing Index just surprised up at 10.04 today, way higher than the -1.75 expected and up from -7.8 prior. New orders were up 20.49 points and shipments jumped 10 points to 13.08 and, of course, prices paid rose to 26.26 but we'll discuss inflation later. Like the Fiscal Cliff, Sequestration and the Debt Ceiling may cut the legs out from under this rally but we can cover that with some hedging – fear of things that haven't happened is not a good reason to run from the markets – as the bears learned in November (well, some of them did).

Worry #3 – "The Economic Data Are Stalling Out." In Europe, yes, in Asia, no, in the US, no way. In fact, the long-suffering Empire State Manufacturing Index just surprised up at 10.04 today, way higher than the -1.75 expected and up from -7.8 prior. New orders were up 20.49 points and shipments jumped 10 points to 13.08 and, of course, prices paid rose to 26.26 but we'll discuss inflation later. Like the Fiscal Cliff, Sequestration and the Debt Ceiling may cut the legs out from under this rally but we can cover that with some hedging – fear of things that haven't happened is not a good reason to run from the markets – as the bears learned in November (well, some of them did).

Record gas prices are mentioned but what all these analysts seem to miss is the 10% drop in demand and we can simplify that by assuming people are getting 10% better mileage on the average car or have found ways to drive 10% less and consume 10% less energy in their home Either way, unless the "record" gas prices are 10% higher than they were (they are not), then what all these clever analysts claim is a net negative for the consumer is actually a net POSITIVE as consumers don't care what they pay per gallon – they care what they pay per fill-up or per month in their energy bills. If you charged me $50 a gallon for gas but I only needed one gallon a month – how is that impacting me negatively?

Record gas prices are mentioned but what all these analysts seem to miss is the 10% drop in demand and we can simplify that by assuming people are getting 10% better mileage on the average car or have found ways to drive 10% less and consume 10% less energy in their home Either way, unless the "record" gas prices are 10% higher than they were (they are not), then what all these clever analysts claim is a net negative for the consumer is actually a net POSITIVE as consumers don't care what they pay per gallon – they care what they pay per fill-up or per month in their energy bills. If you charged me $50 a gallon for gas but I only needed one gallon a month – how is that impacting me negatively?

OPEC (and the NYMEX crooks) have totally screwed themselves by keeping prices so high for so long. They have destroyed demand in a way that will never come back and, even worse, they have set the planet firmly on the path to alternate, renewable energy. We've been very publicly, very short on oil so take my commentary from that perspective but, even as I write this, we are having yet another $1,000 per contract morning shorting oil off the $97.50 line we've been playing for two weeks. We also have longer-term SCO and USO trades looking for bigger moves down but I think we are on very solid fundamental footing here.

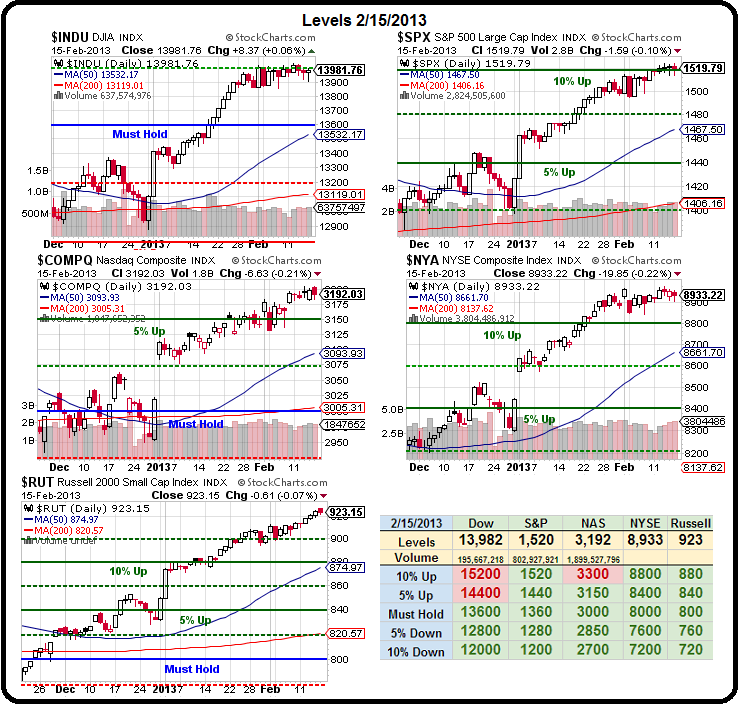

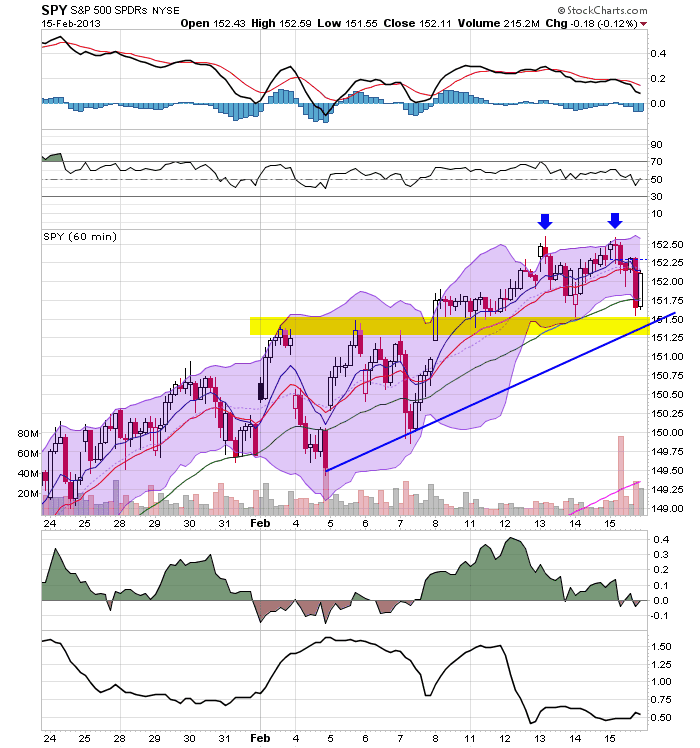

Worry #4 is a good one and, since it's 9:20 I'm going to pause here and finish this article over the weekend. "Fewer Stocks are Moving Up" is a legitimate technical concern regarding rally exhaustion but I question the very brief time-frame (30 days) – especially as we're clearly consolidating along the top of long-term ranges so, of course we are taking a breather here – a healthy one perhaps. As I said above (and have been saying all year) – we MUST watch our levels and keep our emotions in check.

Worry #4 is a good one and, since it's 9:20 I'm going to pause here and finish this article over the weekend. "Fewer Stocks are Moving Up" is a legitimate technical concern regarding rally exhaustion but I question the very brief time-frame (30 days) – especially as we're clearly consolidating along the top of long-term ranges so, of course we are taking a breather here – a healthy one perhaps. As I said above (and have been saying all year) – we MUST watch our levels and keep our emotions in check.

By the way, the article contains statistics and good arguments on the author's side and I'm not repeating them here so please do read the whole thing for the proper perspective as I am simply taking a semi-contrary, more bullish position here.

Worry #5 is essentially the same as worry #4: "Weakening Market Technicals." Now, you know I take my TA with an earth-threatening meteor-sized grain of salt but the fact that so many market participants do practice that particular form of voodoo makes it a self-fulfilling prophesy – a pattern our 5% Rule does an excellent job of identifying.

Worry #5 is essentially the same as worry #4: "Weakening Market Technicals." Now, you know I take my TA with an earth-threatening meteor-sized grain of salt but the fact that so many market participants do practice that particular form of voodoo makes it a self-fulfilling prophesy – a pattern our 5% Rule does an excellent job of identifying.

Mirhaydari points to weakness in EEM and copper as examples of "warnings" we should take seriously and we do check with "Doctor Copper" every morning in Member Chat but perhaps EEM is down because G7 is up and there's only so much money in the World (albeit more being printed every day) and this is nothing more than simple rotation back to the First World.

If we are rotating back to the Developed World, then copper is going to lag because we already have plenty of stuff, thank you. In the dot com boom of 20 years ago – was copper up? Was oil up? Was gold up? No – it was a different paradigm driving the markets and those who failed to adapt to the new model had a very hard time of surviving.

If we are rotating back to the Developed World, then copper is going to lag because we already have plenty of stuff, thank you. In the dot com boom of 20 years ago – was copper up? Was oil up? Was gold up? No – it was a different paradigm driving the markets and those who failed to adapt to the new model had a very hard time of surviving.

Saying copper must go up for Global Markets to thrive is like saying wagon-wheel production is the best economic indicator we have – it might have been true at one time – it might have been true for 200 years – but not this year…

Speaking of thriving markets: Did you know that Private Sector Employment is now back to pre-recession levels – with the notable exception of the Housing Sector. RBC's analysis does show that "the private sector (excluding housing) is back and in full recovery mode," says Mark Zandi, chief economist of Moody's Analytics. By contrast, employment in housing-sensitive sectors — including construction, wood product manufacturing, furniture sales and architectural services — totaled 13.5 million last month, RBC says.That's nearly 500,000 above their December 2010 low. But it's still almost 3 million below their total before the recession started in December 2007.

This has been our bullish premise for two years now – jobs are clearly coming back – only a Republican could possibly deny those facts. More jobs eventually lead to more spending and, ultimately, more housing but OBVIOUSLY housing is going to be a lagging – not leading indicator. If you are going to wait for the next housing bubble to jump into the markets (or housing) – you are likely to once again not only miss the boat but to once again be the guy boarding the Titanic while everyone else is heading for the exits (but at least the band was still playing).

This has been our bullish premise for two years now – jobs are clearly coming back – only a Republican could possibly deny those facts. More jobs eventually lead to more spending and, ultimately, more housing but OBVIOUSLY housing is going to be a lagging – not leading indicator. If you are going to wait for the next housing bubble to jump into the markets (or housing) – you are likely to once again not only miss the boat but to once again be the guy boarding the Titanic while everyone else is heading for the exits (but at least the band was still playing).

So, rather than trying to use housing to "prove" we're not recovering, think of housing as another 3M jobs waiting in the wings to come back – almost another 100,000 jobs a month in that sector alone for the remainder of Obama's term. If the Government stops shrinking (down 20,000 jobs a month on average over the past 3 years) and the private sector keeps adding 150,000 jobs a month – we could be adding 250-300,000 jobs a month once this train gets moving. How's that for a bullish premise?

Worry #6 is an interesting one: "Rising Geopolitical Risks" – Unless China and North Korea are nuking Japan and Greece has literally caught on fire and I wanted to say people are marching in the streets in Spain, Italy and France but that's already happened so I'm already running out of things that can be worse than meteors falling from the sky the day before an actual astroid misses the Earth by less than the distance of a flight from NY to Tokyo. Let's see what Anthony comes up with: North Korea blah, blah, Japan and China blah, blah, North Africa blah, blah, Iran blah, blah and now Russia is also disputing islands with Japan. Sounds like business as usual to me. Hey, remember that time when Germany invaded EVERYBODY and Japan bombed us and we bombed them and 20M people were killed? We survived that and stocks are up since then – I don't think North Korea's going to take us out (been there, bombed that too).

Worry #6 is an interesting one: "Rising Geopolitical Risks" – Unless China and North Korea are nuking Japan and Greece has literally caught on fire and I wanted to say people are marching in the streets in Spain, Italy and France but that's already happened so I'm already running out of things that can be worse than meteors falling from the sky the day before an actual astroid misses the Earth by less than the distance of a flight from NY to Tokyo. Let's see what Anthony comes up with: North Korea blah, blah, Japan and China blah, blah, North Africa blah, blah, Iran blah, blah and now Russia is also disputing islands with Japan. Sounds like business as usual to me. Hey, remember that time when Germany invaded EVERYBODY and Japan bombed us and we bombed them and 20M people were killed? We survived that and stocks are up since then – I don't think North Korea's going to take us out (been there, bombed that too).

If you are not going to invest in the market because the World is a scary place with countries that fight and threaten each other – may I suggest our BBB trade – "Bullets, Beans and Bullion" as you may as well just stock up and head to the fallout shelter now because, judging from history, you're going to have a long, long wait before peace and harmony break out all over the planet.

Worry #7 is "The Risk of Inflation" – Risk? We're counting on it!!! Mirhaydari talks about $4 gas but we covered that above and rising prices due to Fed money printing is EXACTLY WHY you'd damn well better have money in the market and not sitting around in a bank where it's losing value every day. The falling labor productivity is, so far, a blip but also a good sign that Big Business simply can't squeeze any more concessions (longer hours for less pay) from their workers so they either have to invest in better software, robots, etc. to improve productivity (and that boosts the economy – until the robots have all of our jobs), hire more workers or give better incentives to the workers they have. Maybe they do a little of each and THAT is EXACTLY what a booming economy looks like – isn't it?

Worry #8 "Worrisome Global Elections" makes me think Anthony wrote the title before he wrote the article and now he's just stretching to round out 10. I almost never do top 10 lists – even though those kind of articles get 2-3x more hits than any other kind but, unfortunately my fellow writers tend to go for the ratings more often than not.

Worry #9 is "Looming US Budget Fights" and, as I was saying to Ron (I'm spending the week with Opesbridge in LA) last night, I'm pretty sure we're already seeing the sequestration concerns holding back the markets and, when and if those worries are lifted, THEN the market will really take off! $1.2Tn worth of spending cuts sounds like a lot until you realize it's just $120Bn a year, which is 5% of government spending and half of that comes from our bloated $1Tn military budget. Isn't that what we're SUPPOSED to be doing to show some fiscal discipline. While I wouldn't be too enthusiastic about investing in Defense stocks – I am certainly not worried about $60Bn of other Government cuts sinking the economic ship.

Worry #10 is "Slowing Corporate Earnings Growth" and I find this disingenuous as earnings are, in fact, up about 3.5% this year, which puts the S&P currently priced at about 13.5x forward earnings – quite reasonable actually. Of course growth is slowing – this isn't China. We had huge growth because we had losses reported in '09, barely recovered in '10 and had a nice recovery in 2011 and 2012 was more of the same but, now that every additional percentage point of earnings is setting a new ALL-TIME RECORD, perhaps it's OK that they slow down just a bit.

Worry #10 is "Slowing Corporate Earnings Growth" and I find this disingenuous as earnings are, in fact, up about 3.5% this year, which puts the S&P currently priced at about 13.5x forward earnings – quite reasonable actually. Of course growth is slowing – this isn't China. We had huge growth because we had losses reported in '09, barely recovered in '10 and had a nice recovery in 2011 and 2012 was more of the same but, now that every additional percentage point of earnings is setting a new ALL-TIME RECORD, perhaps it's OK that they slow down just a bit.

So not really enough reasons for us to turn bearish. Show us the level failures and we'll be happy to re-consider but, at the moment, it looks to me like we are consolidating for a massive break-out once we do get past the Sequestration nonsense. Consensus earnings for 2013 (ZH chart left) is for a massive improvement through 2013 and the fact that the author points out that just 65 of 500 S&P companies (13%) warned they might not meet those numbers really isn't what I'd call bearish – would you?

As the G20 meeting wound down, Bundesbank President Jens Weidmann spoke to reporters following meetings of Group of 20 nations' finance chiefs in Moscow. In the G-20 "there's unity in rejecting an active exchange-rate policy to bring about competitive advantage," Weidmann said. "Politically-motivated devaluations can't sustainably improve competitiveness, they don't solver structural problems and they set off reactions" elsewhere, he said. "The clear language in the communique underlines this unity, and will allow the debate in the future to take place with a less excited tone," he said.

On the whole, the G20 was soft on currency manipulation and had little to say in general and that's got the Nikkei and the US markets all excited this morning as it's a green light to shower their citizens with Dollars and Yen until we are literally swimming in currency and then we can inflate our way out of debt so let's watch Google break $800 today and maybe someone will even buy AAPL today – I think we should pick up 10 weekly $470 calls for $1.80 for our virtual $25,000 Portfolios as a fun way to start the week.