Japan's economy is already stalling.

Japan's economy is already stalling.

Japan’s economy slowed more than forecast in the second quarter as businesses cut investment, undermining gains in consumer and government spending that helped reduce deflationary pressures. Q2 GDP rose an annualized 2.6%, down from Q1, when it rose 3.8%, the Cabinet Office reported today in Tokyo. The median of 32 estimates by leading Economorons was for a 3.6% gain. While consumers continue to propel Japan’s rebound, companies have yet to commit to the Abenomics project, paring capital spending for a sixth straight quarter.

The Shanghai Composite jumped 2.4% this morning and the Hang Sengs popped 2.1% as money flew out of Japan and into China – the Nikkei fell 0.7% on the day, now down 10% in just over two weeks. As you can see from the WSJ chart above, the emerging market economies certainly aren't picking up the slack and, as noted in today's title, even intense amounts of stimulus aren't doing enough to drive serious growth in the G8.

Can you blame us, then, for getting more bearish into August? I was working on Part 2 of a July Trade Review over the weekend titled "Too Bearish or Just Right?" and, when I started Part 1, way back on August 3rd, we were very unsure that my bearish picks were on the right track. This morning, with Japan down 10% in two weeks and the US Futures down another half a point, at least I'm not looking so crazy anymore!

Can you blame us, then, for getting more bearish into August? I was working on Part 2 of a July Trade Review over the weekend titled "Too Bearish or Just Right?" and, when I started Part 1, way back on August 3rd, we were very unsure that my bearish picks were on the right track. This morning, with Japan down 10% in two weeks and the US Futures down another half a point, at least I'm not looking so crazy anymore!

As macro fundamentalists, sometimes we see things coming a little too far ahead of the curve – like our bets to short V recently, that we bailed on right before they crashed or the SBUX shorts that haven't kicked in yet as no one but us seems concerned that they will have to pay KRFT $1Bn+ to settle a lawsuit in the very near future. The fundamentals on that one are simple, SBUX has $1.6Bn in cash and may get a $2Bn fine – also, they "only" earn $1.3Bn per year so it's not like this is a love bite.

Currently, we're shorting SBUX off the $74 line with the Sept $75/70 bear put spread that we picked up for $1.88 in our Short-Term Portfolio and that spread is now $2.33 (up 24%), so still a very nice return (114% more) if SBUX falls below $70 by Sept expiration (20th). You would think a lawsuit that's been in progress since 2010 wouldn't move the stock but, at the all-time high of $74 and still $72.80 at Friday's close, I don't see how this news is baked in.

That's what I mean about being Fundamentalists – we look at things other investors tend to ignore – until they finally hit the front page of the WSJ or the cover of Barron's but, by then, it's a bit too late to jump on the bandwagon. We were too early with our first short stab at SBUX in August – as we thought the lawsuit would come up in earnings and tank the stock but, as you see from the chart – quite the opposite as investors focused on the low cost of beans saving the company 3% of their costs this quarter. 3% of $6Bn (annualized spending, being generous) is $180M and that popped the stock almost 10% – what's a $1.8Bn COST of a lawsuit going to do to them?

We'll see how SBUX plays out but, at the moment, we're a lot more concerned with the Global Macros and we get CPI and PPI numbers from Europe tomorrow, along with the ZEW Economic Sentiment Reports. US Retail Sales for July come in tomorrow morning along with Business Inventories and Wednesday gives us Euro-Zone GDP, which is expected to show a recessionary decline, held up somewhat by Germany.

We'll see how SBUX plays out but, at the moment, we're a lot more concerned with the Global Macros and we get CPI and PPI numbers from Europe tomorrow, along with the ZEW Economic Sentiment Reports. US Retail Sales for July come in tomorrow morning along with Business Inventories and Wednesday gives us Euro-Zone GDP, which is expected to show a recessionary decline, held up somewhat by Germany.

Thursday is our big data day, with CPI, Empire State Manufacturing, Industrial Production, the Philly Fed and the NAHB Housing Index followed by more housing data (starts and permits) on Friday and Consumer Confidence.

From a Fundamental perspective – our expectations are higher because the market is higher and we have to look at this incoming data while asking ourselves the question: "Is this data good enough to justify all-time market highs?" Of course we know the market is "juicing" on Economis Steriods – that's not the point because it's not "illegal" and they're not going to have to stop using stimulus – but all-time highs are the big leagues. They are the playoffs, in fact, and now they have to be turning in performances that are the best of the best or else the fans (investors) can turn on the markets very quickly!

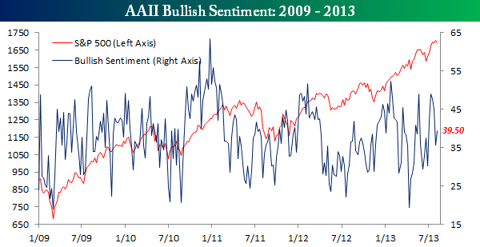

As you can see from this chart by Bespoke Investments, investor sentiment has already detached from the painted performance of the S&P by a wide margin. Again, this is the annoying part about being a Fundamental Investor – what looks glaringly obvious to us isn't even being discussed in the MSM but you can SEE IT COMING – from a mile away.

As you can see from this chart by Bespoke Investments, investor sentiment has already detached from the painted performance of the S&P by a wide margin. Again, this is the annoying part about being a Fundamental Investor – what looks glaringly obvious to us isn't even being discussed in the MSM but you can SEE IT COMING – from a mile away.

The whole trick is learning how to time your investments because, as Keynes learned from bitter experience (he almost went bankrupt betting on funamentals): "The market can remain irrational far longer than you or I can remain solvent." It's easier to be bullish when the market is low, as you still OWN the stock – even if they drop by 50% or more and, all you have to do is wait for them to come back – no matter how long that takes.

Shorting is a different animal – especially when you are fighting the Fed as well as stock promoters – who, as we have noted, have begun taking over the blogosphere now that they have fully infiltrated the MSM to the point where all we really have is one gigantic infomercial on CNBC these days and a "focus" on small-cap stocks on Seeking Alpha. In fact, here's an article about a $30M fine pump and dump scam involving penny stock SENZ and here's the coverage Seeking Alpha – we report, you decide!

Shorting is a different animal – especially when you are fighting the Fed as well as stock promoters – who, as we have noted, have begun taking over the blogosphere now that they have fully infiltrated the MSM to the point where all we really have is one gigantic infomercial on CNBC these days and a "focus" on small-cap stocks on Seeking Alpha. In fact, here's an article about a $30M fine pump and dump scam involving penny stock SENZ and here's the coverage Seeking Alpha – we report, you decide!

GENM is also mentioned as a scam in the article as is HAIR and you can click on the links to read all about why they were a buy according to "top bloggers". It's not just SA, of course, here's Motley Fool's notes on GENM. This is what happens when you ignore fundamentals – you fall prey to market hucksters who are, unfortunately, all around us and waiting to pounce on unsuspecting investors. Here's a good article from Marketwatch that gives a good example of how to be on the lookout for these scam stocks.

If there is a whole industry build around the manipulation of small cap stocks that involves "respected" media outlets, analysts and brokers – why would you think it's not happening on bigger stocks? They're not harder to manipulate just because they are bigger – as Archimedes used to say "Give me a place to stand, and a lever long enough, and I will move the World." The MSM and now even the Blogosphere have given stock market manipulators plenty of places to stand and people like Elon Musk can afford incredibly long levers.

If there is a whole industry build around the manipulation of small cap stocks that involves "respected" media outlets, analysts and brokers – why would you think it's not happening on bigger stocks? They're not harder to manipulate just because they are bigger – as Archimedes used to say "Give me a place to stand, and a lever long enough, and I will move the World." The MSM and now even the Blogosphere have given stock market manipulators plenty of places to stand and people like Elon Musk can afford incredibly long levers.

We've been short (and wrong so far) on TSLA since it crossed $100, now $153 but, FUNDAMENTALLY, as noted by Pat Michaels in Forbes:

The latest round of Tesla wonderment came when it reported its first quarterly profit earlier this month. TSLA stock darned near doubled in a week. Musk then borrowed $150 million from Goldman Sachs (shocking!) and floated a cool billion in new stock and long-term debt. That’s how we—the taxpayers—were repaid.

Tesla didn’t generate a profit by selling sexy cars, but rather by selling sleazy emissions “credits,” mandated by the state of California’s electric vehicle requirements. The competition, like Honda, doesn’t have a mass market plug-in to meet the mandate and therefore must buy the credits from Tesla, the only company that does. The bill for last quarter was $68 million. Absent this shakedown of potential car buyers, Tesla would have lost $57 million, or $11,400 per car. As the company sold 5,000 cars in the quarter, though, $13,600 per car was paid by other manufacturers, who are going to pass at least some of that cost on to buyers of their products.

This is not so much a scam as a clever Capitalist (Musk) taking advantage of a temporary market situation (carbon credits and vehicle requirements that aren't being met by the majors) to get a jump his competition but the PRICE of TSLA stock ($153 on Friday's close) has nothing to do with current earnings (net .15 projected for 2013, 1.49 projected in 2014) but about expectations that this unusual situation will continue long-term.

Meanwhile, MusK has made himself about $5Bn on the company, which he did not found – he was only the lead investor, coming in on the series A round in 2004 with $7.5M in initial financing. Through May 2007, when Mercedes came in with $50M for 10% of the company (of which they subsequently sold 40% to Aabar Investments), Musk is thought to have contributed $70M of $187M raised.

The company then got a $465M loan from the DOE in June 2009 and did an IPO in June 2010 for $226M at $20 per share and then raised another $1.5Bn in cash and financiing while the stock jumped from $35 in April to $155 last week. Nice work if you can get it!

Perhaps this time is different and there's no reason to be concerned by the low(er) volume run-up in the stock since topping $100 and perhaps all the people who bought in at $100 won't take profits at $150 but, FUNDAMENTALLY, it's insane to pay 150x FUTURE earnings for an auto company – even if it's not just a gigantic pump and dump scheme.

During a rally, it's all about technicals and expectations. After a crash – there's a million FUNDAMENTAL reasons that were "obvious" in hindsight. We're only trying to keep pople ahead of the curve BUT, too far ahead of the curve and we're off the rails.

So let's continue to be careful out there.