A quiet weekend so far.

A quiet weekend so far.

Not much is happening today as Europe is closed for their Holiday Weekend now but we did have bad news out of Japan (remember how we were shorting /NKD futures last week) as the Nikkei plunged 2.12% as the BOJ's Tankan Survey (their Beige Book) still down at -8 and, much worse, Domestic Auto Demand fell 15.6% from last year in Japan as subsidies for fuel-efficient cars wound down. The fact that Japan's removal of stimulus immediately leads to a slump in demand is a warning shot across the bow to all that this "recovery" is NOT self-sustaining – by a long shot.

China's PMI was weaker than expected, but still an 11-month high at 50.9. The China Daily has an article this morning that Chain Store Sales are having their lowest levels of growth in the past decade BUT, that's still 8% – a level of growth that's triple our best single month of US growth – so it's all relative.

And mainly it's foreign retailers who are having difficulty growing this year as overall retail sales were up a very strong 14.3%, to $2.9Tn – like US retailers, however, a lot of the money goes from consumers' pockets straight into the gas tank. "There are too many hypermarkets in large cities and the market is saturated. They might consider moving into smaller cities or consider smaller formats such as community stores to better meet market demand," said Peng Jianzhen, deputy secretary-general of CCFA.

Bullish commodity betting has rebounded sharply on this side of the planet as well with investors are boosting wagers on higher commodity prices at the fastest pace in almost four years, rebounding from the least bullish position since 2009 earlier in March, on signs that the U.S. is accelerating and Europe’s debt crisis is easing.

Hedge funds and other large speculators increased net-long positions across 18 U.S. futures and options by 10 percent to 679,191 contracts in the week ended March 26, according to data from the CTFC. The bets surged 67 percent in three weeks, the biggest advance since May 2009. Wagers on higher oil prices climbed the most this year, while those for cattle are at a six-week high.

We went into the weekend slightly bearish, expecting a bit of a pullback but, so far (8 am), it's not indicated in the Futures as our indexes are generally flat. However, in REAL commodity trading, Rebar is at the lowest point since December on the weak(ish) China PMI and Copper is at an 8-month low off the same news so it's not much of a stretch to imagine that energy prices are getting a bit ahead of themselves.

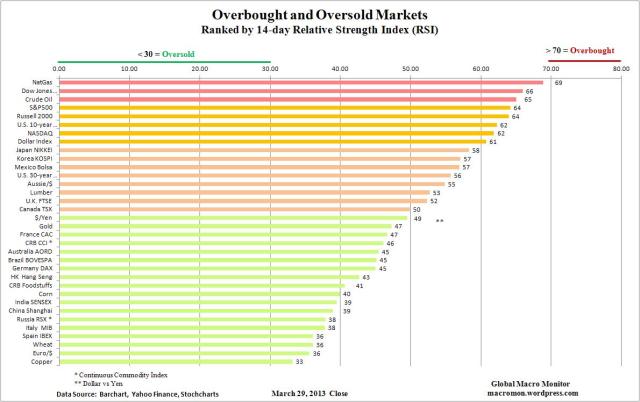

As you can see from this very neat Barchart (thanks Barry!), we sure are heading into overbought territory but we're not really there yet and, of course, as I said last week – there are still plenty of things that aren't overbought at all and copper, for example, is practically oversold so let's not say there's nothing to buy anymore, not with companies like FCX trading at $33 a share, with a forward p/e of 7 and a 4% dividend. Sure, it's no Bitcoin, but it's a real business that's not likely go go away in the next decade.

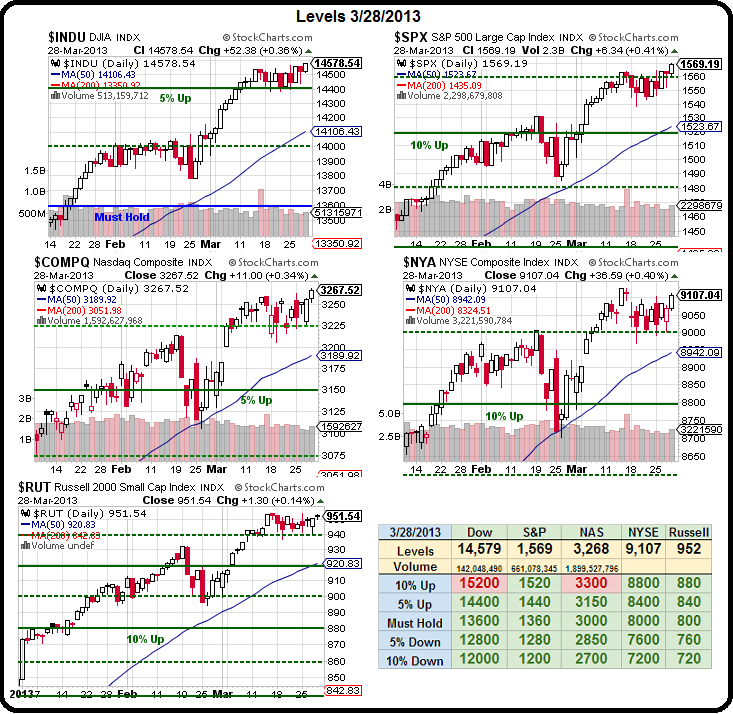

So tons of good stuff for us to BUBUYBUY if things don't fall apart this week and, as you can see from our Big Chart above, we're very comfortably above our support lines and, as I have said for ages, if we get through this week without a correction, we will be saying goodbye to the bottom 10% of our 5% lines, and redrawing the chart where the old 10% lines become our new "Must Hold" levels with the new breakout levels a whopping 20% over the old Must Hold lines.

This week is a bit of watch and wait for now, especially with Europe closed today but tomorrow we get back to work and, hopefully, we'll get an idea of what's real after that heavily painted end-of-quarter, low-volume rally. Of course, getting back to work is a pointless endeavor for 58% of our work-force who, according to the latest BLS study, make a MEDIAN hourly wage of $13.83 or LESS!!! Workers in seven of the 10 largest occupations typically earn less than $30,000 a year. That's a far cry from the nation's average annual pay of $45,790, which is brought unrealistically higher by CEOs who earn THOUSANDS of times what an "average" worker makes.

When one guy in a company earns $45M, then it's as if 2,000 people who make $22,500 make $45,000 and that, my friends, is how America pretends to have a reasonable standard of living – by fudging the data! President Obama is being vilified by the "job creators" for pushing to have the minimum wage raised to a whopping $9 per hour. Of course that's considered unreasonable by the Fox crowd as it "spoils" them with $360 each week – over $1,400 a month for full-time workers or about what the average top 10%'er spends eating out and what the average top 1%'er pays for a "massage."

Even arch-Conservative Ben Stein now believes we are underpaying our work-force to the point were were damaging our economy, saying:

Our conversation over an appropriate minimum wage is just as absurd. For a second-term, liberal President to say with a straight face that he's seeking a minimum wage that "lifts families out of poverty" and then propose a rate that does nothing of the sort, isn't just oily governance, it's evidence of a rotting society.

The question isn't whether minimum wage should be $8 or $9. The conversation should focus on whether or not menial labor warrants a living wage or if the purpose of such jobs is to serve as the first rung on a professional ladder. A country needs to either dedicate itself to providing socialist-like benefits to the downtrodden or come up with another plan.

Longtime Republican (and Nixon speechwriter) Stein summarizes the lack of ambition in a bi-partisan bow: "President Kennedy said, 'A rising tide lifts all boats.' But it doesn't lift the boats that are underwater. There's too much of America that's underwater, and that's the real problem. We have gotten to the point that the discussion of taxes is just a joke," Stein scoffs. In his lifetime he's watched the top tax rate fall from 90% (when he was a kid) to 70% (when he was writing speeches for Nixon) to a situation where no one actually pays the listed tax rate — but the government still shuts down over the prospect of a 3% or 4% hike for the wealthy."

Longtime Republican (and Nixon speechwriter) Stein summarizes the lack of ambition in a bi-partisan bow: "President Kennedy said, 'A rising tide lifts all boats.' But it doesn't lift the boats that are underwater. There's too much of America that's underwater, and that's the real problem. We have gotten to the point that the discussion of taxes is just a joke," Stein scoffs. In his lifetime he's watched the top tax rate fall from 90% (when he was a kid) to 70% (when he was writing speeches for Nixon) to a situation where no one actually pays the listed tax rate — but the government still shuts down over the prospect of a 3% or 4% hike for the wealthy."

Until we begin to address the gaping hole that has been blown in the American Middle Class – we're always going to be in danger of a massive crash, just like we had in 2008, as it will take very little to push the vast majority of consumers into full retreat.

So let;s continue to be careful out there – until we see signs of broader improvements in our economy.