Wheeeeeee!

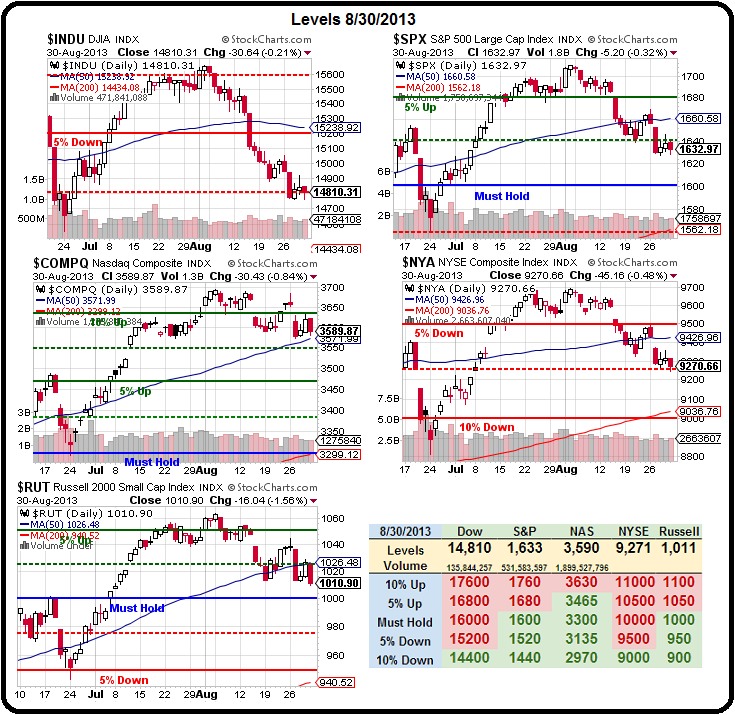

That about sums up our August as the indexes dropped all month long - down 800 points on the Dow (5%) and 80 points on the S&P (5%) and etc., etc... As long-term investors, we know we're going to get a little wet when the market turns down - the trick is to stay in the boat and be ready to ride the next profitable wave.

As I reminded readers on Friday, I never thought the summer would be worth playing in the first place - calling for our Members to cash out and taking a nice summer vacation way back in May. Many people took my advice and we've had a pretty quiet summer in chat but now it's time to go back to work - hopefully at the bottom of a bigger sell-off than the 5% we've had so far. The short story of the Summer is that we fell 5% into the end of June, gained 5% in July and fell 5% in August so here we are, back where we ended May.

That then, had barely any net effect on our long-term positions and, short-term, we were 97 right, 20 wrong and 3 even on our July Trade Ideas (see July Trade Review Part One and Part Two) but we've had little luck with the trade ideas we put in the Short-Term Portfolio, which is currently down a virtual $25,942 but, of course, our Long-Term Portfolio gained back $150,000 over the same time period - so, as a pair, they're actually doing exactly what they are supposed to do (offset each other).

That then, had barely any net effect on our long-term positions and, short-term, we were 97 right, 20 wrong and 3 even on our July Trade Ideas (see July Trade Review Part One and Part Two) but we've had little luck with the trade ideas we put in the Short-Term Portfolio, which is currently down a virtual $25,942 but, of course, our Long-Term Portfolio gained back $150,000 over the same time period - so, as a pair, they're actually doing exactly what they are supposed to do (offset each other).

We don't track our virtual portfolio trades in these reviews - this is for all the trades we don't track - which is most of them, of course. Of coruse, this is an arbitrary point in time and some trades could have had better (or worse) exits in between - we're not doing this to keep score, just to get an idea of what worked and what didn't in the past month so, hopefully, we can make better decisions this month.