I wish I had easy answers but I sure don't.

I wish I had easy answers but I sure don't.

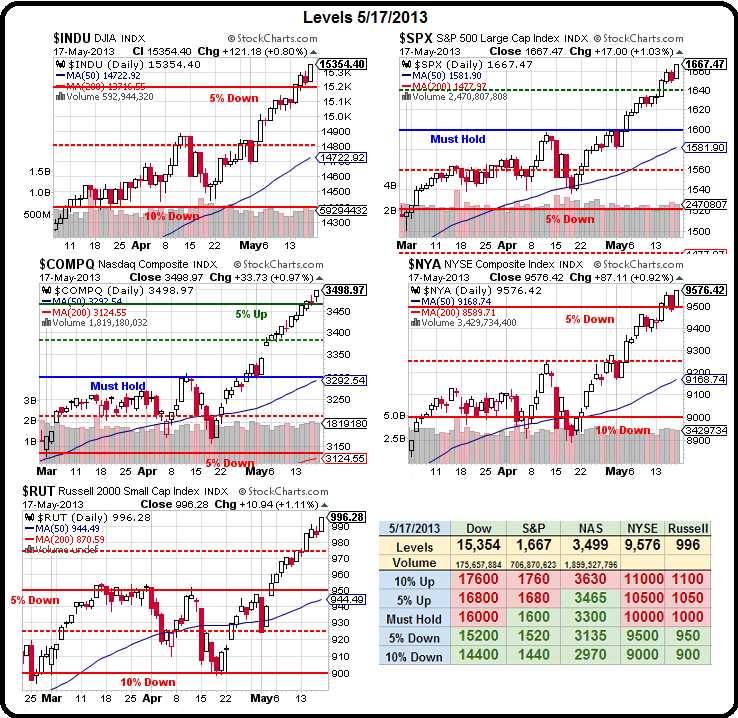

Just look at our Big Chart – we flipped it bullish and put up new level targets just two weeks ago and already the Russell is up 5% to test 1,000. All 3 lines over 1,000 and we're back to being bullish until 3 of 5 fail to hold our "Must Hold" lines.

We should be celebrating this but we played too cautiously as what we thought was a top and I never officially put "5 Inflation Fighters Set to Fly" or our "5 Trade Ideas that Make (made) 500% in an up Market" into our portfolios and I only said:

So lots of fun ways to participate in the next mega-rally. We don't need S&P 1,900 – just holding 1,600 would do us quite well and I cannot emphasize enough that these are HEDGES to our current BEARISH stance – just in case we're wrong and a correction never comes and the markets go up and up forever and all of our bearish positions expire worthless.

In reviewing those posts, I realize I went heavily into detail about my thoughts of the current market environment and we decided we'd better go with the flow until the flow changes and, frankly, I don't have a lot to add to that. A week ago we reviewed our "5 Trade Ideas" that made ridiculous amounts of money in a very short time but, as I have been reminded this weekend – unless I specifally state something should be included in one of our virtual portfolios – it doesn't occur to people that they should add it to theirs so we have been out of balance bearish in our portfolios and have gotten hit pretty hard in this relentlessly climbing market.

That's my fault then and my solution is to make things less confusing and go back to my favorite system for managing trades and that's to have a portfolio for short-term trading and one for long-term trading (the Income Portfolio is a separate strategy and won't be affected) and we'll be instituting that beginning next week. The idea is to practice the basics – position sizing, scaling in, scaling out, using stops, reacting to news, diversifying positions, etc. The Long-Term Portfolio is generally for short-term positions that don't work but that we would like to stick with for a longer-term play. Still, the LTP is pretty much for "set and forget" trades, mostly, and that lets us concentrate on a single STP for day to day trades. I'll still put up more aggressive trades but that's up to more aggressive traders to track for themselves and, of course, I'm always happy to help out with ideas for any adjustments that need to be made.

That's my fault then and my solution is to make things less confusing and go back to my favorite system for managing trades and that's to have a portfolio for short-term trading and one for long-term trading (the Income Portfolio is a separate strategy and won't be affected) and we'll be instituting that beginning next week. The idea is to practice the basics – position sizing, scaling in, scaling out, using stops, reacting to news, diversifying positions, etc. The Long-Term Portfolio is generally for short-term positions that don't work but that we would like to stick with for a longer-term play. Still, the LTP is pretty much for "set and forget" trades, mostly, and that lets us concentrate on a single STP for day to day trades. I'll still put up more aggressive trades but that's up to more aggressive traders to track for themselves and, of course, I'm always happy to help out with ideas for any adjustments that need to be made.

So, now that you're done re-reading our 2 5 Idea articles, let's first talk about what we can still trade:

ABX was the worst performer of our 5 Trade Ideas – it was down 242% as of May 8th with the 2015 $20/30 bull call spread net of the short $20 puts at a $1.20 credit, up from a .35 original credit – meaning you would have to pay net .85 to close it out at the time. ABX has gotten even worse since then and that bull call spread is now $1.90 while the short $20 puts are $5.35 for net -$3.45 so down another $2.25 from May 8th. While that's attractive still as a new play, it's usually wiser to take advantage of the dip and be a bit more conservative. Also, in keeping with our new philosophy of trying to set limits at the outset of a trade:

ABX was the worst performer of our 5 Trade Ideas – it was down 242% as of May 8th with the 2015 $20/30 bull call spread net of the short $20 puts at a $1.20 credit, up from a .35 original credit – meaning you would have to pay net .85 to close it out at the time. ABX has gotten even worse since then and that bull call spread is now $1.90 while the short $20 puts are $5.35 for net -$3.45 so down another $2.25 from May 8th. While that's attractive still as a new play, it's usually wiser to take advantage of the dip and be a bit more conservative. Also, in keeping with our new philosophy of trying to set limits at the outset of a trade:

Let's say you have $5,000 to spend on ABX. You could buy about 300 shares of ABX at $18.50 (269, actually). Since we know we can use options to lower our entry, we can assume we'll end up with 400 shares for around $12.50 so we'll start with selling 2 2015 $18 put for $4.05 ($810) and we can buy 2 of the 2015 $13/20 bull call spreads for $3.20 ($620). That leaves a net credit of $190 so a net entry on 200 shares of ABX at $17.05 if ABX is below $18 in Jan 2015.

Because we also own 2 of the 2015 $13 calls, the break-even on the trade is between $13 and $17.05 = $15.03. That means ABX can drop 20% more from here before we get in trouble. The cash outlay on this spread is none – we have a credit of $190 and, if ABX hits $20 in Jan 2015, the spread will be worth an additional $1,400, for a total of $1,590. The risk is, of course, owning 200 shares ABX for net $15.03 and ordinary margin on this trade is about $1,400 for 2 contracts but the idea would be to set aside the full $3,060 you would need to buy 200 shares at $15.03 and then, below $15.03, you could double down for another $3,000 or less or you could simply do another sale to knock the basis down another 20% or so before the DD is forced on you.

Should there be a stop on this trade? Not really as you can already see how violently it moves. For that reason, we won't be using it in our new Portfolios (we already have some in the Income Portfolio) but it's a very nice way to take a stab at gold without committing too much capital.

DBA has also gotten cheap again (great commercial for using stops to take profits) and our original spread idea was the Jan 2014 $23/26 bull call spread at $2, selling 2015 $25 puts for $1.55 for net .45. The spread has dropped to $1.85 and the 2015 $25 puts are now $1.55 for net .30 less than 1/2 of the .65 we hit on 5/8. We like the same trade with the same bottom for the same reasons still but note how quickly easily you can make or lose 50% on these small net trades – they are not for the feint of heart!

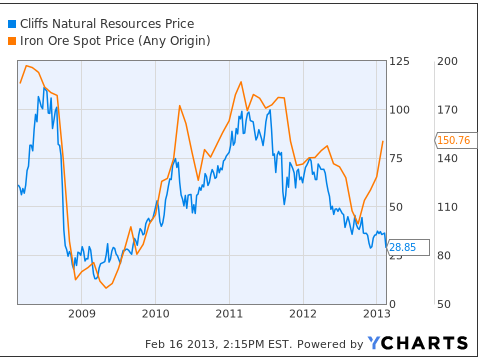

Our Inflation Fighters were an interesting bunch as well. F flew away so hard and fast it can't be chased. CLF took off but is still playable, BAC is up as if they were selling Fords and the MCD/DBA pair trade is doing well because MCD took off (not so much DBA). That then leaves us with ABX but we just did them, unfortunately. I think I should repeat what I said in that post about ABX for all who might play:

Our Inflation Fighters were an interesting bunch as well. F flew away so hard and fast it can't be chased. CLF took off but is still playable, BAC is up as if they were selling Fords and the MCD/DBA pair trade is doing well because MCD took off (not so much DBA). That then leaves us with ABX but we just did them, unfortunately. I think I should repeat what I said in that post about ABX for all who might play:

We've been catching those ABX knives for a while and, if you want to join in the pain, the 2015 $15 puts can be sold for $2.65 and the 2015 $20/30 bull call spread is $1.90 so you keep .75 in your pocket for a net $14.25 entry on ABX (an additional 21.5% discount) and this is super margin-efficient with just $1.55 in margin on the short puts. Obviously, this is a more speculative play but, off a net credit of .75, at $30 you can make an additional $10 for $10.75 or a 1,433% return in less than two years if ABX retakes HALF of what it lost in the past two years.

That post was from the 21st and I am only just looking at it now, AFTER I wrote the previous ABX play up. The 2105 $15 puts are now $2.46 and the $20/30 bull call spread is $1.90 (still) and that's a net credit of .54 so not much change there and your net is $14.46 – just a bit higher than the original trade idea above so – I like that one too.

For variety's sake though, we should pick something else and good old CLF is still around at $20.69 looking good for a move to $30 so I propose we DO put this one in the Short-Term Portfolio with the fallback strategy of going long in the Long-Term Portfolio if CLF get cheap again ($16.62 was the bottom, 20% down-ish). So, how much CLF would we be willing to own? Let's say $10,000 at $17.50 is 600(ish) contracts.

For variety's sake though, we should pick something else and good old CLF is still around at $20.69 looking good for a move to $30 so I propose we DO put this one in the Short-Term Portfolio with the fallback strategy of going long in the Long-Term Portfolio if CLF get cheap again ($16.62 was the bottom, 20% down-ish). So, how much CLF would we be willing to own? Let's say $10,000 at $17.50 is 600(ish) contracts.

We can buy the CLF Jan $17/24 bull call spread for $3.20 and sell the 2015 $18 puts for $4.15 for a net credit of .95. That would, at worst case, give us a net entry of $17.05 but here we would absolutely stop out the bull call spread at $1.55 as that would leave us a net on the short puts of just $15.50.

If we commit to 4 of those positions, we risk having to own 400 shares of CLF at $15.50 ($6,200) out of our $10,000 allocation. That's what we'll do for the Short-Term Portfolio. In reality, as we're playing it short-term, we should be watching the 50 dma at $20.24 and, if they can't hold that, we may need to re-coinsider. On the other hand, the short puts have a delta of .30 and the bull call spread has a net delta of .24 so we pick up about .54 for each $1 CLF moves up and that means we have a pretty good chance, on a 10% move, of making $1 x 4 contracts = $400 and we will be happy to take it as a short-term profit.

Again, there's this nagging question of whether or not the rally is real and we're not sure but we are sure we're able to buy these three stocks at very low prices and that seems worth the risk – even if the market does turn down now. Let's talk about what might happen next:

Again, there's this nagging question of whether or not the rally is real and we're not sure but we are sure we're able to buy these three stocks at very low prices and that seems worth the risk – even if the market does turn down now. Let's talk about what might happen next:

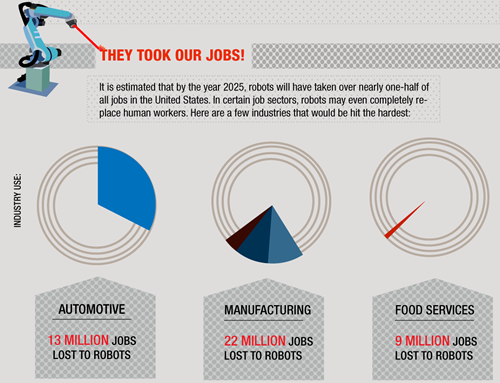

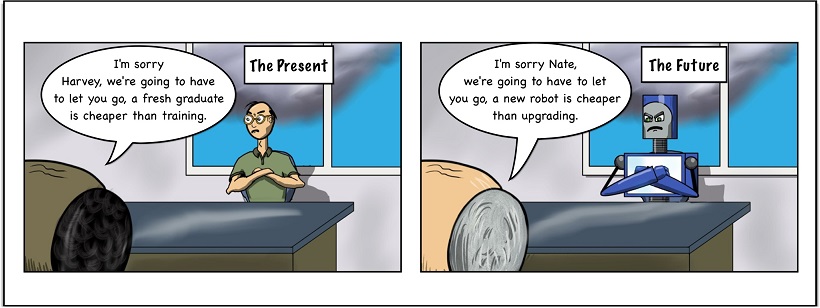

2045 is a good date to keep your eye on as that's the date a Rice University professor believes humans become obsolete as artificially intelligent machines take over most of the work people currently do. I joke about this all the time but 2045 is not all that far off. I'll be 83 and probably won't care that my nurse is a robot – especially if it doesn't ask for Tuesday's off. Still, it won't happen all at once – it will come in stages and we already love our IRBT but not cheap anymore at $34 and IBM of course, at $208 we're already long on and both of those will seem very, very cheap when 60M old bastards like me need a robot to help us take a bath.

What's it worth? Well, home health care is roughly $13,000 a month for 24-hour care and that's just for two 8-hour shifts and the assumption you can get by when you sleep. It doesn't matter if insurance pays for it or you do – someone is putting up the cash. So $130,000 a year is plenty of money to get yourself a $500,000 robot that can be amortized over 5 years instead of a person and, don't forget – you don't have to specifically make that choice – the same agencies that currently hire people will buy the robots and that's what will show up at your door.

The same goes for security guards, meter maids, librarians, secretaries, most manual labor – as the robots get cheaper and faster and smarter, they move down the pay scale and do, literally, make humans obsolete. There was a cool Audi/Star Trek commercial and it's pretty normal but, at the very end, a guy gets out of a car at a country club that goes and parks itself. PRESTO – a few million valet jobs disappear as soon as GOOG and others work out the bugs on self-parking cars.

So – Bad for humans but good for corporations that make robots and parts for robots. Certainly good for CSCO as we'll eventually have as many slaves, er robots, as we do cars, which is 200M in the US and all of those robots are going to need to be on the web which means bandwidth and routers, etc. We also like ALU and they're still and underperformer still at $1.57 but, as a long-term investment, they're a good one.

So – Bad for humans but good for corporations that make robots and parts for robots. Certainly good for CSCO as we'll eventually have as many slaves, er robots, as we do cars, which is 200M in the US and all of those robots are going to need to be on the web which means bandwidth and routers, etc. We also like ALU and they're still and underperformer still at $1.57 but, as a long-term investment, they're a good one.

That's our 30-year horizon all taken care of. If we want to speculate it's going to be on people who make batteries or fuel cells as we'll need lots of those too. If we roll back to 2035, we'll certainly be well into that cycle already and to some extent, I think the leisure industry will do well, with people having way more free time but, the question is – how do we get them more money? So social unrest is the game between 2015 and 2035. By 2015, there's a very good chance that Watson alone will put tens of millions of customer support people, call center operators, secretaries, record keepers, librarians, sales people and even paralegals out of work.

Look how hard people work to write apps now that make $100,000, $200,000 or $1M. Imagine how many companies will jump on the bandwagon to develop apps that can replace 100,000 $35,000 jobs ($3.5Bn) at a clip! Again, this will be great for the companies that used to have to hire all these people and not so great for the people who used to work there. Unemployment, in the long run, is not only here to stay – it's at the very early stages of 2/3 of a developed nation's population not working (already full employment is 50%). In Japan, for example, 1 out of every 30 workers is already a robot!

You can see we're already facing the problem of what to do with all these extra people. They're not lazy, they're not stupid – there are simply more people available than there are jobs that need to be filled because this country, which consumes about 10x what the average country in the World does – still produces so much stuff that, without oil imports ($350Bn a year) – we'd almost have a trade surplus. China has a trade surplus, Japan has a trade surplus, Europe is closed so they don't count, Australia has a trade surplus, Canada has a trade surplus, South Korea has a trade surplus… That's a lot of surplus!

You can see we're already facing the problem of what to do with all these extra people. They're not lazy, they're not stupid – there are simply more people available than there are jobs that need to be filled because this country, which consumes about 10x what the average country in the World does – still produces so much stuff that, without oil imports ($350Bn a year) – we'd almost have a trade surplus. China has a trade surplus, Japan has a trade surplus, Europe is closed so they don't count, Australia has a trade surplus, Canada has a trade surplus, South Korea has a trade surplus… That's a lot of surplus!

And we're doing all this with less than 1 in 100 workers being robots at the moment. As I said, EXTRA people. What can we do with extra people then? Usually we send them off to war – that's always a good way to save on unemployment, not to mention retirement as we convert a lot of them into dead bodies (maybe the robots can bury them – they already use back-hoes to dig the graves). If we don't find some way to kill off the extra people – what do we do? This is the most important question on Earth over the next couple of decades only no one wants to discuss it.

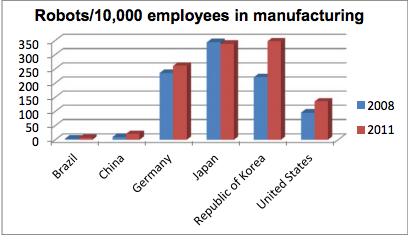

Are we NOT going to get up to Japan or Germany's level of robots in Manufacturing (above chart)? That makes no sense, of course we need to compete. Robots are the entire secret to AMZN's success as they scuttle about the warehouse floors filling orders. I myself invested in a private RFID company that allows those robots to find any package within sensor range – it's a decade away from being mainstream but now's the time to get in on these things. As of 2011 just over 1.2% of our factory jobs are robotic but that's up from 0.75% in 2008 – even during a recession it almost doubled in 3 years. Japan is already over 3% and a 2% replacement of our 34,000,000 factory jobs is 680,000 people out of work – almost 60,000 jobs a month being lost to robots in just that sector.

Are we NOT going to get up to Japan or Germany's level of robots in Manufacturing (above chart)? That makes no sense, of course we need to compete. Robots are the entire secret to AMZN's success as they scuttle about the warehouse floors filling orders. I myself invested in a private RFID company that allows those robots to find any package within sensor range – it's a decade away from being mainstream but now's the time to get in on these things. As of 2011 just over 1.2% of our factory jobs are robotic but that's up from 0.75% in 2008 – even during a recession it almost doubled in 3 years. Japan is already over 3% and a 2% replacement of our 34,000,000 factory jobs is 680,000 people out of work – almost 60,000 jobs a month being lost to robots in just that sector.

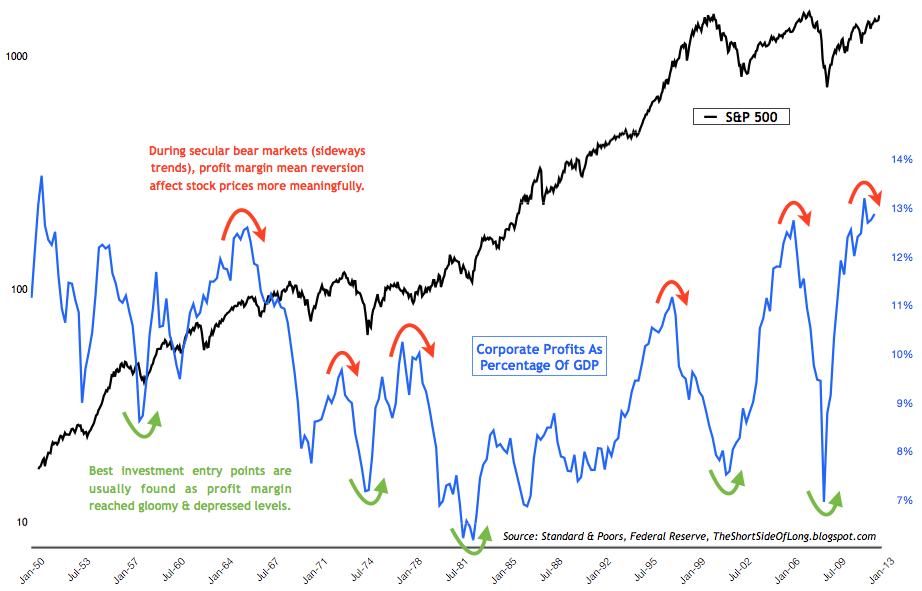

And what is the Fed doing? Lending money at record low rates so companies can invest in upgrading their plants and LOWERING their costs and that is code for labor costs and that is code for jobs lost by humans. And what does Bernanke say to these Corporations? He says it all the time – essentially its: "As long as you keep unemployment over 6.5%, I'm going to KEEP giving you MORE FREE MONEY!" As you can see from the above chart for 2008-2011 – it's certainly been getting a response from Corporate America.

And what is the Fed doing? Lending money at record low rates so companies can invest in upgrading their plants and LOWERING their costs and that is code for labor costs and that is code for jobs lost by humans. And what does Bernanke say to these Corporations? He says it all the time – essentially its: "As long as you keep unemployment over 6.5%, I'm going to KEEP giving you MORE FREE MONEY!" As you can see from the above chart for 2008-2011 – it's certainly been getting a response from Corporate America.

Free money is letting companies buy back their stock and cut down their debt and lay off workers (as there's usually an up-front cost to that) BUT, they are not, so far, spending that money on R&D or CapEx or expansion – THOSE are the signs of a healthy economy. What we are seeing now is a smooth contraction. We're also seeing inflating prices at the retail level while commodity and labor costs are dropping and THAT is increasing Corporate Profits – not a greater demand for goods and services.

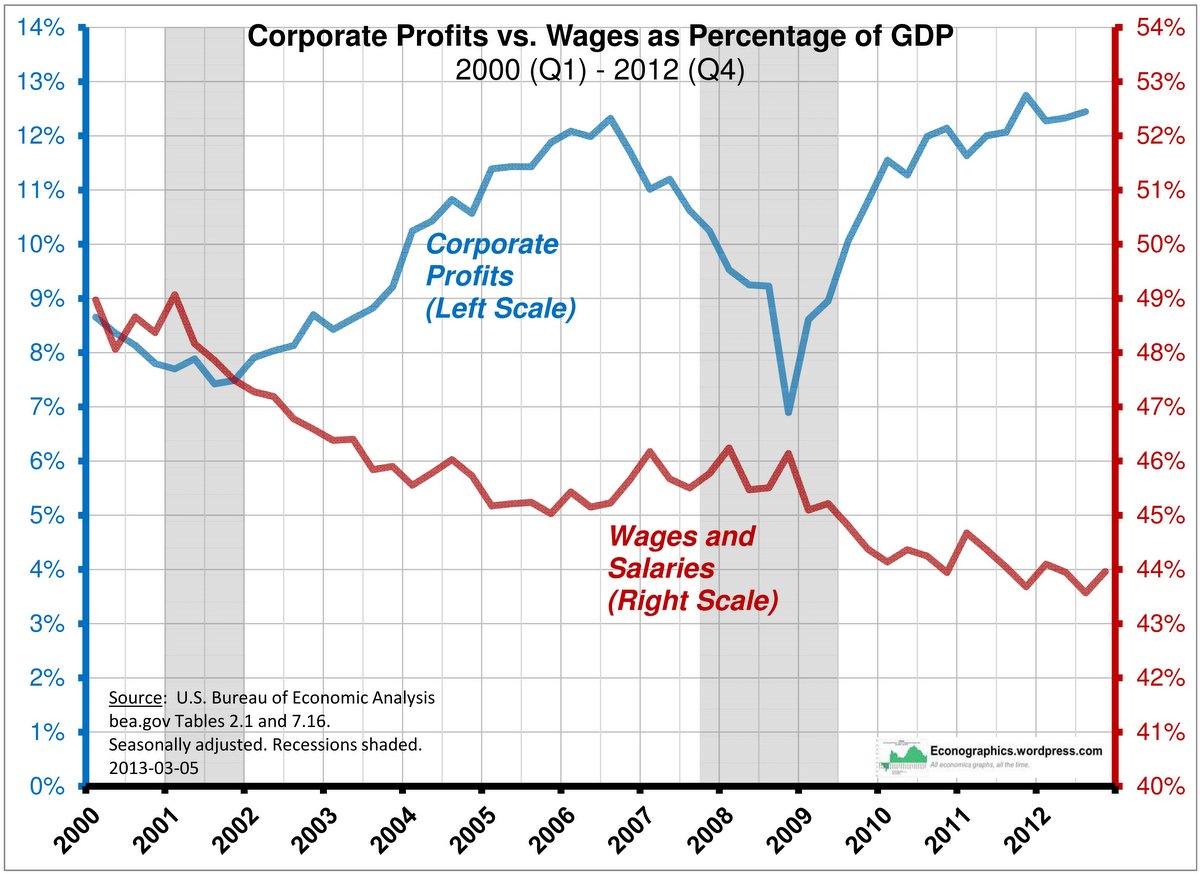

And we put this chart up all the time but you HAVE to think about the implications:

And we put this chart up all the time but you HAVE to think about the implications:

How can we build a sustainable recovery when we a wringing those profits out of the paychecks of the consumers? China is already getting blowback and salaries are up 9.2% over last year, after being up 7.2% last year from the year before. That has brought Chinese manufacturing wages up to a whopping $4 an hour vs. $19 in the US and, while that may not sound like much – it's less than 1/5th of what a US worker makes and, as recently as 2010, it was 1/10th and, in 2005, it was 1/20th.

China's wages have, in fact, just passed Mexico's and NAFTA is starting to give Mexico the edge as a manufacturing choice for US companies. Of course it's difficult for 112M Mexicans to compete with 1.3Bn Chinese and that's the key demographic to understand – we are, in fact, simply running out of human labor – well, cheap human labor – and that's the only kind our Corporate Masters are interested in.

You can see, in 2007, what happens to Corporate profits when labor stops getting cheaper every quarter. It makes that E in p/e fall right off a cliff. The usual solution for that is to lay off more workers and cut back spending but – didn't we just do that? Can they really make MORE cuts at this point? That's why I have trouble buying into rosy forward forecasts. We're NOT paying the workers in the US more money, we are at record levels of Corporate Profits due to cost cutting, money is the cheapest its ever been and rising wages in other countries is causing a demand for our goods.

You can see, in 2007, what happens to Corporate profits when labor stops getting cheaper every quarter. It makes that E in p/e fall right off a cliff. The usual solution for that is to lay off more workers and cut back spending but – didn't we just do that? Can they really make MORE cuts at this point? That's why I have trouble buying into rosy forward forecasts. We're NOT paying the workers in the US more money, we are at record levels of Corporate Profits due to cost cutting, money is the cheapest its ever been and rising wages in other countries is causing a demand for our goods.

The age of the robot is not upon us yet. Down the road, humans are screwed and Corporate Citizens and their armies of robot slaves will rule the earth but, for the moment, there is still manual, human labor that needs to be done and that puts a functional lid on Corporate Profits and, at the moment, the stock market does not reflect that possibility. The markets have jumped right from 2013 to 2045 in it's expectations and, I'm fairly sure – we're not there yet, which means we'll have to conclude that the markets are, in fact, ahead of themselves.

We'll see by July but I'd say it pays to be careful now.

If I'm wrong and the market keeps going up – it doesn't take a big bet to make a lot of money. For instance, the Dow is our lagging index, according to our Big Chart, at 15,354 and the Nikkei has pulled ahead, at 15,360 with it's 40% comeback. Our goal on the Dow is 16,000 and that's up 700 points, which is almost 5% and, if we're not going to get the pullback we expect, then the rally is likely to continue into the Summer and we can pick up the DIA July $153/157 bull call spread for $1.70 and that makes $2.30 if the Dow goes up 400 points (and holds it through July expirations, of course).

If I'm wrong and the market keeps going up – it doesn't take a big bet to make a lot of money. For instance, the Dow is our lagging index, according to our Big Chart, at 15,354 and the Nikkei has pulled ahead, at 15,360 with it's 40% comeback. Our goal on the Dow is 16,000 and that's up 700 points, which is almost 5% and, if we're not going to get the pullback we expect, then the rally is likely to continue into the Summer and we can pick up the DIA July $153/157 bull call spread for $1.70 and that makes $2.30 if the Dow goes up 400 points (and holds it through July expirations, of course).

If you are not satisfied with a 135% gain in 60 days off a 4% Dow move higher, you can find something you WOULD like to buy if the Dow drops 20%, like BA for example. BA is at $98.92 and the 2015 $75 puts are $4.20 and let's say you're willing to own $37,500 worth of BA at net $75 and that would cost you roughly $19,000 in margin but then you'd do a buy/write and knock it down – of course. So, with 5 BA puts sold for $2,100, you can buy 20 of the DIA July $153/157 bull call spreads for $3,400 and, if the Dow does go up 4% into July expirations, you won't get your cheap BA stock but you will make $4,600 on the DIA spread.

At that point, we'd cash out the DIA spread AND the BA puts and keep the cash. If the trade goes so far the other way that the DIA spread goes to zero, then we net into 500 shares of BA at $77.60 (the extra $1,300 divided by 500 plus the net of the put strike). Of course, we want to stop out before that happens and we have a line key support line at 15,200 that should stop us out. The net delta on the DIA spread is .23 so a 150-point drop in the Dow should cost us about .35 so our stop on the bull spread should be about net $1.20 or if the Dow fails to hold 15,200.

That would limit the loss to $1,000 and we'd still be net $73.80 on the BA puts (25% off the current price). This is how we can go to cash, set up trades to re-buy similar positions at cheaper prices and not miss a very nice gain if we were premature and the rally continues.