Courtesy of Sabrient Systems and Gradient Analytics

I suspect there is no greater example of “summer doldrums” than the week surrounding the Fourth of July, especially when the holiday falls mid-week. From my standpoint, I certainly have received my share of “out of office” auto-responses on emails. For bullish investors, this is usually a time for caution, as any apparently dominant psychology of the market can be misleading. For bearish traders, it’s hard to get much momentum going. Bears thought they had their catalyst when the FOMC announced its intention to begin tapering off on the quantitative easing program. But alas, bulls defended their ground, but not before significant technical damage had been done to the bullish charts.

I suspect there is no greater example of “summer doldrums” than the week surrounding the Fourth of July, especially when the holiday falls mid-week. From my standpoint, I certainly have received my share of “out of office” auto-responses on emails. For bullish investors, this is usually a time for caution, as any apparently dominant psychology of the market can be misleading. For bearish traders, it’s hard to get much momentum going. Bears thought they had their catalyst when the FOMC announced its intention to begin tapering off on the quantitative easing program. But alas, bulls defended their ground, but not before significant technical damage had been done to the bullish charts.

In addition, ever since the Fed announced two weeks ago its intention to begin tapering off on the latest quantitative easing program, investors have been somewhat paralyzed by uncertainty. On the one hand, Fed Chairman Bernanke has made it clear that the FOMC will only taper asset purchases if the economic data continues to improve in a self-sustaining way. But on the other hand, investors know that it can’t go on forever. The Fed’s balance sheet must stabilize sooner than later and eventually unwind, no matter the state of economic recovery.

Although interest rates spiked with the bond selloff, and many suspect that this flight of capital from bonds is rotating into stocks, I think a continued rise in rates likely will be short-lived. Given the extreme importance of housing to the U.S. economy and investor psychology (“wealth effect”), any significant increase in mortgage rates will reduce the affordability factor until home-buying cools off, thereby negatively impacting the improving economic data.

Beyond the Fed’s promised tapering, there are other headwinds for U.S. stocks. For one, corporations and the analysts who follow them have been lowering their earnings guidance for the second half of the year. Second, U.S. stocks have dramatically outperformed other developed markets as well as emerging markets, so many advisors are suggesting that better values can be found in those beaten down global regions. As Jason Zweig wrote last week in his latest must-read Intelligent Investor column on wsj.com, “I long ago concluded that regression to the mean is the most powerful law in financial physics….”

Third, the recent market pullback has left the S&P 500 with formidable overhead resistance from its 50-day simple moving average (SMA) and the uptrend line of former support that had been in place since last November. And fourth, let’s not forget the global dynamics, turmoil, and (in some cases) government experiments in places like Portugal, Egypt, Syria, China, and Japan, among many others.

Even at the local level, we each continue to hear about municipal government, school district, and state budget deficits…as well as the many cancellations of annual events like Fourth of July fireworks displays, due to an inability to pay for them (even by private organizations).

Still, the first half of the year saw the best performance since 1999, with the S&P 500 up by +12.6%. The second quarter saw bullish leadership from the financial and consumer discretionary sectors as investors rotated from defensive sectors (which were the Q1 leaders) into cyclicals. Looking at the ten U.S. business sector iShares ETFs, Financial (IYF) and Consumer Services (IYC) were the clear Q2 leaders. Nevertheless, Healthcare (IYH) is still the leader on a year-to-date performance basis, up +18%.

Friday brings the highly anticipated employment report (non-farm payrolls), which could be a market mover. But since Friday is one of those unpredictable orphan days after a Thursday holiday, in which few investors are paying much attention, it’s hard to know how big of a catalyst the report might be.

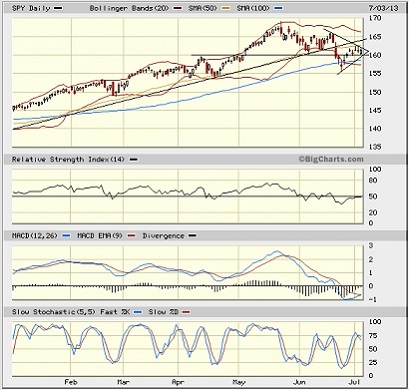

Looking at the chart of the SPDR S&P 500 Trust (SPY), it closed Wednesday at 161.28. After a disastrous breakdown through the long-standing uptrend line, prior psychological support at 160, and the 50- and 100-day SMAs, it bounced near prior support around 155. Much of this selloff likely was simple overreaction to the Fed announcement, which accounts for the quick recovery back above 160 (which corresponds with S&P 500 at 1600) and the 100-day SMA. But it was turned back at the 50-day, and now SPY might be forming a symmetrical triangle with an imminent apex, which positions it to break one way or the other next week.

The oscillators like RSI, MACD, and Slow Stochastic are each giving a different signal: RSI is neutral, MACD is turning up from oversold, and Slow Stochastic is crossing down from overbought. No clues here.

The CBOE Market Volatility Index (VIX), a.k.a. “fear gauge,” closed Wednesday at 16.20, which is where it was two weeks ago — just before it spiked above 20 for a few days for the first time all year. At this level, it is back in the zone of complacency. Given the recent rotation into cyclical sectors and their higher-beta stocks, we might see VIX staying above 15.

My take on market direction? I think stocks continue their struggle to find much upside for the summer, but I also doubt they fall very far, as investors hold on in anticipation of further upside later in the year.

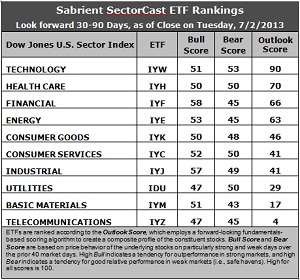

Latest rankings: The table ranks each of the ten U.S. business sector iShares ETFs by Sabrient’s proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. The multi-factor model considers forward valuation, historical earnings trends, earnings growth prospects, the dynamics of Wall Street analysts’ consensus estimates, accounting practices and earnings quality, and various return ratios. In addition, the table also shows Sabrient’s proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Observations:

1. Technology (IYW) as jumped back into the top spot with a robust Outlook score of 90. Stocks within IYW display a low forward P/E, a solid long-term projected growth rate, and the best return ratios, although the Wall Street analysts aren’t highly optimistic about their earnings projections. In fact, Wall Street hasn’t been very upbeat on any of the sectors lately. Healthcare (IYH) moves ahead of Financial (IYF) to take the second spot with a score of 70. Energy (IYE), and Consumer Goods (IYK) round out the top five this week. Notably, IYE sports the lowest (best) forward P/E.

2. Telecom (IYZ) stays in the cellar with an Outlook score of 4, although it boasts the best Wall Street analyst support, such as it is. Otherwise, IYZ is generally weak with a high forward P/E, low long-term projected growth, and poor return ratios. It is joined in the bottom two again this week by Basic Materials (IYM) at 17. Materials stocks continue to be pounded with earnings downgrades from Wall Street.

3. This week’s fundamentals-based rankings remain on the bullish side of neutral, but they still aren’t progressing. IYW, IYH, and IYF remain the top three, even with some shuffling. IYE is hanging tough, and Industrial (IYJ) rose a bit.

4. Looking at the Bull scores, IYF has been the leader on particularly strong market days, scoring 58, followed closely by IYJ, while IYZ and IDU score the lowest at 47, and in fact they are the only two scoring below 50. The top-bottom spread is still a narrow 11 points, indicating relatively high sector correlations. High sector correlation indicates more of a “risk-on/risk-off” approach in which all boats are lifted together, rather than a thoughtful stock-picking approach, so I’d rather see a wider top-bottom spread.

5. Looking at the Bear scores, IYW remains the favorite “safe haven” on weak market days, scoring 53. IYM scores the lowest during extreme market weakness as reflected in its low Bear score of 43. The top-bottom spread is 10 points, which still indicates relatively high sector correlations on weak market days.

6. Overall, Technology (IYW) shows the best all-weather combination of Outlook/Bull/Bear scores. Adding up the three scores gives a total of 194. Telecom (IYM) is the by far the worst at 96. Looking at just the Bull/Bear combination, Industrial (IYJ) displays the highest score of 106, while Telecom (IYZ) scores by far the lowest at 92. This indicates that Technology stocks have been the strongest in extreme market conditions (up or down) while Telecom stocks are generally avoided.

These Outlook scores represent the view that Technology and Healthcare sectors may be relatively undervalued, while Telecom and Basic Materials sectors may be relatively overvalued based on our 1-3 month forward look.

Some top-ranked stocks within IYW and IYH include Western Digital (WDC), Cree (CREE), Regeneron Pharmaceuticals (REGN), and Celgene Corp (CELG).

By the way, Sabrient’s annual Baker’s Dozen portfolio of top stocks for 2013 continues to perform well. Despite the recent market turmoil, it is up over 18% from the portfolio’s inception on January 11 through July 3 with 12 positions solidly positive, led by Genworth Financial (GNW), which is up nearly +47%. Eleven of the 13 stocks are up by double digits, while the S&P 500 is up less than 10% over the same timeframe). Only Ashland Inc. (ASH) is down, by a mere -1.6%. Note that Sabrient publishes a similar list each quarter called Earnings Busters Quarterly.

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a 1-3 month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs.