This is now officially scary.

This is now officially scary.

Note this chart from Zero Hedge that illustrates how macro data has fallen off a cliff in the past 60 days while the markets have continued to climb. There are other charts to reinforce the point but do you really need more charts than this very obvious one.

Let's not kid ourselves – this is no surprise, we can see it, we can feel it – but we've been riding that market wave up and up as if it's never going to break.

I told our Members I was going to do a lot of reading over the weekend to see if S&P 1,600 was justified and we just reviewed a ton of articles in our Member Chat, since 3:19 this morning, in fact, and the short story is – it's not justified. The market is ONLY up due to unrelenting QE and we all know that the same amount of QE over time has a diminishing effect on the markets and, by our value metrics, the S&P is at 1,450 naturally, plus $150Bn a month pumped in by the Fed and the BOJ to give us 150 bonus points. Rumors of the ECB putting in stimulus as well put us over the 1,600 line but I think rumors are not enough to sustain us and, until we get an actual announcement, it's not likely to hold up.

In fact, this morning, at 3:22, I tweeted out our trade idea to short the Nikkei Futures at 12,265 and oil below the $96 line – a trade I reiterated for our Members at 6:59, as oil finally broke below our target. Already (8:15), the Nikkei has fallen to 14,200 for a 65 x $5 ($325) per contract gain and oil is now at $95.30, for a $700 per contract gain, so far – not a bad way to start our week!

In fact, this morning, at 3:22, I tweeted out our trade idea to short the Nikkei Futures at 12,265 and oil below the $96 line – a trade I reiterated for our Members at 6:59, as oil finally broke below our target. Already (8:15), the Nikkei has fallen to 14,200 for a 65 x $5 ($325) per contract gain and oil is now at $95.30, for a $700 per contract gain, so far – not a bad way to start our week!

Those are the kind of nice, quick gains we like to take off the table, if stopped out (our "Egg McMuffin Money"), certainly ahead of normal trading and we've already flipped to the Dow (/YM in Futures contracts) at the 14,900 line – looking for a break below as the Dollar gains strength while the Euro dips below $1.31 and the Pound fails to hold $1.555 (the logic behind all this is exactly what we talk about all weekend in preparation for these trades, so I won't re-hash it here).

While we are still LONG-term bullish, in the short run, it would be truly miraculous if we keep heading higher without a correction and, much as hope is not a valid investing strategy – neither is betting on miracles. We have plenty of hedges in place and I'm certainly not saying TODAY is the day that investors wake up and realize the underlying economy sucks but that certainly doesn't mean we can't prudently follow our Rule #2 of investing, which is: "When in doubt, sell half."

While we are still LONG-term bullish, in the short run, it would be truly miraculous if we keep heading higher without a correction and, much as hope is not a valid investing strategy – neither is betting on miracles. We have plenty of hedges in place and I'm certainly not saying TODAY is the day that investors wake up and realize the underlying economy sucks but that certainly doesn't mean we can't prudently follow our Rule #2 of investing, which is: "When in doubt, sell half."

Step one is getting into the mindset to be taking our profits off the table and step two is to keep that itchy trigger-finger on the profit-taking button.

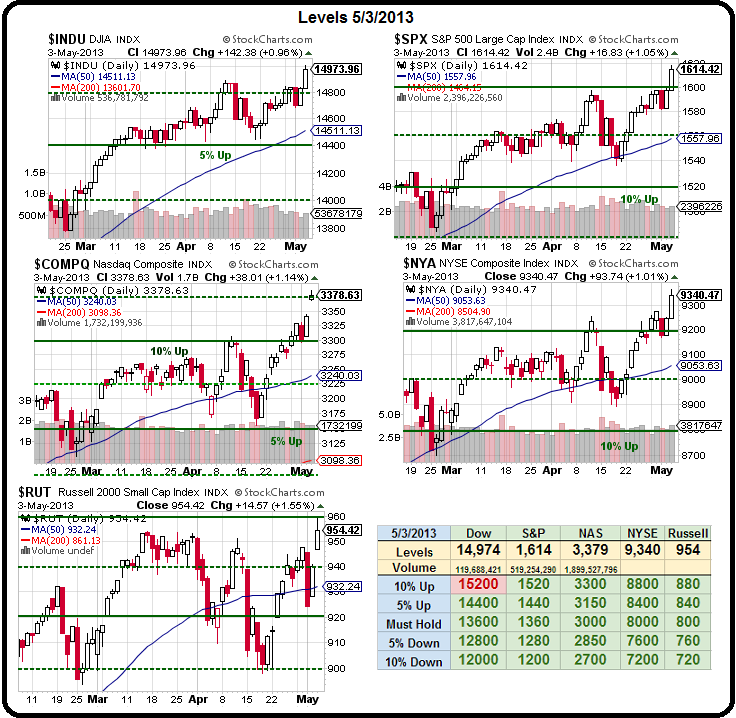

We're going to raise our Must Hold Lines on the Big Chart up 10% and redraw our levels to reflect the new equilibrium with the Dollar at 82.50 (ish) and our markets back at the highs. As I noted to our Members this morning, we're EXPECTING a 10% pullback from Dow 16,000, S&P 1,600, Nasdaq 3,300, NYSE 9,500 and Russell 950. Those are going to be our new "Must Hold" lines, below which we play bearish.

From those lines, we will calculate our new up and down levels in each direction and that will establish our new trading channel with a 10% drop on the Dow at 14,400 (the recent 5% up line) and a 10% drop on the S&P at 1,440 – also the 5% up line we crossed quite a while ago. We've always been calculating these lines from our upside targets – that's why we so rarely have to change the charts – essentially this is the completion of the rally we predicted in 2009. That's not to say that we think the market can't possibly go higher – it's just that this would seem a prudent place to begin exercising a bit of caution – ESPECIALLY if our new, aggressive lines fail to hold.

Can we go higher? Absolutely, there is still tons of money sitting on the sidelines and the Fed and the BOJ are making more of it every day. I made my case for S&P 1,800 last week in Member Chat and Laszlo Birinyi is going me one better this morning with a 1,900 target. He and I both agree that it's a fantastic time to buy commodity stocks – even if we do get our pullback, as we may not get another chance at these prices again and, in fact, our beloved CLF is popping this morning as FRB buys into my investing premise and gives them a BUYBUYBUY rating at $20.

AAPL is also getting some loving this morning as Barclay's ups their target to $525 from $465 – maybe the first of many upgrades as 13 of 58 analysts following the stock still have them at hold or sell with the stock crossing $450 and up 10% in a week. We covered 1/4 of our long AAPL shares last week and hopefully they don't pop $500 this week or we'll be sorry we did but that's one easy way to keep the market rally alive, even as sellers head for the exits and dump stocks that don't move the indexes the way AAPL does.

Wow, 8:52 update and oil just failed $95 without bouncing so now we're up over $1,000 per contract from our 6:59 entry so we can upgrade to bacon, egg and cheese croissants for breakfast (and make sure that's fresh-squeezed OJ, thank you very much!). No reason to be greedy here, it would be unusual not to get a bounce on the NYMEX open at 9am…

Wow, 8:52 update and oil just failed $95 without bouncing so now we're up over $1,000 per contract from our 6:59 entry so we can upgrade to bacon, egg and cheese croissants for breakfast (and make sure that's fresh-squeezed OJ, thank you very much!). No reason to be greedy here, it would be unusual not to get a bounce on the NYMEX open at 9am…

I'll be reviewing our hedges with Members this morning and we'll be looking for some aggressive hedges along the lines of our fantastically successful "5 Plays that Make 500% if the Market Falls" from last October 20th, when the S&P was at 1,433, before it slumped down to 1,350 (5.7%) into November and made us very, very happy with our hedges. I'm not ready to put up a public article like that yet – this is the same point we were at last year where our Members began shorting at 1,450ish, maybe a month ahead of where I felt ready to make a bold call on a sell-off.

Be careful out there!