Day after day,

Alone on a hill,

The man with the foolish grin is keeping perfectly still

But nobody wants to know him,

They can see that he's just a fool,

And he never gives an answer

Well on the way,

Head in a cloud,

The man of a thousand voices talking perfectly loud

But nobody ever hears him,

or the sound he appears to make,

and he never seems to notice,

the fool on the hill,

And nobody seems to like him,

they can tell what he wants to do,

and he never shows his feelings,

But the fool on the hill,

Sees the sun going down,

And the eyes in his head,

See the world spinning 'round.

Ben Bernanke speaks to Congress today in a true test of the greater fool theory as all of the people in the Capitol attempt to fool all of the people in the World, as well as each other, all of the time.

Ben Bernanke speaks to Congress today in a true test of the greater fool theory as all of the people in the Capitol attempt to fool all of the people in the World, as well as each other, all of the time.

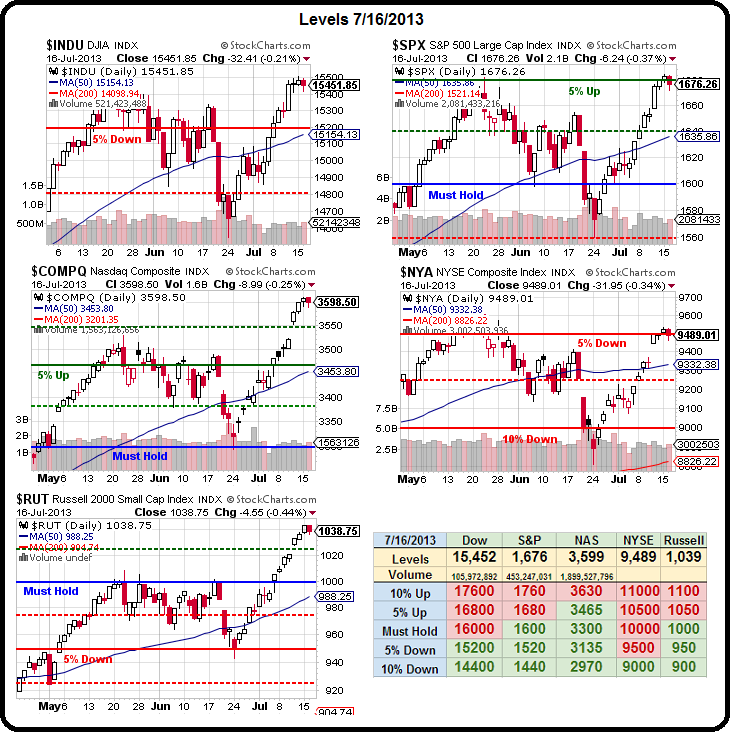

Some of the people sold their stocks yesterday (we went short(er) last week) and we'll see what some of the people do today as yesterday (and the day before) was a very low-volume affair and, as you can see from Dave Fry's Dow chart – we're pushing that 15,500 resistance level and well set up for a massive breakout…. Or a 1,000-point collapse.

At the moment, we're betting on the collapse for the simple reason that "M" patterns love to be made and the earnings and the macros are, so far, not matching the price of equities, which are now up that 1,000 points since April's earnings and up 2,000 points since January's earnings and up 3,000 points since November earnings.

That's 30% in 3 quarters! Did your stock make 30% more than it made last year? If not, it may be overpriced. Did your stock sell 30% more than it did last year? If not, it may be overpriced. Is your stock projecting to grow 30% in 2014? If not, it may be overpriced…

Oil sure is overpriced and yesterday they dumped just 14,000 August contracts (depriving the United States of 14Mb of oil that were scheduled to be delivered in August and creating an artificial shortage), leaving NYMEX traders still with 138M barrels of oil scheduled for delivery to the US in August. That would be about 45M barrels a week delivered to the US and those are binding contracts that can only be cancelled by the "buyer."

I use the quotes because these criminals have no intention whatsoever of buying oil. They are ORDERING oil in order to drive up the price that YOU (an ACTUAL user) are forced to pay by creating a false demand environment. In fact, of the over 4Bn barrels of August oil contracts that are TRADED this month, only 11M (0.2%) will actually be DELIVERED – the rest is an artificial pump job aimed at manipulating the price of oil. And who do you think all those trading fees are ultimately passed on to?

We take advantage of the fakery to print our own money. Yesterday, for example, I sent out an Alert to our Members to short oil (/CL) futures at $106.49 and, later, when oil went up to $107 (as planned in the morning post) we hit that short too. We caught the drop during the day to $105.75 and that's $1,250 PER CONTRACT in profits and, this morning, we got another run up to $106 for another shorting opportunity. So we don't care if "THEY" manipulate the oil markets personally – but it is a very bad thing for America and needs to be stopped!

We take advantage of the fakery to print our own money. Yesterday, for example, I sent out an Alert to our Members to short oil (/CL) futures at $106.49 and, later, when oil went up to $107 (as planned in the morning post) we hit that short too. We caught the drop during the day to $105.75 and that's $1,250 PER CONTRACT in profits and, this morning, we got another run up to $106 for another shorting opportunity. So we don't care if "THEY" manipulate the oil markets personally – but it is a very bad thing for America and needs to be stopped!

Now, enough talk of ameteur manipulators. Why bother with them when the Master speaks this morning?

Already we have the release of Bernanke's testimony and TLT (we're long) is flying up as the Fed Chairman says they have no intention of curtailing (tapering) the current $85Bn a month bond-buying program and that the Fed may even INCREASE purchases if US Corporations fire more workers (or simply refuse to hire new ones). That's the not-very-coded message from the Fed to Corporate America – "We will keep giving you free money as long as unemployment remains high."

Already we have the release of Bernanke's testimony and TLT (we're long) is flying up as the Fed Chairman says they have no intention of curtailing (tapering) the current $85Bn a month bond-buying program and that the Fed may even INCREASE purchases if US Corporations fire more workers (or simply refuse to hire new ones). That's the not-very-coded message from the Fed to Corporate America – "We will keep giving you free money as long as unemployment remains high."

That's sent gold (we're long) flying back up to test $1,300 and the markets did pop (as expected) but, on the whole – so what? What is this man saying that's new? What is this man saying that should make us ignore earnings misses by MAT, NTRS, NVS and PJC this morning, along with revenue misses by ASML, KNL, STJ, TXT and USB. There were only 20 earnings reports this whole morning and 9 of them were tarnished!

Not only that but the "beats" we're seeing have year over year revenue gains of 1%, 2% not a single double digit gain in the group yet there's probably not two of these stocks (10%) that aren't up 20% or more from last year (average stock is up 30% since November!). SOMETHING is not connecting here and, when there is a disconnect between the market and reality – reality often wins in the end.

Not only that but the "beats" we're seeing have year over year revenue gains of 1%, 2% not a single double digit gain in the group yet there's probably not two of these stocks (10%) that aren't up 20% or more from last year (average stock is up 30% since November!). SOMETHING is not connecting here and, when there is a disconnect between the market and reality – reality often wins in the end.

That's all Uncle Ben is trying to do – postpone the end. Hopefully extending it past the point of his resignation, so he can go out as the man who led the markets to a 200% gain since March of 2009, rather than the guy who blew the biggest bubble in history. Bernanke hedges all of his legacy bets, saying:

“The risks remain that tight fiscal policy will restrain economic growth over the next few quarters by more than we currently expect, or that the debate concerning other fiscal policy issues, such as the status of the debt ceiling, will evolve in a way that could hamper the recovery. More generally, with the recovery still proceeding at only a moderate pace, the economy remains vulnerable to unanticipated shocks, including the possibility that global economic growth may be slower than currently anticipated.”

We'll see how all this is digested by the markets today but, leading off with this statement pre-market – there's probably nowhere to go but down from here. Could this be The End??