Wheeeeeee – what great fun!

We finally got a move in the market that wasn't up yesterday and the thrill is back in the markets all of a sudden. Congratulations to anyone who followed our early morning tweet yesterday at 3:24 am, which was:

Futures Fun: Good Chance for Quick Gains Shorting /CL, /NKD and /TF $$ $IWM $USO $EWJ #Futures — bit.ly/YYHM2c

Those Nikkei Futures ended up dropping a cool 1,000 points for a ridiculous $5,000 per contract gain and THIS is why we love the futures as you can usually stop out with a fairly small loss but, once in a while, you can get some spectacular gains.

We're now looking to go long on a possible bounce over the 14,700 line (now 14,665) in the Futures as the 7% panic may be just a bit overdone. Europe was down about 2.5% earlier this morning but seems to be holding that line and the FTSE is "only" down 1.7% – all because the Fed Governors weren't 100% doveish (only about 80% doveish). What a silly, silly market this is.

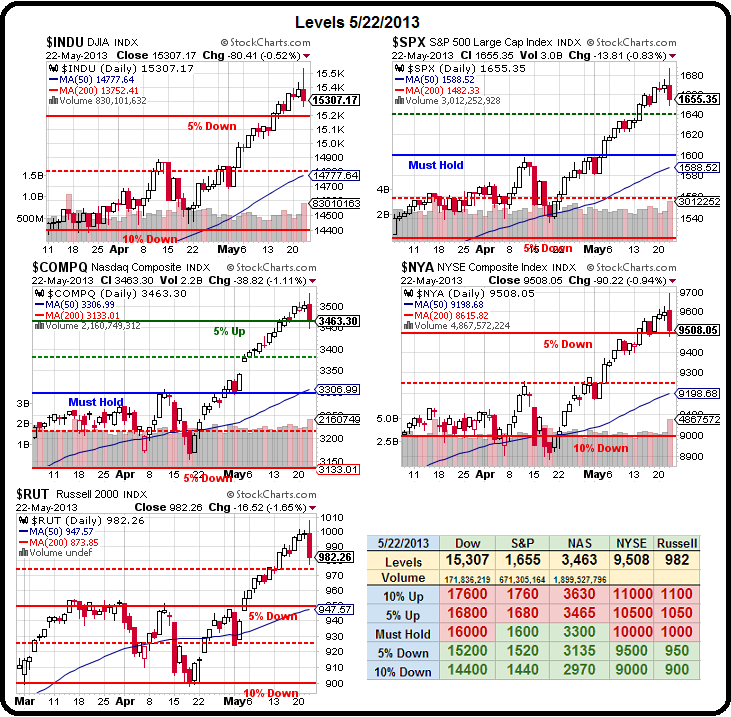

As you can see from our Big Chart – it's much ado about nothing, so far as this long-needed correction hasn't even violated our 2.5% or 5% lines. We overshot and now we correct – it's the way of the World, my friends. In fact, last Friday, we made our final adjustments to the $25,000 Portfolio and we expected this drop, as you can see from these adjustments to our main hedges:

As you can see from our Big Chart – it's much ado about nothing, so far as this long-needed correction hasn't even violated our 2.5% or 5% lines. We overshot and now we correct – it's the way of the World, my friends. In fact, last Friday, we made our final adjustments to the $25,000 Portfolio and we expected this drop, as you can see from these adjustments to our main hedges:

- QQQ – May $70s now $3.90 can roll straight across to June $70s at $4.15 for .25 credit. We're $5 in the money on the longs and happy to add a $70/75 bull call spread if we have to roll callers up further but, for now, we're locking in profits on the $67/70 spread which is $5 in the money yet priced at $1.50 so – if we end up paying the callers $4 that's -1.65 against the gain of $4 on the longs – we can live with that but, at the moment, the position shows a $1.45 loss on the short calls vs a .51 gain on the longs. This is why you need to understand how the options work over time and not be ruled by current balances! This one can move to the LTP.

- DIA – $152.61. The puts are still .71 with a delta of .15 so a 2.5% drop in the Dow is about 4 points on DIA or .60, which means we'd need a 5% drop to make $1.20 back and get out even on DIA. So, not very useful and I do like having a hedge we can cash on a dip but we're naked on TZA so I'd rather press those than DIA so time to kill these.

- TZA – June $39s now .43 and we have 20 and we lost $1.40 on those and another .35 on the DIAs (per 20) so down $1.75 means we need too much to get even and TZA is at $31 so 1,000 on the RUT is the stop (holding for 2 full days) and we "go for it" by rolling to 20 of the July $32 calls at $2.42 and doubling down there which makes the net on 40 $2.42 + 1/2 of the $1.75 loss = .88 + $2.42 so 40 at net $3.30 and currently down .88 (26%) with a delta of .50 and, of course, 1/2 out at $3.30 and we'll put that in the LTP as a hedge.

As we discussed Friday, we now have virtual Short-Term and Long-Term Portfolios but we still have our Income Portfolio, which had similar hedges. We love TZA as a hedge and you can see why from yesterday's 16-point dip. TZA is already up around $33 this morning and we should be in fantastic shape on that hedge while QQQ is back to $73 already – rewarding our faith in the position (or lack of faith in the Nasdaq!).

As we discussed Friday, we now have virtual Short-Term and Long-Term Portfolios but we still have our Income Portfolio, which had similar hedges. We love TZA as a hedge and you can see why from yesterday's 16-point dip. TZA is already up around $33 this morning and we should be in fantastic shape on that hedge while QQQ is back to $73 already – rewarding our faith in the position (or lack of faith in the Nasdaq!).

Dave Fry's chart indicates the very nice bump in volume we got on yesterday's reversal and it's going to be a great sign of STRENGTH in the S&P if we can get through this and hold 1,600, which is still 3.3% above where we are now – so another week of dips like this before real technical damage is done.

So, blah, blah, blah the Fed – I don't need to talk about them, it's all we're hearing about. Of course they are having a debate about how long it's safe to keep increasing the money supply by 10% a year – I'd be a lot more upset if they weren't. It seems like forever that I've been saying the market has gotten ahead of itself on irrational expectations that they will never change their policy or the even more irrational expectations that the Fed will INCREASE the supply of free money.

Jim Bullard has an excellent power-point from yesterday's lecture on "Monetary Policy Options in a Low Policy Rate Environment" and, if you REALLY want to know what the Fed is thinking – here it is. Keep in mind that Bullard is one of the most hawkish Fed Members (which is why the Germans pay him a nice fee to come out and speak to them) but, the presentation is excellent as an overview of Fed policy options.

Iceland is saying "thanks, but no thanks" to an EU membership. Prime Minister-elect Sigmundur Gunnlaugsson, whose Progressives won last month’s vote together with the Independence Party, said he doesn’t want to join a bloc in crisis as his own economy recovers. Asia has problems of their own, with China printing the first sub-50 PMI reading since October (but at least their market has been acting normally to the bad data this year). Japan had to halt bond futures this morning as they went limit up – all the way to 1% as sellers scramble for cash.

Iceland is saying "thanks, but no thanks" to an EU membership. Prime Minister-elect Sigmundur Gunnlaugsson, whose Progressives won last month’s vote together with the Independence Party, said he doesn’t want to join a bloc in crisis as his own economy recovers. Asia has problems of their own, with China printing the first sub-50 PMI reading since October (but at least their market has been acting normally to the bad data this year). Japan had to halt bond futures this morning as they went limit up – all the way to 1% as sellers scramble for cash.

So buy the dips at your own peril – we're probably not out of the woods yet and, of course, it's still May so please – be careful out there!