This is getting interesting.

This is getting interesting.

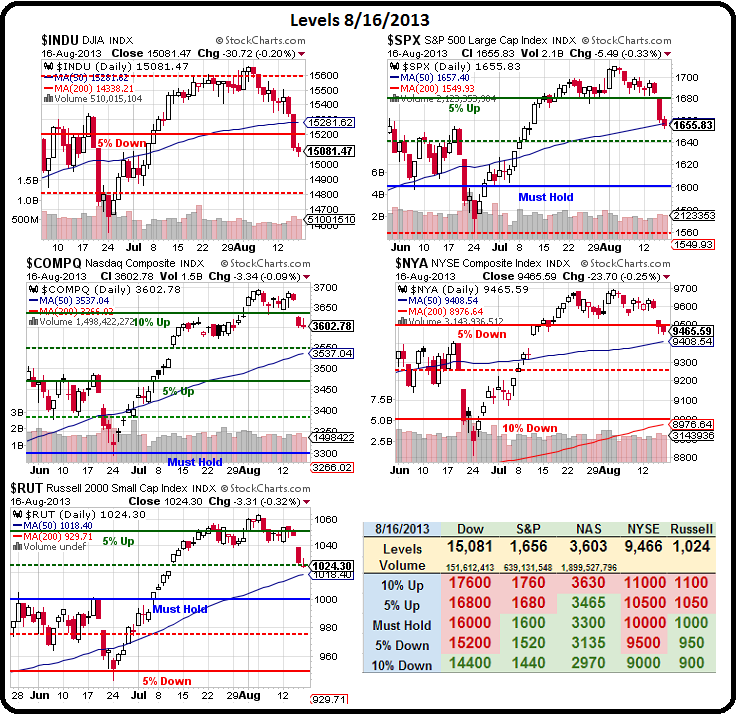

As you can see from our Big Chart, we're testing that 50 dma on the NYSE at 9,408 after failing to hold the 9,500 line (-5%) we've been watching for some time. I had been annoying people all during July by never feeling able to get more bullish and, after finishing our July Trade Review, I think we can sum it up to low volume and lethargic earnings that was bothering me the most on the way up.

Now that we've had a bit of a pullback, the question is – where should it end? What's the "fair value" for our indexes? It's kind of a tricky question as we have long maintained, since last year, that 1,450 on the S&P was our year-end target without stimulus. But there is stimulus – $85Bn a month from the Fed and $75Bn a month from the BOJ and call it $25Bn a month from China and $15Bn a month from the ECB is $200Bn a month for a total of $2.2Tn a year pumped into the system by the G4.

Based on our patented stimulus to S&P conversion table, $1Bn per month = 1 S&P point over fair value so that gives a 1,650 target for the S&P WITH stimulus. Without it – look out below! Tapering. whatever it ends up being, will only withdraw SOME of the stimulus but we're also hitting the debt ceiling yet again – and that's a wildcard.

Based on our patented stimulus to S&P conversion table, $1Bn per month = 1 S&P point over fair value so that gives a 1,650 target for the S&P WITH stimulus. Without it – look out below! Tapering. whatever it ends up being, will only withdraw SOME of the stimulus but we're also hitting the debt ceiling yet again – and that's a wildcard.

Other wildcards in play are China melting down, Egypt blowing up, Japan just doing what they're doing now, Europe heading back into Recession, the collapse of the US Middle Class, etc. Plenty to worry about. In fact, we can add Brazil to that list as JPM just cut that country's growth forecast for Q3 by 80%, from 1.5% to just 0.3%. Emerging markets have fallen generally out of favor but Brazil is the "B" in BRIC – not encouraging…

The "I" in BRIC is India and the Rupee continues to make new record lows on a daily basis in August with the Sensex falling 4% on Friday (see Dave Fry's chart). The good news is that Prime Minister Singh is taking charge of the economy to prevent a crisis like India had in 1991, when their balance of payments spiraled out of control as the Rupee collapsed.

The "I" in BRIC is India and the Rupee continues to make new record lows on a daily basis in August with the Sensex falling 4% on Friday (see Dave Fry's chart). The good news is that Prime Minister Singh is taking charge of the economy to prevent a crisis like India had in 1991, when their balance of payments spiraled out of control as the Rupee collapsed.

The bad news is – Singh WAS the country's Finance Minister in 1991 – and he blew it then and now the current-account deficit is 4.8% and growth is below 5% and it looks like they will cross…. again…. like in 1991….

This is kind of like us not worrying about having another complete economic melt-down because Ben Bernanke was still in charge – could you imagine people being that stupid?

Other letters in BRIC are Russia and China and we're already worried about China and the only reason we're not worried about Russia is that they've been irrelevant for years, so why start thinking about them now? Barron's ran this helpful chart over the weekend, outlining the risks facing the emerging markets.

Other letters in BRIC are Russia and China and we're already worried about China and the only reason we're not worried about Russia is that they've been irrelevant for years, so why start thinking about them now? Barron's ran this helpful chart over the weekend, outlining the risks facing the emerging markets.

Australia is also in big trouble as this year's slowdown in China and India and drop in commodity prices has crippled their export industry. PIMCO sees the Aussie Dollar collapsing to 80 cents (devalued by 25% since January) over the next 12 months as that nation's Central Bank is forced to cut interest to spur growth.

The silence is deafening regarding these major meltdowns in the G20 and none more so than Japan, where their national debt went over 1,000,000,000,000,000 Yen last week. I guess you can say it's only Yen so we divide by 100 and get $10Tn but interest alone on $10Tn in debt is $100Bn per 1% annually and "normal" borrowing rates are about 3%, so that's a debt service of $300Bn a year and Japan's GDP is roughly 1/3 of our size, so that would be roughly equivalent to the US having to pay $1Tn a year in interest alone on our debt.

Is that sustainable? Certainly not when the Bank of Japan is adding $75B or 7.5Tn (yes, Trillion) Yen PER MONTH to their debt load. One of my own articles I re-read with great interest when finishing our Trade Review this weekend was July 24th's "Wednesday the Rally Resumes on the Japan Scam," where I pointed out that ALL the "good" economic news coming out of Japan wasn't good at all – it was simply the result of the 25% devaluation of the Yen over the past 12 months.

Is that sustainable? Certainly not when the Bank of Japan is adding $75B or 7.5Tn (yes, Trillion) Yen PER MONTH to their debt load. One of my own articles I re-read with great interest when finishing our Trade Review this weekend was July 24th's "Wednesday the Rally Resumes on the Japan Scam," where I pointed out that ALL the "good" economic news coming out of Japan wasn't good at all – it was simply the result of the 25% devaluation of the Yen over the past 12 months.

One of our most important lessons we teach our Members at Philstockworld is to think about what economic data really means: Where does it come from? What are the underlying factors that affect it? Who is able to manipulate it and what are their motivations? How does it look in context? Learning to step back and analyze data like Japan's Export Numbers in proper context helps us make profitable FUNDAMENTAL decisions – like shorting the Nikkei Futures (/NKD) at 14,850, which subsequently bottomed out at 13,400 – good for a $7,250 per contract gain at $5 per point, per contract.

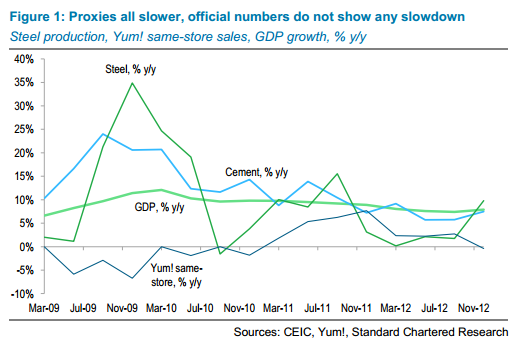

We've been playing the same game with our own currency, of course, but no one beats Japan (so far) in destroying the wealth of it's citizens in order to paint a prettier-looking economic picture. Except maybe China, who according to Mish in our Phil's Favorites section this weekend, releases "Willfully Fraudulent" data to the tune of over $1Tn – 20% of their GDP.

We've been playing the same game with our own currency, of course, but no one beats Japan (so far) in destroying the wealth of it's citizens in order to paint a prettier-looking economic picture. Except maybe China, who according to Mish in our Phil's Favorites section this weekend, releases "Willfully Fraudulent" data to the tune of over $1Tn – 20% of their GDP.

I make a lot of fun of "Economorons" because they miss their estimates by miles on a regular basis, yet they still have jobs. A lot of the reason this happens is because they take data they work with at face value, because that's what they were taught to do in Business School. With almost every country running some scam or other on its Citizenry, there's just no way to arrive at the truth if you allow your basis to be formed by false data. That's why skeptics like us have a tremendous market advantage.

I mentioned how the Yen has been weakening over time and how Aussie Dollars and Rupees are devaluing rapidly but people tend to forget – against what? That's the joke of the thing: In 2008, there were $1.599 Euros to the Dollar and now they barely hold $1.30 – down 18% but the Dollar itself has fallen from 97 to 81 (16.5%).

I mentioned how the Yen has been weakening over time and how Aussie Dollars and Rupees are devaluing rapidly but people tend to forget – against what? That's the joke of the thing: In 2008, there were $1.599 Euros to the Dollar and now they barely hold $1.30 – down 18% but the Dollar itself has fallen from 97 to 81 (16.5%).

Global currencies' race to the bottom reminds me of the roadie in Spinal Tap who said "make everything louder than everything else" – that's what our Central Banksters are doing in reverse, driving down the value of money to mask the decline of the Global Economy.

Who benefits from the Global destruction of currency? The people in power benefit, because they have unmanageable (and unimaginable) debts to pay off and paying it off by printing money is now the only way left. The Corporations benefit as it's easy for them to borrow cheap money and then use it to pay their workers less without actually having to reduce the AMOUNT of their wages – though the VALUE of the wages drops tremendously. The top 1% benefit because they have more assets (40% of the total) than income (20% of the total), so weakening currencies make what they already own much more valuable (inflation).

In fact, the entire top 10% benefit from this scam so no one "who matters" really complains about it. The last 5 years have seen the greatest transfer of wealth from the bottom 90% to the top 10% in the history of this Planet and, as you can see from the chart, it's far too late to fix it – so the only rational thing you can do is to make damned sure you keep yourself in the top 10%. Surely, you don't want to spend the rest of your life fighting for scraps with 300M other Americans, do you?

In fact, the entire top 10% benefit from this scam so no one "who matters" really complains about it. The last 5 years have seen the greatest transfer of wealth from the bottom 90% to the top 10% in the history of this Planet and, as you can see from the chart, it's far too late to fix it – so the only rational thing you can do is to make damned sure you keep yourself in the top 10%. Surely, you don't want to spend the rest of your life fighting for scraps with 300M other Americans, do you?

When inflation really begins to kick in, you'd BETTER have some assets to inflate. We just saw how gold was driven into the dust and, at the time, I warned our Members that it was very artificial – the result of the manipulation of the exchanges by Banksters like GS and JPM, who were able to move physical gold around in a sort of shell game to drop prices and then force players like Paulson to liquidate in ETFs like GLD, which then dumped more physical gold on the local exchanges and drove prices even lower – below even the extraction cost of gold.

Why would they do this? So they can buy gold and gold futures cheaply ahead of the collapse of currencies. That's a good, rational reason isn't it? In fact, as I'm often reminded by Corporate apologists – it's the FIDUCIARY DUTY of the CEOs of these fine Financial Institutions to do WHATEVER it takes to maximize shareholder value. That's why they constantly push the limits of the law while, at the same time, spending Billions on lobbying to rewrite those laws even more in their favor.

Earlier in this post I linked to "The Century of the Self" (and Part 2 and Part 3 and Part 4) and I cannot recommend watching this series more strongly if you want to understand the context of the ongoing 100-year campaign to create the modern Corporate Kleptocracy we all find ourselves currently trapped in. If you're going to play – you'd better understand the game you're playing and, as the great Ice-T so aptly put it:

Don't hate the player, hate the game

N***as, sharpen your aim

Every baller on the streets is searchin' fortune and fame

Some come up, some get done up, except the twist

If you out for mega cheddar, you got to go high riskI didn't chose the game, the game chose me – Ice-T