Will bad news be good news again?

Will bad news be good news again?

Or will good news be bad news. It would be very confusing if good news were good news or bad news was bad news as we'd have to go back to reading the news again and, we don't want to do that because the news is sooooooooooo depressing! As Dave Fry noted last night: "There is much to discuss about the Jobless Claims and the Employment Report since much of the data is now skewed by incoherent data. With Jobless Claims data it’s been more about people exhausting their benefits and falling off the rolls. Much the same can be said about the Employment Report since the percentage of workers, or the participation rate, is historically low at around 63% of the workforce. The Gallup organization for example has stated less people are working now than one year ago."

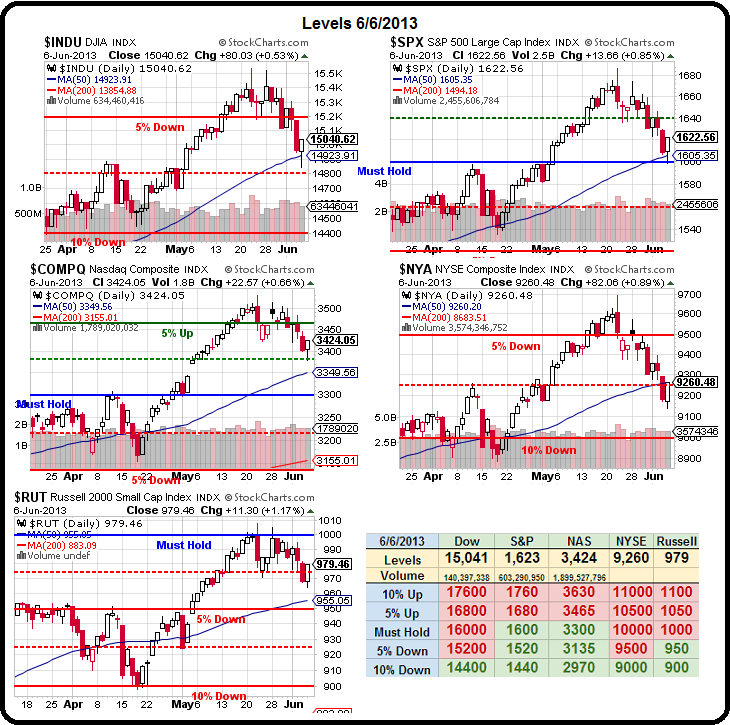

As you can see from Dave's chart, we got to our 1,622 "weak bounce" target, that our 5% Rule™ predicted yesterday morning, the very hard way but hit it right on the nose on that silly-spike close. We also predicted 3,420 on the Nasdaq and it finished at 3,424 and we predicted 9,280 on the NYSE and it finished at 9,260 and we targeted 975 on the Russell and that one got over at 979 right at the close, after spending over an hour at 975.

Well, we can't get them all, can we? The Dow was our biggest disappointment, falling way short of our 15,108 target at 15,040. Not that we care – those were just the lines we expected to bounce to and maybe they'll catch it this morning before failing into the weekend. That's right, we're still bearish BECAUSE the weak bounce lines failed on day one and ONLY catching the strong bounce lines into the weekend (15,216, 1,634, 3,440, 9,360 and 981.40) would change our minds.

Well, we can't get them all, can we? The Dow was our biggest disappointment, falling way short of our 15,108 target at 15,040. Not that we care – those were just the lines we expected to bounce to and maybe they'll catch it this morning before failing into the weekend. That's right, we're still bearish BECAUSE the weak bounce lines failed on day one and ONLY catching the strong bounce lines into the weekend (15,216, 1,634, 3,440, 9,360 and 981.40) would change our minds.

Keep in mind that the Dollar (which these indexes are priced in) has fallen 2% this week and 4% this month so, if we apply a 4% discount to those index spike bottoms from yesterday, we get (in steady dollar terms) 14,250 on the Dow, 1,534 on the S&P, 3,242 on the Nasdaq, 8,784 on the NYSE and 926 on the Russell.

THAT's how far the markets have fallen off the top if not for the 4% drop in the Dollar propping them up. So, the biggest fear a market bull should have right now is the same one that has plagued the Nikkei this week – a rising currency will crush the market!

Ahead of NFP, the Dollar is at 81.36, down from 84.60 at the beginning of the month. More jobs should use more Dollars so this is probably the bottom but, if this is the bottom for the Dollar then that's a problem as the strong Dollar would go with strong jobs and strong jobs may lead to the notion that the Fed is off the table sooner than later and, of course, any hint that the FREE MONEY spout may run dry is enough to send traders heading for the hills.

8:30 Update: 175,000 jobs. That's in-line so, neither good nor bad on the whole. Unemployment is at 7.6% and higher than the 7.5% expected and that's GOOD as it means the Fed is still far from their 6.5% target. The Futures are jerking up in response but I don't think it holds – as I said above, the Dow still needs 68 points to test it's weak bounce level and I don't even know if we'll see that (0.4%) before we head back down.

8:30 Update: 175,000 jobs. That's in-line so, neither good nor bad on the whole. Unemployment is at 7.6% and higher than the 7.5% expected and that's GOOD as it means the Fed is still far from their 6.5% target. The Futures are jerking up in response but I don't think it holds – as I said above, the Dow still needs 68 points to test it's weak bounce level and I don't even know if we'll see that (0.4%) before we head back down.

It's a great time to look to re-load on those bearish hedges we talked about yesterday. We already shorted oil at the $95 line (/CL in the Futures) in Member chat as the rising Dollar (and reality) should hit them into the weekend. SODA came back to reality, as expected and TLT is giving us a wild ride but the NFP bump in the morning should give us another chance to short FAS at that $68 line (see Short-Term Portfolio) and we already have our oil plays in place on that one, but more aggressive since yesterday's note (as planned).

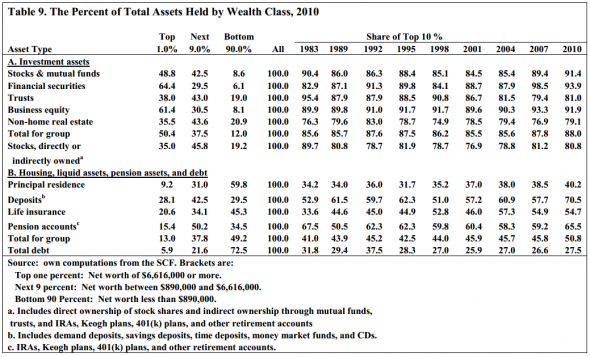

No Friday would be complete without contemplating the sickening amount of wealth disparity in this great nation of ours (that was once upon a time founded to stop exactly this kind of abuse of the nobel class). Here's a nice chart from Economix that breaks down the wealth of the top 10% – who have 90% of all the investment assets in America, leaving the other 270M people to fight over the 10% that falls off their tables:

America – land of the tax-free and home of the working slaves!

Homework for today. Check out this headline and article from Fox news: New York Times editorial board says administration has 'lost all credibility' – and then read the actual NY Times article, where it simply says "The administration has now lost all credibility on this issue." If you read these two articles and still believe Fox news doesn't do it's best to manipulate you with out of context BS – you're hopeless…

Have a great weekend,

– Phil