Now, where were we?

Now, where were we?

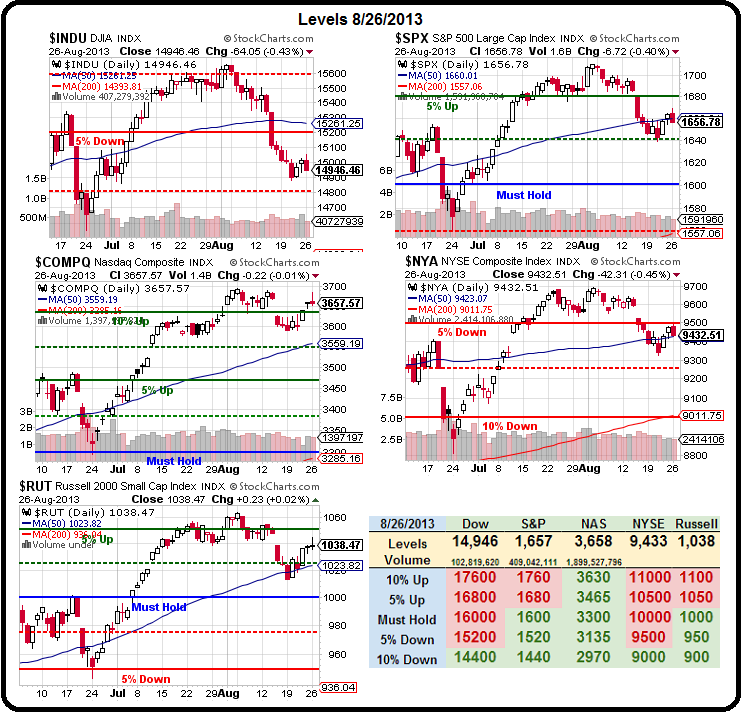

Oh yes, right back where we were last Wednesday, when I said we had to hold that 1,650 line to avoid BIG TROUBLE. We did manage to spike it into the close and finished at 1,651 and now we'll be back at 1,645ish this morning and looking to do it again.

We already failed to hold 15,000 on the Dow and 9,400 will fail this morning on the NYSE so those need to be taken back and we KNEW this would happen because we failed to take back our bounce levels (see last Wednesday's post) and that's why we watch them in the first place, isn't it?

Also the same as it ever was is oil spiking back over $108 (/CL), where we're looking to short it again in Member Chat either below the $108.50 line or below the $108 line if it crosses back with VERY tight stops as they are pumping the Hell out of this thing on war talk – even though Syria has very little to do with oil as it only exports 263,000 barrels of oil a day and does not have access to any critical ports of pipelines. Fear-mongering is good for short boosts, but they tend not to last.

Of course the real fear-mongering is coming from within as the GOP gears up for yet another debt-ceiling battle and, as much as they try to spin this market pullback as being about Syria (a country that is surrounded by our allies and bases), what's really spooking the markets is the very real fear of another massive collapse – like we had in August 2011, when the S&P fell almost 20% while the Republicans held the nation hostage.

Of course the real fear-mongering is coming from within as the GOP gears up for yet another debt-ceiling battle and, as much as they try to spin this market pullback as being about Syria (a country that is surrounded by our allies and bases), what's really spooking the markets is the very real fear of another massive collapse – like we had in August 2011, when the S&P fell almost 20% while the Republicans held the nation hostage.

Gold is a good bet (we're long miners) on both war talk and fiscal terrorism and, back in 2011, GLD flew from $150 to $180 (20%) during that crisis, This morning gold is already $1,417 and GLD is off the lows at $115 and is already up to $135 but I think we can get to $150 (about $1,500 on /YG) and I like the GLD October $140/145 bull call spread at $1.20 as a nice upside play on gold with a potential to make $3.80 (316%) in 52 days if gold rallies past $1,450. Let's get 20 of those for the Short-Term Portfolio and set a stop at 0.70 so we risk an even $1,000 to make up to $7,600.

Yesterday was a "watch and wait" day for us, as we weren't buying the low-volume rally (see yesterday's post) so we're also not going to get too excited about a low-volume sell-off, especially if the 5% lines hold up. Those levels are (5% from the recent non-spike highs: Dow 14,800 (should be on the button at the open), S&P 1,620, Nas 3,550 and Russell 1,010.

Russell was our index short yesterday (/TF on the Futures). I mentioned in the morning post that we wanted to short it below the 1,040 line and I reminded our Members as we passed the line (finally) in afternoon Member Chat and it looks like /TF is already at 1,024 – a gain of 16 points at $100 per point, per contract or $1,600 – aren't futures fun?

Russell was our index short yesterday (/TF on the Futures). I mentioned in the morning post that we wanted to short it below the 1,040 line and I reminded our Members as we passed the line (finally) in afternoon Member Chat and it looks like /TF is already at 1,024 – a gain of 16 points at $100 per point, per contract or $1,600 – aren't futures fun?

June Case-Shiller came out this morning and home prices were up 0.9% for the month, slowing the annual pace slightly to a still hyper-inflationary 12.1%. All this does is make homes unaffordable again until wages begin to catch up and, as I mentioned yesterday – we're still a long way from seeing that happen. Keep in mind this data is running a month behind – before rates shot up dramatically.

Also keep in mind (see chart) how far we've fallen from our highs. If we call that middle 120 at the start of the year, it will take 100% gains (6 years at 12% per year) to get back to our highs. Not that we SHOULD get back to our highs but there are millions of people who bought at those highs who wish we would and plenty of banks who are still carrying those "assets" on the books that still haven't written off the losses.