What a wild market!

What a wild market!

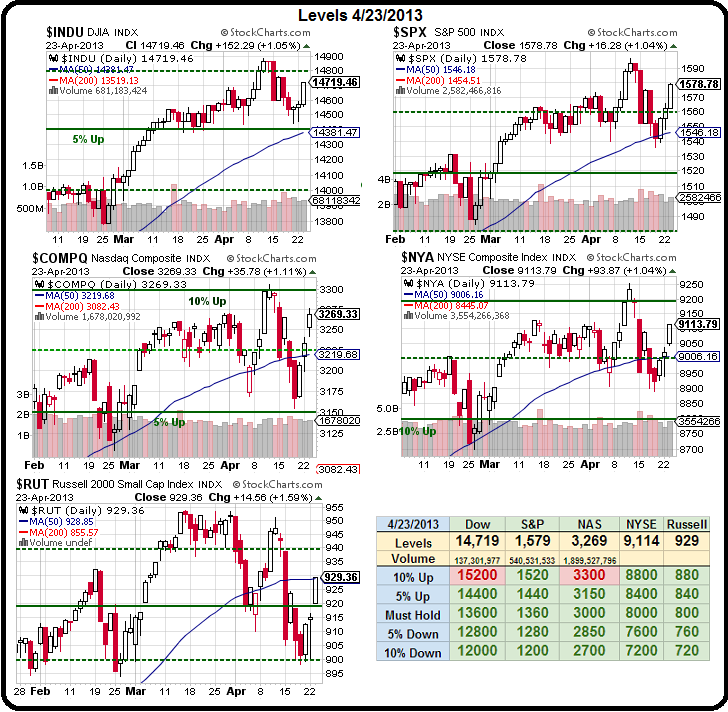

As you can see from our Big Chart – we're still 3 of 5 over our 10% lines but it seems like we're always 3 of 5 over and it's getting about time for the Dow (needs 15,200) and the Nasdaq (needs 3,300) to put up or shut up. The Dow made a mighty move yesterday – up 152 points but still 500 shy of goal at 14,700 and the Nasdaq just lost AAPL as a possible catalyst as their conference call indicated there would be no new iStuff at least until Christmas.

That's going to weigh on AAPL's suppliers this morning so most likely the Nasdaq goes lower but we did get good news from FDX and BA this morning and BA is a Dow component and FDX is big in the Transports so that should help the overall picture on the Industrial side.

Even ABX chipped in with a beat and our stock of the year (AAPL) may be getting kicked in the teeth but our stock of the century, IRBT, is up 16% pre-market on way better than expected earnings and raised guidance. We just added 20 short Sept $17.50 puts at $1.50 to our Income Portfolio last week – and that's how fast we can lock down a $3,000 gain! We were actually hoping they'd go $3 the other way, so we'd get a chance to buy them but it looks like $3,000 will be our consolation prize for not being able to buy the stock below $17.50…

Speaking of machines taking over the World: Yesterday's rally was briefly interrupted by a tweet from the official AP site, which has 2M followers, stating: "Breaking: Two Explosions in the White House and Barack Obama is injured." That caused the major indexes to drop 1% in less than a minute as News-Reading Trade Bots (yes, they have those) took those key words as a sell signal and crashed the market.

Speaking of machines taking over the World: Yesterday's rally was briefly interrupted by a tweet from the official AP site, which has 2M followers, stating: "Breaking: Two Explosions in the White House and Barack Obama is injured." That caused the major indexes to drop 1% in less than a minute as News-Reading Trade Bots (yes, they have those) took those key words as a sell signal and crashed the market.

Turns out, of course, that it was a false rumor from someone who hacked the AP account (will an arrest be made or is Lloyd Blankfein still at large?) and was quickly corrected by human traders but, as there are less than 12 of us left – it took 5 minutes for the markets to correct.

Actually, the "Syrian Electronic Army" is taking credit for the compromise, but have yet to substantiate their claims. Just days earlier, though, Twitter suspended that group’s main account after they took responsibility for hacking @60Minute, @48Hours and @CBSDenver — three accounts all registered to CBS News.

As if we didn't have enough to worry about as traders – now we have to worry about hackers spamming news feeds and triggering robots to dump positions. This is coming at the same time as the SEC brilliantly decided it would be OK for Corporations to use Twitter and Facebook to make official disclosures – MADNESS!

Whatever the reason, we take these "flash crashes" as signs that the market may be getting dangerous and we pressed our shorts yesterday – especially our SQQQ calls ahead of AAPL's questionable earnings (this is not the quarter we expected them to do well but we did think they might snap out of their funk – no such luck).

Whatever the reason, we take these "flash crashes" as signs that the market may be getting dangerous and we pressed our shorts yesterday – especially our SQQQ calls ahead of AAPL's questionable earnings (this is not the quarter we expected them to do well but we did think they might snap out of their funk – no such luck).

Also, we couldn't see how Durable Goods would be a good number and it turns out they are down a whopping 5.7% in March and down 1.4% ex-transport, so you can't just blame BA or even sequestration for this decline – which pretty much mimics declines we're already seeing in Asia and Europe. The -5% in March is not yet reflected in this chart from Briefing.com, but I'm sure you get the idea…

Durable Goods simply DO NOT go negative in a healthy economy folks. You can blame sequestration but what's the difference WHY no one is buying durable goods – the fact is they aren't selling. This is, by the way, DESPITE a housing rally that SHOULD cause a big wave of orders for washers, dryers, refrigerators, couches, carpet – the kind of stuff you put into homes… Not to mention auto sales in the US are great (F is another stock we are loving – see weekend picks) and those are durable goods too!

So, there is a great weakness underlying the data we've been seeing lately but there is, of course, one massive source of strength and that's money, Money and MORE FREE MONEY from the Fed and the BOJ and it's skewing everything we see. The Nikkei ran up 2.5% this morning as exporters began reporting fantastic sales on the weaker (down 20% from last year). With that kind of bonus to sales – even Japanese steel stocks are flying with JFE, Kobe Steel and Nippon Steel all up over 5% today.

So, there is a great weakness underlying the data we've been seeing lately but there is, of course, one massive source of strength and that's money, Money and MORE FREE MONEY from the Fed and the BOJ and it's skewing everything we see. The Nikkei ran up 2.5% this morning as exporters began reporting fantastic sales on the weaker (down 20% from last year). With that kind of bonus to sales – even Japanese steel stocks are flying with JFE, Kobe Steel and Nippon Steel all up over 5% today.

As you can see from the chart on the left, THERE IS NO NIKKEI RALLY, there is only a repricing of the Nikkie (white) to reflect the devaluing of the Yen (green) as the BOJ prints the equivalent of $4.5Tn (in relation to the US GDP) at a rate of what would be about $225Bn a month in the US economy and is actually a still very-impressive $75Bn actual Dollars per month. That's in addition to our own Fed slapping $85Bn a month into the mix – and there's your rally.

Look how easy it is to add 20% to your stock market. So easy, in fact, that the IMF and the European Commission want to get on the stimulus bandwagon now and EC President Jose Barroso commented on the wisdom of continued austerity in the EU, saying:

"While I think this policy is fundamentally right, I think it has reached its limits," Mr. Barroso said. "A policy to be successful not only has to be properly designed, it has to have the minimum of political and social support."

His comments are the latest in a series of public statements that indicate a shift in European economic policy is under way. They also coincided with the release of new figures that showed some of the euro-zone countries with the most aggressive austerity programs were having the least success in narrowing their deficits.

The International Monetary Fund last week said the bloc should ease back on austerity, while a number of governments outside the EU have made the same call, arguing that its belt-tightening is holding back the global economic recovery and could end up being self-defeating. The Spanish Finance Minister Luis de Guindos said on Sunday that his new budget plans to be presented later this week will emphasize economic growth and reduce the stress of spending cuts.

The International Monetary Fund last week said the bloc should ease back on austerity, while a number of governments outside the EU have made the same call, arguing that its belt-tightening is holding back the global economic recovery and could end up being self-defeating. The Spanish Finance Minister Luis de Guindos said on Sunday that his new budget plans to be presented later this week will emphasize economic growth and reduce the stress of spending cuts.

This is exactly the scenario that we expected to develop and this is why I wrote "5 Trade Ideas that can Make 500% in an Up Market" on the 14th as well as this past weekend's "5 Inflation Fighters Set to Fly" (and Part 2). Hedging is not just for the downside, you need upside hedges as well if you are positioned too conservatively. Our 5 picks from the weekend were F, CLF, BAC, ABX, MCD and DBA and all are well up from Monday's open but still playable.

As I noted yesterday, with a 7,500% potential upside on net cash on the DBA play – you don't need to make big plays to get yourself positioned – just in case we all start to look like Japan, with our markets flying and our currencies diving.