And Jackson Hole is open for business!

And Jackson Hole is open for business!

The conference officially kicks off this morning but, usually, we get early pronouncements – there were none yesterday. Possibly because Bernanke is NOT attending the Federal Reserve's Annual Meeting (draw your own conclusions) – it's been pretty quiet so far. Tonight's dinner is hosted by KC Fed President, Esther George and will focus on the impact of the Fed’s unconventional policies, according to the WSJ.

The papers and discussion on Friday will center on the situation the Fed has grappled with since the 2008 financial crisis: short-term interest rates close to zero but the economy still flailing, prompting experimentation with new policy tools and how those tools work.

On Saturday, the scope of the conference widens to the global impact of the Fed’s policies, though a panel discussion Friday featuring the head of Bank of MexicoGov. Augustin Carstens, a Chinese academic and a European Central Bankofficial is also likely to touch on that theme. Janet Yellen is not giving a speech, but is the emcee for Saturday’s events. Larry Summers won't be there (thank God!), which leads me to think no one will say anything of note at this conference.

Highlights for the Conference, which kicks off at 8am PST with "The Natural Rate of Interest, Financial Crises and the Zero Lower Bound" (bring coffee!) should be the 10:25 Panel on Monetary Policy Options,

Highlights for the Conference, which kicks off at 8am PST with "The Natural Rate of Interest, Financial Crises and the Zero Lower Bound" (bring coffee!) should be the 10:25 Panel on Monetary Policy Options,

Christine Lagarde makes a 12:15 lunch speech (and then they call it a day after a rough 4 hours work) and then tomorrow, after discussing Global Liquidity and Cross-Border Capital Flows, there's a 10:25 panel with BOJ's Kuroda and BOE's Mr. Bean (Deputy Governor).

That's it, two days of almost 4 hours each day is a grueling week for Central Banksters so, if you see one at the airports on Sunday – be sure to give them a pat on the back for a job well done! If you haven't done so, I urge you to read "The Creature from Jekyll Island" to learn more about what the Fed really is or, in the very least, watch the video (cheater!). These people (as noted in the above cartoons) are not there for your benefit (unless you are in the top 1%, of course)– not at all!

Even if the Fed did WANT to help us? What could they really do? Print more money? Been there – done that. JPM says that the long-run potential growth rate for gross domestic product has slid to around 1.75% per year, from an average rise in GDP of 2.5% since 1990. That would be the lowest level since World War II and below the 2 percent mark that Pacific Investment Management Co. pegged as the new normal for the economy.

Even if the Fed did WANT to help us? What could they really do? Print more money? Been there – done that. JPM says that the long-run potential growth rate for gross domestic product has slid to around 1.75% per year, from an average rise in GDP of 2.5% since 1990. That would be the lowest level since World War II and below the 2 percent mark that Pacific Investment Management Co. pegged as the new normal for the economy.

The “U.S. future isn’t what it used to be,” said Michael Feroli, chief U.S. economist at JPMorgan in New York. Declining productivity gains and a slower expansion of the labor force “should limit the U.S. average growth pace” in the long run.

In the end, all the Fed can really do is blow more bubbles and bubbles, unfortunately, tend to pop!

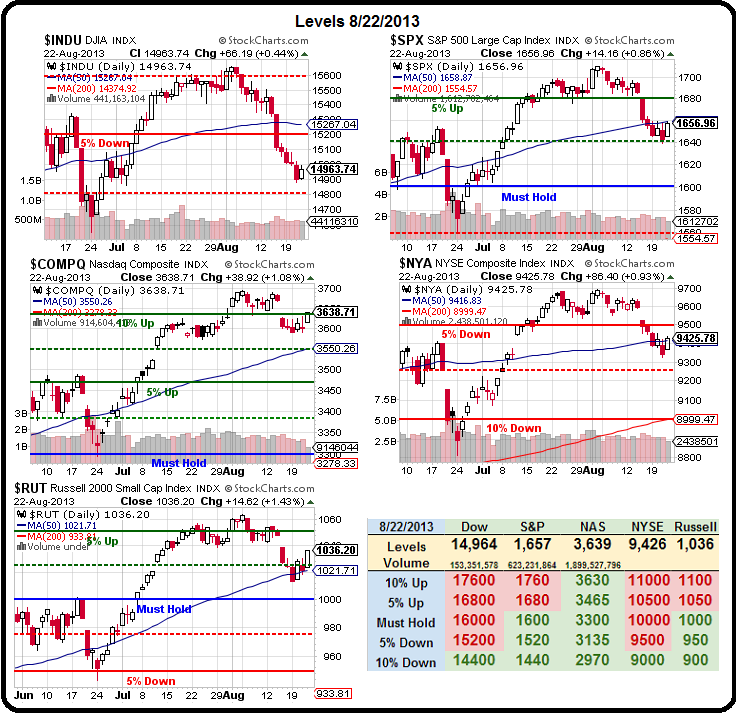

We hit our weak bounce levels (see Tuesday morning's amazingly accurate predictions) and now we're looking for strong bounces but, of course, we now have better information so we recalculate based on the top to bottom drops using our 5% Rule™. As I noted to our Members this morning, we have to factor in volume and duration and I'll discuss that over the weekend but, for now, the "simple" numbers are:

- S&P 1,710 to 1,645 is 70 points (3.8%) and we'll look for a weak bounce of 13 to 1,658 and a strong bounce of 26 to 1,671

- Dow 15,600 to 14,800 (strong support ASSUMED (we didn't hit it yet)) is 800 points (5.1%) and that makes the weak bounce +160 to 14,960 and a strong bounce +320 to 15,120

- Nasdaq is our most unreliable indicator as it's easily distorted by a single stock (AAPL) but 3,700 to 3,600 is 100 (2.7%) and a weak bounce of 20 takes us back to 3,620 and a strong bounce of 40 would be 3,640 before we're impressed.

- NYSE fell from 9,700 to 9,350 and that's 350 points (3.6%) and 70 points bounces us to 9,420 and another 70 is the strong bounce at 9,490 but that 9,500 line is our -5% line on the Big Chart – so that's what we'll be looking for as a bullish sign (as we discussed Monday, when they failed it). This is our most important line to cross!

- Russell has been our fastest mover to the downside, falling from 1,060 to 1,010 and that's 50 or 4.7% so right about our 5% Rule and that makes 1,020 weak and 1,030 strong but we won't be impressed until they take back 1,050, which is 5% over our Must Hold line at 1,000. If you're going to lead, then LEAD!

Funny how I barely had to change a word or number from Tuesday's predictions. When the 5% Rule rules, then you know you're watching Bots in action and the trading has very little to do with real changes in sentiment. However, it's a technical World out there and we have to respect our lines. Fundamentally, I don't think they can hold them – even with Fed help but we'll keep an open mind through the weekend.

Have a good one,

– Phil