Down is no longer an option, is it?

Down is no longer an option, is it?

It's getting kind of freaky to be in a market that just goes up and up every day. For those who are not in the market, it's like being a little kid and watching a balloon you were just holding fly up into the sky and get further and further away – for a second you think you might catch it but then it's gone and then you can't believe how high it goes and you keep expecting it to pop but it just goes up and up and up until you can't even see it anymore.

Denkst du vielleicht g'rad an mich

Dann singe ich ein Lied für dich

Von 99 Luftballons

Und dass so was von so was kommt – Nena

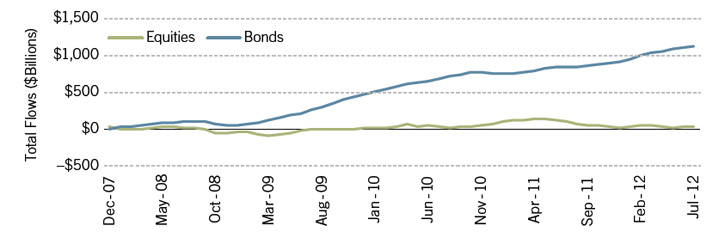

As Mark Hulbert points out: "Investors — tantalized as they are by the prospect of the stock market “melting up” as the trillions currently in bond funds get transferred into equities — don’t want to prematurely leave the party Wall Street has been throwing. Yet they also are worried about the downside risks of a bull market that is unquestionably getting rather long in the tooth."

Barry Ritholtz then makes a good case that it's pointless to try to guess tops and bottoms but – that's what you pay us for so we'll keep guessing anyway! As I often tell Members – I may be a pretty good guesser but, as with baseball pitchers, winning 60% of the time in the market is considered damned good. The trick is to learn to manage your money so you take advantage of that small winning percentage and, of course, our big advantage using options to generate incomes lets us BE THE HOUSE and creates a huge advantage over typical buy and hold strategies.

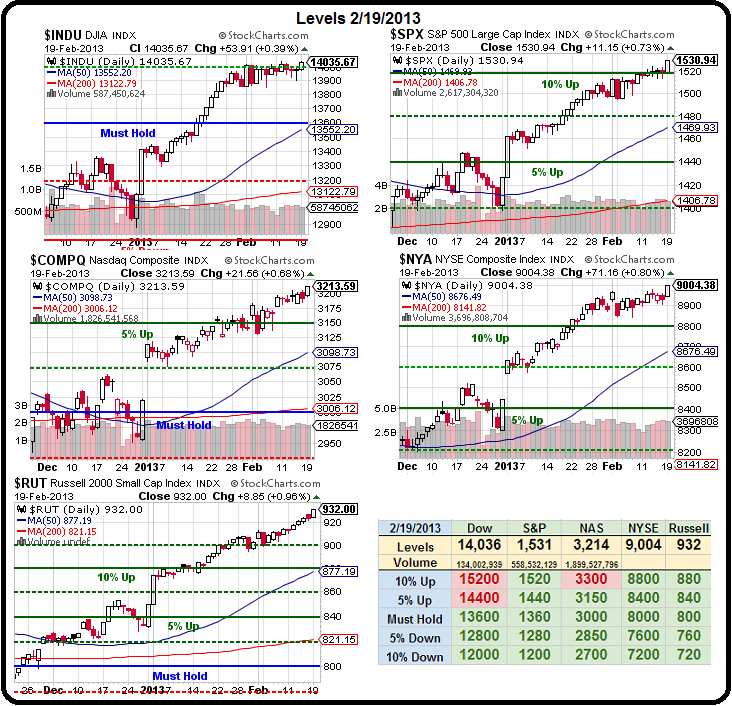

As you can see from our Big Chart – we are simply off to the races at the moment and, rather than sitting back to enjoy it – everyone is waiting for the crash – kind of like Nascar Racing, I guess… Andrew Parlin of Kotell Advisors says this rally may just be in it's infancy:

While some dismiss Fed policy as creating the next bubble in credit markets, this is a misuse of the word bubble. A bubble describes an excess that eventually self-destructs. This, in contrast, is a healthy tonic for a very fragile economy. It is the only pathway out of a long-lasting liquidity trap. Just ask the Japanese about whether liquidity traps cure themselves. They don’t. It takes a policy shock. This is exactly what the Fed is delivering. The precondition for a better economy is a powerful and long-lasting rally in stocks and credit, thus driving down the cost of capital for American business.

We are reaching a turning point where robust capital markets finally inject optimism into corporate decision marking. Recent activity in M&A is reflective of this. And it suggests that we are on the cusp of a new cycle in private capital spending. All of this points to an improvement in labor markets, better growth in personal income and a sustained improvement in final demand.

The really good news is that Bernanke knows all too well that monetary policy must remain highly accommodative until the economy is without any question on a firm footing. After all, it was the premature withdrawal of monetary stimulus in 1932 that turned a recession into the Great Depression. We are a long way from the next tightening cycle, particularly given a very large output gap and the contractionary impulses that are about to come from higher taxes and smaller public sector outlays.

Rarely do central bankers keep such forceful monetary stimulus in place well into an economic expansion. But this is the unusual dynamic at work today. It is nirvana for stocks, which is why the 128% advance off the 2009 lows should be viewed as little more than a return to baseline. The next big secular rally has just begun.

Of the $37.5B of flows into ETFs this year, 92% has gone into stock funds, according to ConvergEx, well above the typical ratio of 65-70%. U.S. stocks garnered the biggest share at 42%, while Japanese ETFs (see WETF) saw 8%. Dividend ETFs (DVY) have received nearly $4B already this year vs. $9B for all of 2012. "I think we're seeing fear fatigue," says money manager Darell Krasnoff. Clients of his out of stocks for some time are calling and asking to get back in. It's the same story at Fidelity and Schwab both seeing marked increases in trading activity while the Vix declines even on days when the markets sell off.

Of the $37.5B of flows into ETFs this year, 92% has gone into stock funds, according to ConvergEx, well above the typical ratio of 65-70%. U.S. stocks garnered the biggest share at 42%, while Japanese ETFs (see WETF) saw 8%. Dividend ETFs (DVY) have received nearly $4B already this year vs. $9B for all of 2012. "I think we're seeing fear fatigue," says money manager Darell Krasnoff. Clients of his out of stocks for some time are calling and asking to get back in. It's the same story at Fidelity and Schwab both seeing marked increases in trading activity while the Vix declines even on days when the markets sell off.

There are, of course, opportunities in either direction – after spending all day yesterday telling our Members to be PATIENT on oil, we were rewarded this morning with a spike in /CL Futures to $97.50 (our shorting line) at 6:20 and, even as we crossed below $97, in Member Chat this morning I said: "Very harsh rejection of oil off our $97. 50 line this morning – fast drop back to $97 so far and that line is OK to short off if it breaks but bouncy at the moment and has been bouncy since end of yesterday's session so very strange action." That was a good short call as we took a further dip to $96.80, which may not seem like much but it's $200 per contract and pays for the whole family's Egg McMuffins – which is all we try to do with our Futures trades. Now oil is back at $97.25 pre-market and we'd love to get another crack at the $97.50 line but, due to the holiday, no inventories until tomorrow so lots of room for the NYMEX crooks to jam it up ahead of that.

We have Fed minutes later today (2pm) and those could take the wind out of our sails if they seem more hawkish but I doubt it. There was an attempt to sabotage AAPL early this morning by claiming Foxconn's hiring freeze was due to lack of iPhone orders. In fact, right now (9:13) CNBC is spinning it that way and Cramer is pontificating on AAPL's "woes" BUT – upon further (any?) investigation, it turns out that "Foxconn halted recruitment until the end of March after more employees returned from the Chinese New Year break than a year earlier, Bruce Liu, a spokesman for the Taipei-based company, said today in a phone interview. The decision wasn’t related to iPhone 5 production, he said."

It took me all of 10 seconds this morning to check the original rumor and read the Bloomberg article and find out it was BS (and AAPL dropped $10 in pre-market trading on the rumor, now back to $456 despite the CNBC hack job) but CNBC had to ACTIVELY AVOID checking facts or doing ANY SORT OF RESEARCH and the created AN ENTIRE SEGMENT bashing AAPL that was based on an unfounded, UNTRUE rumor that any of the talking heads on the station should have been suspicious of in the first place. This is not Cramer's first round of AAPL-bashing either (see picture), it's a pattern of lies and unfounded attacks designed to allow his hedge-fund buddies to buy stocks on the cheap as Cramer chases his deluded followers out of their positions.

Yet amazingly, no arrests will be made…