I apologize for the brief post.

I apologize for the brief post.

My morning post was lost as I stayed in AC yesterday and had a spot of computer trouble this morning. Anyway, not much action and I'll certainly catch up in chat today. Futures pretty flat. I hope everyone enjoyed yesterday's conference – it was great getting to meet some of the Members in Person. Between here and Las Vegas, I've met about 60 of our Members so far and I hope to meet many more of you at future conferences.

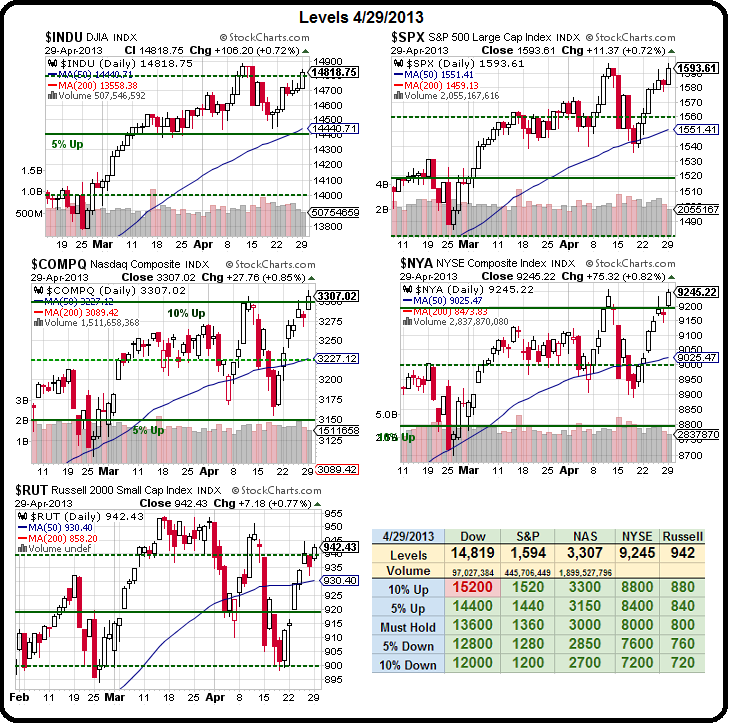

As you can see from the Big Chart – we're actually doing a good job of avoiding those "M" patterns so far but we are mindful of the fact that the Dollar has dropped 1% in the past two sessions so we take the 1% move up with a huge grain of salt.

Of course, there's no reason to think the Yen will get stronger (now 97.42) and push the Dollar even lower and we get a Fed Rate decision tomorrow followed by the ECB's decision on Thursday morning so we'll have to stay tuned to see how those two balance each other out but, most likely, the ECB will lower rates, drop the Euro below $1.30 and that will be supportive of the Dollar and NOT supportive of stocks and commodities – in the short run.

In the long run – as we discussed at the conference, the free money continues to flow but, as Dave Fry notes: "The bad-news-is-good theme continues as both Personal Income and Spending came in at 0.2% and missed expectations. The Dallas Fed Index plunged to -15 vs 7.4 previously but Pending Home Sales rose to 1.5% vs prior -1%. As to housing data, one would expect spring and summer home sales to increase so this comes as no surprise. "

In the long run – as we discussed at the conference, the free money continues to flow but, as Dave Fry notes: "The bad-news-is-good theme continues as both Personal Income and Spending came in at 0.2% and missed expectations. The Dallas Fed Index plunged to -15 vs 7.4 previously but Pending Home Sales rose to 1.5% vs prior -1%. As to housing data, one would expect spring and summer home sales to increase so this comes as no surprise. "

Data continues to be poor in Europe but stocks rallied on the hopes of more easing from the ECB, a new government in Italy, and even a relaxation of austerity measures. China is taking a more measured view of fiscal policies but stocks rallied there anyway which helped Asia in general. U.S. stocks rallied as more QE/ZIRP keeps bulls stuck on Fed life support as noted in Reuters. Recent inflation data, no matter how you view its authenticity, allows central banks more flexibility to lower interest rates and provide whatever stimulus is needed.

As noted in this XLB chart, Materials have made quite the comeback but we need to be mindful that it may be noting more than a bounce off resistance while bulls may, of course, say that this a bullish flag forming and we are consolidating for a huge breakout. That's what makes a market! We are, of course, long-term bullish on miners but not so much oil stocks – so a mixed outlook for XLB although the inflationary tide should lift all ships eventually.

As noted in this XLB chart, Materials have made quite the comeback but we need to be mindful that it may be noting more than a bounce off resistance while bulls may, of course, say that this a bullish flag forming and we are consolidating for a huge breakout. That's what makes a market! We are, of course, long-term bullish on miners but not so much oil stocks – so a mixed outlook for XLB although the inflationary tide should lift all ships eventually.

Oddly enough (well not oddly at all, really, as we expect manipulation) the Futures today are at the same trouble spots we identified yesterday and the RUT still can't get over 940 (/TF) and makes a good short below that line while the Nasdaq (/NQ) is having lots of trouble at 2,860, which is the 3,300 line on the Big Chart.

The S&P has failed to hold 1,590 (/ES) and the Dow (/YM) is having it's problems at 14,750. Oil (/CL) is having trouble holding $94 and gold (/YG) can't get over $1,480. The Dollar is mired at 82.25 and that's $1.3069 on the Euro and 97.50 on the Nikkei – those are going to be key levels.

The Dallas Fed Index was terrible yesterday and today, at 9:45 we get the Chicago PMI, which will likely sound like China's PMI as it includes Detroit as well. At 9am we'll have more Case-Shiller Home data and at 10 we get Consumer Confidence, which hopefully will be up a bit as fuel prices declined along with mortgage rates. At 10 we'll also get State Street's Investor Confidence Index and, of course, about 200 earnings reports today too many to mention.

We looked at an earnings play on LVS in Member Chat yesterday but. for the most part – we want to let this week wash over us and make most of our plays in quieter weeks – where there are not so many cross-currents.

We looked at an earnings play on LVS in Member Chat yesterday but. for the most part – we want to let this week wash over us and make most of our plays in quieter weeks – where there are not so many cross-currents.

Scary chart of the day is this McClellan Index that shows how we are becoming more and more oversold WITHOUT stocks actually going higher – that's not a good thing folks…

AAPL is (amazingly) another huge factor lifting the markets with a $20 move, from $410 to $430 coming in the last two sessions. If we hold $426 (weak retrace) it's staying very bullish and over $436 likely means we'll be on the way to the next leg up, from $430 to $450. As you know, a 5% move in AAPL boosts the Nasdaq by 1% and, even in the S&P, it would be about 0.15% and that's not including the other components in the "Appleconomy" they drag along with them – for good or ill.

According to Seeking Alpha: Halfway through Q1, 67% of companies have beat earnings estimates, but only 42.6% have posted positive revenue surprises – signalling that companies are cutting their way to profit growth. Without top-line growth, it will be a tall order to grow earnings over the coming year as the available areas from which to cut disappear.