We're doing an experiment here and seeing if a book can be authored by a group.

We're doing an experiment here and seeing if a book can be authored by a group.

I think we all have enough experience, as students, teachers and traders, to write the best book ever written so let's give it a shot.

Sadly, there is no money in publishing – the publisher takes about 90% of it but, if this book goes well, maybe we'll have leverage on the 2nd one! I just think it would be really cool to have a book that's written by a trading group like ours so I'm going to post chapters as they are being worked on, which means I am not at all attached to their content but it's a good way to get started.

In the comment section, feel free to make changes, copy parts and rewrite them or whatever. If you want to include an image, please just post the link for it and I'll fix it up.

What we have here is two drafts of Chapter one that Sage and I were working on so our first job is to determine which way the book should go or combine the two somehow. The main idea is to figure out which style is going to resonate with the average book reader.

Keep in mind this is our first book so a bit of intro to options and we'd like to teach people to "Be the House" – but maybe we'll save that for the second book and make this one more about learning the basics or maybe you guys feel that if you see another book about basics you will kill yourselves (my feelings, really, but I'm way out of touch with what's good for beginners) – we'll all have to decide.

Anything that has ever been written on this site is fair game -as is anything you want to contribute. This is a good time to mine the Wiki and our Education Section and those notes people take but, while you are at it – please try to add to the Wiki too – as I find it quite useful for new Members. And so, let us begin at the beginning:

CHAPTER 1 – INTRODUCTION

The dot.com phenomenon in the late nineties demonstrated the ease with which money can be made in a rising market. But as the aftermath of that phenomenon demonstrated there is a flip side to that coin. Paper profits can be wiped out and major losses incurred in the seeming blink of an eye.

The dot.com phenomenon in the late nineties demonstrated the ease with which money can be made in a rising market. But as the aftermath of that phenomenon demonstrated there is a flip side to that coin. Paper profits can be wiped out and major losses incurred in the seeming blink of an eye.

Many people have concluded from their experiences during the market downturn that stock market investing is very fickle, that there is a large element of luck in trading, that one must buy and sell at the right times, and that making the necessary decisions is often fraught with angst. These uncertainties have made them fearful of the stock market and at the same time they have a desire to play the market with a view to enhancing their own financial positions.

This mix of emotions, the desire to participate allied with the fear of incurring losses, is frequently compounded by misconceptions about stock markets. Many people, for example, would take it as given that money can only be made if stock prices rise. But believe it or not, that would be incorrect! What would you say if you were told that there was a way to protect what you had invested? What if you were told that you could protect the stocks that you had invested your life savings in? Would you be interested in learning how to protect your money no matter how the stock performed, even if the stock price fell?

What if you were told that you could generate money every month on stocks you already own? You would not have to wait passively for stock prices to rise but you could proactively generate cash each and every month. Would you be interested in learning how to do that?

What if you were told that you could generate money every month on stocks you already own? You would not have to wait passively for stock prices to rise but you could proactively generate cash each and every month. Would you be interested in learning how to do that?

The overall objective of this book is to explain how one can profit in the market regardless of the direction in which it moves, and how to do so with equanimity and a high sense of personal control. This book provides you with the necessary tools to be able to achieve this goal through the strategies of spread trading. This knowledge, combined with an understanding of techniques and strategies for analyzing stocks with a view to determining their likely direction of future movement, should enable you to trade profitably and consistently in any market. These matters and all related matters are covered in detail in this book, as are suggestions as to precisely how one should move from a mastery of the skills involved to profitable market place trading.

The strategies proposed have been thoroughly tested and disciplined adherence to them should provide you with Secrets to Explosive Stock Market Profits. They should yield handsome and consistent profits over time coupled with tremendous personal satisfaction.

1.1 Objectives

When you have completed this book you should have an excellent understanding of the following topics:

- How to answer the million dollar question – how can I buy high, sell low and profit?

- What stocks to buy and when to buy them

- When to trade with the crowd and when to trade against the crowd

- Eliminate greed in your trading

- How to own a stock for zero cost basis

- Proactively generate cash flow with stocks you own

- Eliminate fear in your trading

- How to insure your stocks when the market goes down

- How to profit in a down trending market

- How to profit using advanced strategies

- What exit strategies to use

- How to correctly apply strategies

- What brokerage should you use

- Money management

1.2 What is the profit potential and how can I achieve it?

In order to gain maximum benefit from this book you should plan on putting in the effort to get a good understanding of the principles involved and you should paper trade for a further period. It is also recommended that you refrain from real-life trading until such time as your command of the subject is producing 7 or 8 successful trades out of every 10.

Application of the strategies taught in this book could yield annual returns of 40% for low-medium risk strategies and much more if higher risk strategies are employed! Thus an initial investment of $5,000 is capable of being turned into $27,000 over five years, and into $144,000 over ten years. Indeed if the annual rate of return could be lifted to 50% and the term extended to fifteen years, the original $5,000 would appreciate to well in excess of $2,000,000! So the potential is fantastic!

In this book you will learn that, in many cases, you do not have to accept losses. In fact when you learn to adjust your trade to the current trend you can often turn a losing trade into a profitable trade. You will learn that you can protect your money such that even if the stock you purchased goes to zero, you can still sell the stock at a fixed price and hence limit your risk. You will also learn strategies that will allow you execute a trade and be confident that even if you don’t look at the stock market for the next year you will not have to worry about the outcome of the trade.

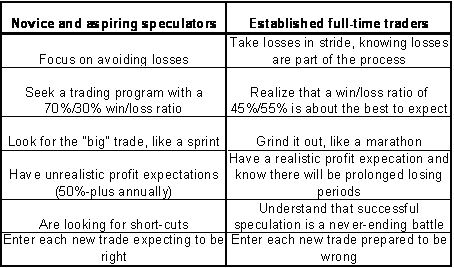

1.3 Trading Psychology

It is further the intention of this book to eliminate limiting beliefs such as:

It is further the intention of this book to eliminate limiting beliefs such as:

- You have to accept losses

- You can lose all your money

- Trading is risky and complicated

- You have to dedicate a huge amount of time to be successful

- The trade must go your way

- You have to be very intelligent to trade

And to replace them with empowering beliefs:

- Trading can be low risk

- Trading with pre-defined exit points will reduce fear

- Trading can be simple

- Trading does not have to demand a huge amount of time

- You can be consistently profitable when trading

CHAPTER 1A – The Adventure Begins

1.1 Embark on an Unforgettable Adventure!

You’ve just embarked on a journey that can make you very very rich! But you have heard those words “can make you rich” too often. So, we’re going to captain you on an adventurous crusade that will not only show you how you can get rich, but much more importantly, show you the precise steps we followed to riches and how you can embark on the same path for yourself.

We have been there and done it. We have got the ragged t-shirts that are testaments to our market trials and tribulations. We have felt the searing pain when we made the mistakes and we have felt exhilaration when the market moved in our favor. Most importantly, we have learned and created from our experiences a system of trading that works for us and we are confident will work for you. We know because our system is flexible, adaptable and can be tailored to any individual of any level of risk tolerance and with any degree of stock market proficiency!

In this book we, Phil and Gareth, our combining our extensive experiences in the stock market to produce the most readable, interesting, educational, profitable and fun guide to options trading the world has ever seen. As we embark on our profitable adventure we will intersperse golden rules and cardinal sins of investing that you can use to enhance your trading results. But before we kick off you are probably wondering who the heck we are?

Phil is a prolific writer with a huge online readership and proven track record at the well-known trading site: www.philstockworld.com. In the blogosphere, few writers have gained the notoriety and widespread appeal as Phil. In fact so much so that Phil has enjoyed mention in such esteemed publications as the Wall Street Journal. Phil was a former editor of a University of Massachusetts humor magazine and it shows in his writing which is filled with colorful commentary. His success is primarily attributable to Phil’s ability to distill extensive reading and research into simple straightforward trading ideas that are overwhelmingly profitable. In fact, Phil’s biggest problem is often being too far ahead of the curve and having to wait until the analysts catch up! With Phil you can be assured of smart discussion, more good ideas than you can imagine and a lot of witty commentary to keep you entertained too!

Gareth also has a widespread following as a well-respected educator in the field of stock and option trading. Gareth has taught literally thousands of classes to self-directed investors on topics including options basics, spread trades, complex spreads, risk management, fundamental, technical & sentimental due diligence and more. His expertise lies in his ability to “turn losing trades into winning trades” and he lives by the philosophy that “if every losing trade can be turned into a winning trade then every year will be a profitable year”.

Gareth also has a widespread following as a well-respected educator in the field of stock and option trading. Gareth has taught literally thousands of classes to self-directed investors on topics including options basics, spread trades, complex spreads, risk management, fundamental, technical & sentimental due diligence and more. His expertise lies in his ability to “turn losing trades into winning trades” and he lives by the philosophy that “if every losing trade can be turned into a winning trade then every year will be a profitable year”.

Gareth has tailored the system of trading that he teaches to highly conservative multi-millionaires looking for steady and safe income streams in addition to highly aggressive self-directed investors looking for stellar returns and almost every category of trader/investor in between. Furthermore, Gareth has taught at investment conferences all across the United States, from Hawaii to Florida and many states in between. Gareth enjoys putting his teaching into practice at www.markettamer.com – a service he started to show traders how it is possible to win consistently in the stock market – even if you are not initially right!

The bottom line is you need to know how to win and win consistently in the stock market to grow your wealth. And you need something much more than a boring text book with theoretical, formulaic exhaustive passages written with hypothetical examples of what could be done if a myriad other conditions fall into place all at a precise moment in time. This book, on the other hand, benefits from the perspectives of two successful stock market aficionados with a united goal of showing you step-by-step, example-by-example real world situations that you will encounter again and again, how they have profited in the past and leverage those experiences to profit in the future.

.png?maxX=500&maxY=345) In this book you will learn how to control your two worst enemies, greed and fear! You will learn what you need to know to make money not the 1001 things that won’t make you a dime! You will see example after example of winning trades and more importantly the reasons why they were entered and the criteria to look for when you are searching for similar positions. You will leverage Phil’s prowess in identifying the right trade at the right time and Gareth’s expertise in risk mitigation. You will learn the golden rules to live by and the cardinal sins to avoid at all costs.

In this book you will learn how to control your two worst enemies, greed and fear! You will learn what you need to know to make money not the 1001 things that won’t make you a dime! You will see example after example of winning trades and more importantly the reasons why they were entered and the criteria to look for when you are searching for similar positions. You will leverage Phil’s prowess in identifying the right trade at the right time and Gareth’s expertise in risk mitigation. You will learn the golden rules to live by and the cardinal sins to avoid at all costs.

This book will level the playing ground. You have heard how the wealthy take advantage of hedge funds, private equity, pre-IPOs and so forth. You have heard how program trading has affected the markets and you wonder how the small investor can take on the large institutions. In this book you will see you don’t have to. In fact, you can simply ride on their coattails in many instances. You have many advantages over the common institution in your ability to quickly get in and out of the market. They can’t hide on the big playing field but you can skillfully navigate your way through the market by following the path presented in this book. You won’t need to be concerned about fighting the big boys because you’ll be on the same side as them.

Here’s a quick recap of what you should expect to learn from this book:

- Option Trading “Must-Knows”

- How to Eliminate both Fear & Greed

- How & When to Buy Insurance

- When & Why to Enter & Exit

- Real-Life Documented Profitable Examples

- The Golden Rules of Trading Options

- How to Avoid The Cardinal Sins

- Profit from Steep Declines

- Profit from Volatility

- How to Deal with Uncertainty

- Where to Find 100%+ Returns

- How to Speculate with Vegas Trades

- How to Turn Losing Trades Into a Winning Trades

1.2 How much can I make and how should I begin?

You will see real-life trades presented in this book that have made greater than 20%, 40%, even 100% in short timeframes and you will see strategies that have more conservative profit targets. It really does depend on how much risk you are willing to take. If you accept high levels of risk you must be willing to accept much more volatility in your account as it fluctuates.

In order to set expectations, let’s refer to one of the richest men in the world as a guideline and see what he targets annually. Warren Buffett is often cited as one of the world’s best investors and his average annual return is considered to be above 20% historically. Now keep in mind Warren Buffett controls a vast fortune so making 20% on a HUGE number is a whole lot more difficult than making 20% on a relatively small number – say thousands to millions of dollars as opposed to billions of dollars.

Trading options certainly offers us opportunities to exceed 20% per year but let us simply use that number as a basis for calculating what 20% per year would amass to over time. Some might deem 20% to be a fantastic return while others might deem it a modest return but if it’s good enough for a billionaire let’s go ahead and see what it would mean for us. And to make the calculations simple, let us assume a starting capital of $100,000 is being traded in a qualified account such as an IRA so we can defer the impact of taxes.

|

Year |

Capital (20% per year) |

|

START |

$100,000 |

|

1 |

$120,000 |

|

2 |

$144,000 |

|

3 |

$172,800 |

|

4 |

$207,360 |

|

5 |

$248,832 |

|

6 |

$298,598 |

|

7 |

$358,318 |

|

8 |

$429,981 |

|

9 |

$515,977 |

|

10 |

$619,172 |

At the end of 10 years we can see our initial investment has appreciated from $100,000 to just over half a million dollars. Now let’s see how dramatically this number changes if we can increase our return slightly from 20% to 25% and if we contribute an extra $5,000 per year to our investment.

|

Year |

Capital (25% per year + $5,000 additional investment at end of each year) |

|

START |

$100,000 |

|

1 |

$130,000 |

|

2 |

$167,500 |

|

3 |

$214,375 |

|

4 |

$272,968 |

|

5 |

$346,210 |

|

6 |

$437,762 |

|

7 |

$552,202 |

|

8 |

$695,252 |

|

9 |

$874,065 |

|

10 |

1,097,581 |

You can see right away the huge impact just a few extra percent and a small contribution each year has on our overall returns. Our capital has appreciated to over $1,000,000 in this example. It is for this precise reason that we make every attempt to avoid losing trades and indeed convert those losing trades into winning trades through adjustment strategies where possible. In short, every % point we can squeeze out will increase our returns over time exponentially.

A corollary to this is to note the % increase in account value required to breakeven if we were to initially take a loss.

|

% Loss |

% Increase Required to Breakeven |

|

10 |

11 |

|

20 |

25 |

|

50 |

100 |

It is also the reason why you will hear Buffett’s First Rule of Investing is “Don’t Lose Money” and his Second Rule of Investing is “Don’t Forget the First Rule!” Small changes early on make big differences later on and so our priority is to avoid taking losses at all costs.

It is also the reason why you will hear Buffett’s First Rule of Investing is “Don’t Lose Money” and his Second Rule of Investing is “Don’t Forget the First Rule!” Small changes early on make big differences later on and so our priority is to avoid taking losses at all costs.

So, what’s the best way to make sure to avoid those losses? Risk-free virtual trading! Take advantage of commentary and picks at www.philstockworld.com and www.markettamer.com through virtual trading or even paper trading, through a journal. Lots of broker/dealers have virtual trading platforms that allow you test your ability in the stock market at no cost to you and no risk. It’s a guaranteed way to learn quickly and we would highly encourage you take advantage of it.

If you are eager to jump in to make a fast buck, then we would encourage you to remember one of Gareth’s favorite phrases “Patience Pays”. One of our primary goals in writing this book is to convey to you that greed and fear have no business in your system of trading. In fact, an eagerness to dive in without practice is likely attributable to the greed-devil whispering bold suggestions that would be best avoided. In the stock market, great trades exist every day and a little practice can go a long way towards honing your skills early on.

Without further ado let’s raise the curtain on this exciting adventure and journey towards our profitable destination. We hope it will be as much fun for you reading as for us writing. Away we go……