Is there anybody out there?

Just nod if you can hear me

Is there anyone home?Relax

I'll need some information first

Just the basic facts

Can you show me where it hurts?I, have become comfortably numb – Floyd

Yesterday's volume was the lowest of 2013 – and that includes half-days!

As noted in yesterday's post, it's a fitting song choice for this over-stimulated economy, where the money flows into stocks simply because it has nowhere else to go and the VIX drops down to 11.84 with the OEX (S&P 100 Options) trading at a record high causing what is known as the "Blue Sky Index" (OEX/VIX) to reach a level it usually reaches just before a market catastrophe.

As noted in yesterday's post, it's a fitting song choice for this over-stimulated economy, where the money flows into stocks simply because it has nowhere else to go and the VIX drops down to 11.84 with the OEX (S&P 100 Options) trading at a record high causing what is known as the "Blue Sky Index" (OEX/VIX) to reach a level it usually reaches just before a market catastrophe.

Yesterday's volume was so meaningless that Dave Fry didn't even bother charting most of it. One meaningful chart we did find, and discussed in our early morning Member Chat was BAC's net of Institutional and Private Client Equity Purchases, which are flashing a signal last seen in late 2011, when the market had a 10% correction – after having a 20% correction earlier in the summer:

As I wrote on Friday – "Fools Rush in Where Fundamentals Fear to Tread" and this chart is an illustration of the Greater Fool Theory in action as professional traders dump their too-hot potatoes on the Retail Sheeple that are now being herded into the top of the market by the Corporate Media.

As noted by ZeroHedge, the June gap of $70Bn of the difference between equity buying and bond fund buying is the highest ever, breaking the previously ill-timed record of February 2000. This is all coming while hedge funds (chart on left) are running for the exits and, keep in mind, this chart reflects the PAST 21 sessions, to drop the average that fast, they are already well below that zero line.

As noted by ZeroHedge, the June gap of $70Bn of the difference between equity buying and bond fund buying is the highest ever, breaking the previously ill-timed record of February 2000. This is all coming while hedge funds (chart on left) are running for the exits and, keep in mind, this chart reflects the PAST 21 sessions, to drop the average that fast, they are already well below that zero line.

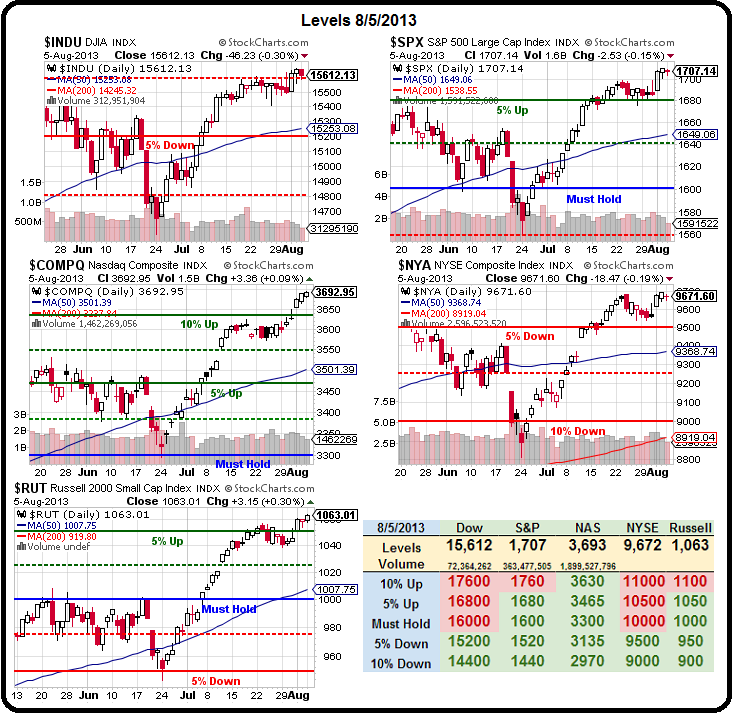

Still, as promised, we did some BUYBUYBUYing ourselves yesterday because we're already bearish and there's no sense in getting more so until the S&P fails that 1,700 line. We even put a long play on TSLA to take advantage of the idiocy, as well as to hedge our long-term short positions into earnings.

GMCR comes out this evening and estimates are they wil make 0.77 per $81 share and that's not too bad if you multiply 0.77 by 4 and get $3.08 for a p/e of just 26.3, which is fine for a growth stock. But – is it a growth stock? Don't forget, the company already jumped to $81.70 after their Q1 earnings beat (14%) sent them up from $59 (up 38%) and it's the prospect of that sort of gap up again that has the Bulls in a frenzy ahead of this report.

The big news last Q was SBUX signing on for a 5-year deal, rather than waiting for GMCR's patent to expire and creating their own cups. Also exciting traders is GMCR's ironic filing of a trademark application to make their own soda maker – like SODA, fulfilling my shorting premise against that company (that it's too easy to copy). Barron's discussed the company's problems over the weekend and GMCR says it expects unlicensed compatible products will have only about 5% of the K-Cup universe this year, and perhaps 15% in two or three years. Seems a bit optimistic to me.

Data from scanner trackers like Nielsen Holdings indicate that unlicensed products are gaining share in the K-Cup market at a faster rate than Green Mountain predicted. Nielsen's expert on consumer trends, Todd Hale, notes that 26 new brands have entered the single-serve coffee segment since Green Mountain's patents expired, and by Nielsen's tally those new brands have garnered 16% of the segment's dollar sales this year.

Nielson doesn't even measure big-box retailers like COST and AMZN, who account for about 25% of GMCR's total sales to crowds that are notoriously price-conscious in the first place. This is what Fundamental Investing is all about – the CEO or the pundits tell one story, the facts we're observing tell another. Also, EVEN if GMCR keeps licensing the K-cups, they won't have the same margin as when they sold them direct – isn't that obvious?

Nielson doesn't even measure big-box retailers like COST and AMZN, who account for about 25% of GMCR's total sales to crowds that are notoriously price-conscious in the first place. This is what Fundamental Investing is all about – the CEO or the pundits tell one story, the facts we're observing tell another. Also, EVEN if GMCR keeps licensing the K-cups, they won't have the same margin as when they sold them direct – isn't that obvious?

As a coffee company, GMCR is a little over-priced but, as a packaging company, it's insanely over-priced!

Our morning trade idea was to sell 5 Aug $77.50 calls for $5.60 ($2,800) while buying 5 of the Oct $80/87.50 bull call spreads for $2.65 ($1,325) for a $1,475 credit. If GMCR hits $80, not including rolling our calls, we owe them back $1,250 between $77.50 and $80 – after that, we are covered up to $87.50, a 10% bump in the stock. Later in the day, the $80 calls jumped to $6 as the stock recovered and that, of course, made for an even better front-month sale, using the same vertical spread as a backstop. We'll find out this evening which side of this debate wins out but there's a trade idea that's probably still playable this morning.

There's not much going on this morning other than earnings. We had very lame 0.3% growth in ICSC Retail Sales – especially poor since last week was down 1.6%. We'll have Redbook Chain Store Sales closer to 9 and those shouldn't be as bad.

There's not much going on this morning other than earnings. We had very lame 0.3% growth in ICSC Retail Sales – especially poor since last week was down 1.6%. We'll have Redbook Chain Store Sales closer to 9 and those shouldn't be as bad.

UK Retail sales were up 2.2% from last July after being up 1.4% in June but on-line growth dropped 50%, from 15.6% to 7,9%. Growth "has been driven by the warm weather and retailers working hard to offer deep discounts," says the BRC's Helen Dickinson. Andy Murray's Wimbledon win also apparently added to positive data.

Europe is flattish ahead of our open and we have $32Bn worth of 3-year notes to sell at 1pm, so that ought to be interesting and Chicago Fed President Evans, a slight dove, speaks right at the open this morning but nothing Earth-shattering is expected. The big data-point of the week is China's Retail Sales and Industrial Production Reports early Friday morning – after their CPI and PPI Thursday night.

Until then, it's all about the earnings so please – be careful out there!