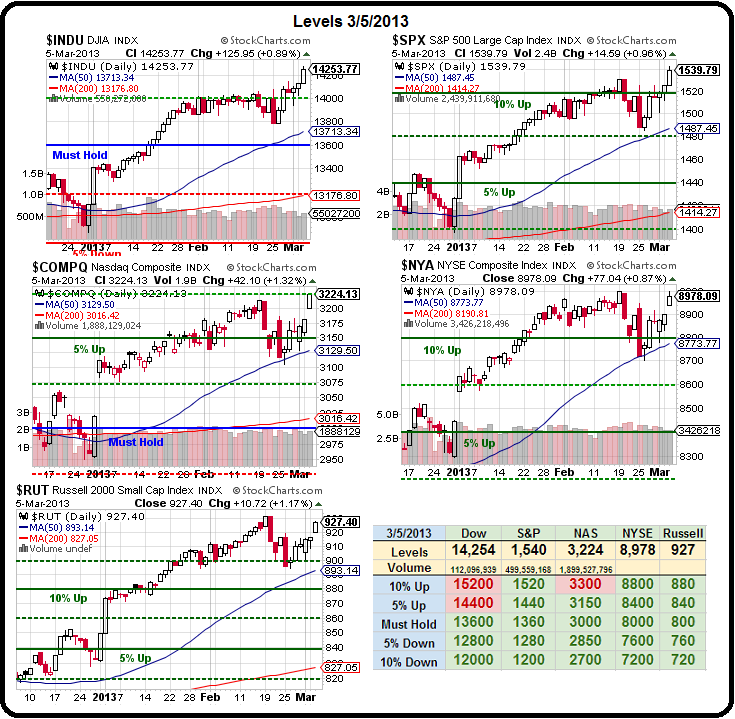

Happy 14,253!

It's a brand new all-time high for the Dow, which is not, of course, the same Dow as we had in 2007 but let's not sully our victory with facts, right?

OK, lets: In Feb 2008, MO and HON were replaced by BAC and CVX, then AIG was replaced by KFT that September and in June, 2009, C and GM were replaced by CSCO and TRV and then KFT was replaced by UNH last September.

MO was a great drop, it's half of where it was in 2008 (was split off), HON is up 10 points but AIG is down 200, C is up 10 GM is a whole new company so hard to judge now and KFT split up so at least a 190-point drop from the Dow Components that were dropped since we made our highs and that would have cost the Dow at least 1,600 points had they not been ALTERED – more than 10%.

And what did the new components do for the Dow? BAC was a poor choice, dropping 30 since 2008 while CVX made up for it with a 33-point move up. CSCO has gone nowhere but TRV was a 40-point winner since inclusion and UNH is about the same so let's call it 40 points added by new components for 320 Dow points (roughly 8 points per Dollar) but now we're talking about a 1,900-point swing between the old Dow and the New Dow so let's not be too impressed with matching the 2007 high when the deck has been stacked so heavily in the Dow's favor.

And what did the new components do for the Dow? BAC was a poor choice, dropping 30 since 2008 while CVX made up for it with a 33-point move up. CSCO has gone nowhere but TRV was a 40-point winner since inclusion and UNH is about the same so let's call it 40 points added by new components for 320 Dow points (roughly 8 points per Dollar) but now we're talking about a 1,900-point swing between the old Dow and the New Dow so let's not be too impressed with matching the 2007 high when the deck has been stacked so heavily in the Dow's favor.

As David Fry notes on his Dow chart, it's all about QE and ZIRP but those are facts and he makes reference to Zero Hedge, who had a table outlining other economic conditions that have changed a lot since the October 2007 high:

-

Dow Jones Industrial Average: Then 14164.5; Now 14164.5

Regular Gas Price: Then $2.75; Now $3.73

GDP Growth: Then +2.5%; Now +1.6%

Americans Unemployed (in Labor Force): Then 6.7 million; Now 13.2 million

Americans On Food Stamps: Then 26.9 million; Now 47.69 million

Size of Fed's Balance Sheet: Then $0.89 trillion; Now $3.01 trillion

US Debt as a Percentage of GDP: Then ~38%; Now 74.2%

US Deficit (LTM): Then $97 billion; Now $975.6 billion

Total US Debt Outstanding: Then $9.008 trillion; Now $16.43 trillion

US Household Debt: Then $13.5 trillion; Now 12.87 trillion

Labor Force Participation Rate: Then 65.8%; Now 63.6%

Consumer Confidence: Then 99.5; Now 69.6

S&P Rating of the US: Then AAA; Now AA+

VIX: Then 17.5%; Now 14%

10 Year Treasury Yield: Then 4.64%; Now 1.89%

EURUSD: Then 1.4145; Now 1.3050

Gold: Then $748; Now $1583

NYSE Average LTM Volume (per day): Then 1.3 billion shares; Now 545 million shares

So, lots of changes since the last time the Dow was at 14,000 but, unlike ZH, I'm not sure I think it's all a bad thing. We have 6.5M more people unemployed and that causes 20M more people to go on food stamps since not everyone works, of course and, as jobs come back, both numbers will begin to improve so that's GOOD news ahead, not bad. Our Government debt has climbed but Household debt is down and Consumers still are not confident so it's another area that can greatly improve going forward.

For the first time in 100 years, the US's credit rating can be UPGRADED and clearly, from the price of gold, the Dow has miles to catch up just to begin to reflect inflation. The low volatility and low volume show that the market in no way is reflecting the irrational buying frenzy of 2007 – so imagine what will happen when the buyers do return. In the words of Al Jolsen – You ain't seen nothin' yet!

Of course it's all a huge house of cards and will likely all end in tears but you have to make hay while the sun shines – rather than keep betting on a crash that may not come for quite a while. I pointed out last week that the reason consumers aren't rolling over and dying with $3.73 gas is because they are using a lot less gas than they did in 2007 so the total amount of Dollars spent on gas is the same.

Of course it's all a huge house of cards and will likely all end in tears but you have to make hay while the sun shines – rather than keep betting on a crash that may not come for quite a while. I pointed out last week that the reason consumers aren't rolling over and dying with $3.73 gas is because they are using a lot less gas than they did in 2007 so the total amount of Dollars spent on gas is the same.

When I was a kid, we used to get huge tubs of Bryer's Ice Cream because it was about $1 for the whole family – now Ben and Jerry's is $4 for a pint so we consume less of it. People adjust their buying habits (within reason) to what they can afford.

In 2007, we were at full employment and our debt was going up and gas and oil were going up and, let's not forget that a multi-Trillion Dollar bank fraud had yet to be uncovered and THAT is what really derailed the economy – an issue that is papered over by the MSM, who's main sponsors are the very Banks and Energy companies who committed the largest crime in the history of the planet Earth.

Rather than bitching about the debt and the money-printing and the inflation – we need to realize the economic reality of the situation – there is simply A LOT more money chasing fewer stocks (we lost a bunch of companies in the crash and had few IPOs since) so, OF COURSE, the PRICE (maybe not value) of those stocks is going to go up.

Rather than bitching about the debt and the money-printing and the inflation – we need to realize the economic reality of the situation – there is simply A LOT more money chasing fewer stocks (we lost a bunch of companies in the crash and had few IPOs since) so, OF COURSE, the PRICE (maybe not value) of those stocks is going to go up.

HOPEFULLY (not a valid investing strategy) all that money will find its way into the broader economy and all those Corporations who are so flushed with cash will begin to spend some of it on hiring and then homes will be built and those homes will be furnished and all those Consumers will stop being 30% less confident than they were in 2007 and will go out and buy cars and washing machines and stuff that will create demand for more stuff that causes more workers to be hired and then the VALUE of the stocks begins to catch up with their price and everyone is happy (except Zero Hedge, of course).

It may not work out that well and it may not last – but at least let's enjoy the ride while it does…