Wheeeeeeee!

Wheeeeeeee!

Down we go again. This time it's ostensibly because the BOJ, who are already pumping 15% of their GDP into BOJ stimulus, isn't doing MORE to boost the economy (which was up 4.1% on the 15% stimulus in yesterday's GDP report). Dave Fry's chart is from yesterday but the Nikkei neatly gave up everything it gained since Friday with a 500-point dive (which is why we wisely took the money and ran on EWJ yesterday morning!). I believe it was Prince who said:

Maybe you're just like the markets

They're never satisfied

Why do we ease qualitative?

This is what it sounds like

When (Fed) doves cry

Our Members are very satisfied with the drop as we got aggressively bearish in our Short-Term Portfolio on yesterday's little pop, which is now almost 200 Dow points ago! I called for making adjustments to our virtual portfolio in Member Chat at 10:08 and we hit all of our intended targets by 11:42 and there was not much else to do but sit back and enjoy the ride for the rest of the day.

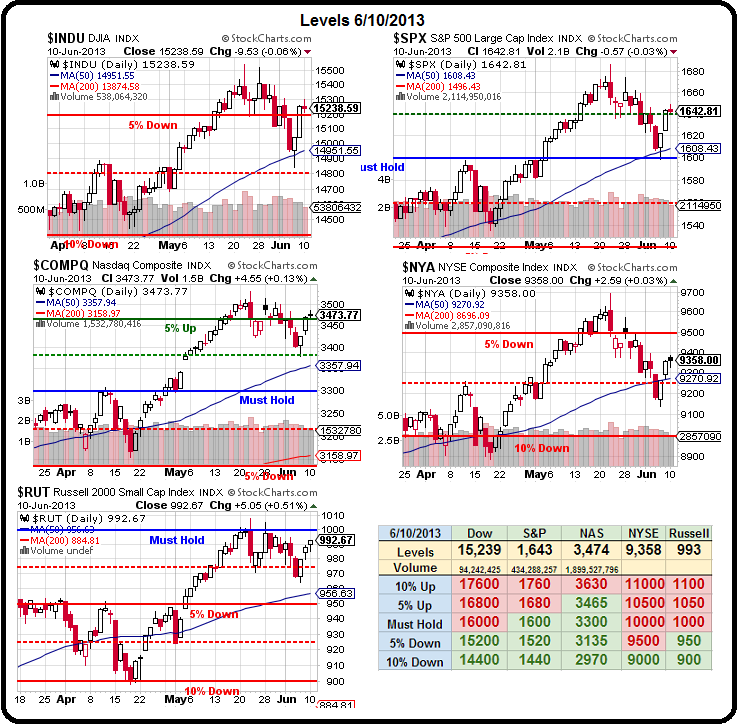

What we'll be looking for today are re-tests of our weak bounce lines (see Thursday's post for details), which are:

What we'll be looking for today are re-tests of our weak bounce lines (see Thursday's post for details), which are:

- Dow 15,108 (weak bounce) and 15,216 (strong bounce)

- S&P 1,622 and 1,634

- Nasdaq 3,420 and 3,440

- NYSE 9,280 and 9,360

- Russell 975 and 981.40

Of course we'll be losing 3 of 5 of our strong bounce lines this morning (so we're not bullish) and losing 3 of 5 of our weak bounce lines before hitting our 50% lines (see yesterday's morning Alert to Members) puts us back to bearish but, of course, that's what we predicted would happen yesterday morning based on those silly Fundamentals that I keep yammering on about – so we're about a day ahead of the TA people already.

We're also a day ahead of oil traders as we aggressively shorted the NYMEX yesterday and we picked up a few quarters here and there ($250 gains) on the way to a big drop this morning that's going to trigger nice gains on our very aggressive USO shorts and SCO (ultra-short oil) longs. /CL Futures hit $94.50 this morning, a $1,500 per contract gain off our shorting line at $96!

We ran through the NYMEX charts yesterday and decided this was a good week to short oil as they only have 7 more sessions to dump 216M barrels of fake orders before the

We ran through the NYMEX charts yesterday and decided this was a good week to short oil as they only have 7 more sessions to dump 216M barrels of fake orders before the criminals traders at the NYMEX get caught with their hand in the cookie jar and are forced to take delivery of oil. Believe me, the LAST thing an oil trader at the NYMEX wants is to actually buy any oil! The NYMEX is nothing more than a gigantic scam aimed at manipulating the price of oil, gasoline, etc that the end user has to pay by creating a completely artificial demand at ridiculously high prices – virtually none of which is ever actually delivered.

Our job, as contrarian traders, is to make sure no good pump goes unpunished so we short oil around our $96 line and usually we take those quick $250 profits when they are offered but, once in a while, we get nice dips like this one, that make all the waiting worthwhile.

The great thing is, no matter how much money the NYMEX traders lose, they will do it again. Because it's not about the millions they lose to traders like us but about the Billions they are able to screw consumers out of by creating a completely fake demand for oil on the market that ultimately sets the price you pay at the pump.

I tweeted out my early morning commentary on how this scam is starting to impact Global Consumers once again and this is how the greed of the oil companies sows the seeds of their own (as well as the broad economy's) destruction – just as they did in 2008.

I tweeted out my early morning commentary on how this scam is starting to impact Global Consumers once again and this is how the greed of the oil companies sows the seeds of their own (as well as the broad economy's) destruction – just as they did in 2008.

Only now, we don't have an economy that is firing on all cylinders but they STILL insist on squeezing the consumer dry. In fact, the National average retail price of regular gasoline rose to $3.655 a gallon last week, 8.3% above last year's levels despite SIGNIFICANTLY lower demand and retail sales and earnings are beginning to show that they are breaking the back of consumers.

In fact, this morning we now have a report that ICSC Retail Store Sales are DOWN 2.7% for the week. That's after last week's worse than expected 1.9% gain and has now dropped our year over year rate from 4.3% to 2.2%. The Government posts it's major Retail Sales Report Thursday morning and, ex-gasoline, it's probably going to suck. We get Chain Store Sales at 8:55 and those should, hopefully be not so bad as East-Coast consumers headed to the malls to avoid rainy weather last week but yes, this is just what we expected to happen so Yay!, I guess…

TXN, the largest maker of analog chips, predicted second-quarter profit and sales that may fall short of analysts’ bullish estimates as some consumer-electronics makers hold off on component purchases. While orders for chips used in industrial machinery and cars have continued to grow, demand is weak for semiconductors used in personal computers and consumer devices such as game consoles.

TXN, the largest maker of analog chips, predicted second-quarter profit and sales that may fall short of analysts’ bullish estimates as some consumer-electronics makers hold off on component purchases. While orders for chips used in industrial machinery and cars have continued to grow, demand is weak for semiconductors used in personal computers and consumer devices such as game consoles.

Clients were net sellers of stocks in May, according to the TD Ameritrade Investor Movement Index. The gauge declined for a 2nd consecutive month to 5.02 from 5.31 previously. Clients were net buyers across the materials sector (XLB), but reduced exposure elsewhere and, frankly, I think we may have caused that XLB bying with our bottom fishing picks (most of our Members use AMTD's Think or Swim) – so maybe we shouldn't give it too much weight!

Meanwhile, in Workers of the World news: Waves of strikes and worker protests in China's southern export belt is a fresh sign that slowing growth and rising wages have started to pinch the labor market on the world's factory floor. China Labour Bulletin, a Hong Kong-based labor group, has recorded 201 cases of labor disputes, including strikes, in the first four months of the year in China, almost double the number of cases in the same period last year. A survey of more than 4,000 employers by human-resources consultancy Manpower Group found that the net employment outlook deteriorated to 12% in the second quarter, down from 18% in the first, and the lowest level since the end of 2009.

Hopefully (for the sake of the economy), we bounce off those weak bounce lines and get back over our strongs but, sadly, hope is not a valid trading strategy so – be careful out there!