What a crazy month July has been.

What a crazy month July has been.

Now that it's over, we've clearly gotten very bearish - even pressing our bearish bets into Friday's rally. How did this happen to us? Why do we hate the rally?

Well, for one thing, we were good little Stock Market timers and we "sold in May" - when the market topped out near the end of the month I called for cashing out bullish positions but, of course, we're still here - so we still make our daily picks.

June was choppy but more or less a downhill event. By the end of June, we were flipping bullish again and a lot of the reason we've been getting so bearish at the top of the July rally is that we have all these bullish late June/early July positions we need to protect. As a rule of thumb, you should always be putting 1/4-1/3 of your upside profits into downside hedges - that's just good hedging.

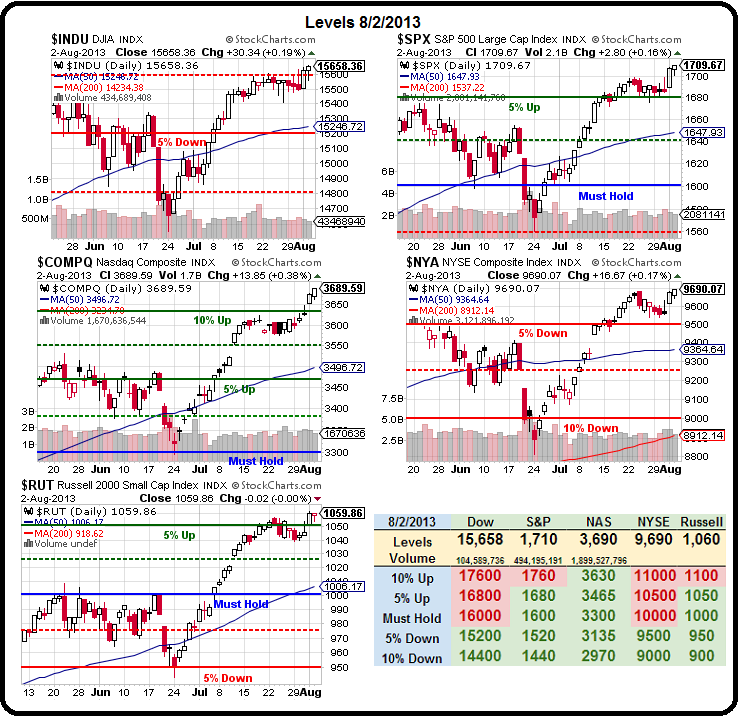

From time to time it's good to step back and take a big-picture view of how the market is doing and how you've been doing following it - it helps you see (hopefully) if you are getting certain things wrong or right. Also, it's important to remind our new Members that our Short-Term Portfolio is just that, a portfolio of SHORT-TERM positions used to counterbalance the longer-term bets that dominate the rest of our posts and chat.

There are, perhaps, a dozen Short Term Portfolio positions while there were over 100 picks for the month. Our short-term positions are directional GUESSES while our longer-term picks are for INVESTING - it's VERY important not to get the two confused....

I did a mini-review on June 21st (Friday) and noted in that post that we had flipped more bullish on that sell-off because we were expecting the bounce.