Everything we were worried about is "fixed" and most of the Global markets are snapping higher this morning. That suits us just fine as we got much more aggressively bullish at our Strong Bounce lines on Tuesday (see "5 More Trade Ideas that Make 500% in an Up Market") and, even better, we nailed it again on oil, which is DOWN to $106.50 again this morning (/CL) for $2,000 PER CONTRACT gains!

As I said on Tuesday: "I can only tell you what is going to happen and how I think you can make money trading it – the rest is up to you!" On Thursday morning I said trading the Nikkei to fall on a rising Yen was the second easiest trade on the planet (it dropped 150 points that day), with the first being shorting oil (/CL Futures) at $108.50 that morning. If you are one of our Members (and if not, why not?) or if you read our posts regularly, you know WHY we were shorting oil last week, so I won't rehash it here.

$106.50 was our primary target for oil to drop, but we do expect to test $105 between now and Friday – perhaps much lower if we are lucky. We moved our USO puts to October, just in case oil took longer to fall than we thought but our very aggressive SCO (ultra-short oil) position stayed open over the weekend and would pay off VERY nicely at $105 or lower.

Europe is still a mess, Asia is a boarderline disaster and the bottom 80% of our country can barely bring themselves to get out of bed in the morning but – So What? – MORE FREE MONEY!!!! That's the deal from the Fed this week (or so the bullish traders believe) and we should be able to peg those highs again, at least until Wednesday's FOMC Statement (2pm) or Bernake's 2:30 press conference after the meeting.

Europe is still a mess, Asia is a boarderline disaster and the bottom 80% of our country can barely bring themselves to get out of bed in the morning but – So What? – MORE FREE MONEY!!!! That's the deal from the Fed this week (or so the bullish traders believe) and we should be able to peg those highs again, at least until Wednesday's FOMC Statement (2pm) or Bernake's 2:30 press conference after the meeting.

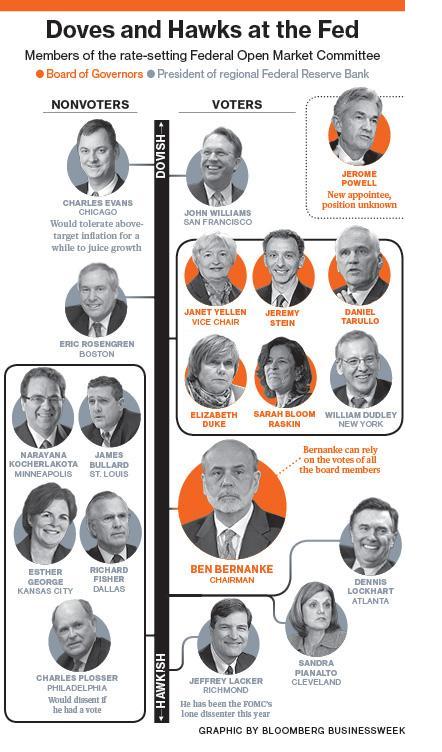

Friday is a regular Fed-A-Palooza, with George (hawk) speaking at 12:30, Tarullo (dove) at 12:40, Bullard (hawk) at 12:55 and Kocherlakota (hawk) at 1:45 to close out the quarter on a Quad Witching Options Expiration Day. I am declaring Friday an UN-Vacation. You CANNOT be away that day – it could get pretty crazy!

This is, in theory, Ben Bernanke's swan song as he is about to be replaced so we'll see what a man with nothing to lose (other than his legacy) has to say as he prepares to hand over the reigns to the next Bankster in Chief. Note that Yellen is even MORE doveish than Bernanke on this chart!

We have our five big bullish plays already in place from last week – perhaps now it's time for 5 Inflation Fighters as we prepare for the deluge of printing that may be the hallmark of a Yellen Fed. We already tagged ABX last week and they got even cheaper during the week (see StockWorldWeekly) but, with a net entry of $15 – we'll take cheaper!

Don't forget we only have 2 more weeks (until 9/30) to avert a shutdown of our Government (again!) and, although Obama says he would be happy to negotiate with the Republican terrorists, he is also standing firm on not scrapping Obamacare nor is he willing to let the GOP cut $40Bn from the Food Stamp program – especially considering that 20% of American Families don't have enough money for food – the highest level since 2011 and close to where we were in the Great Depression.

The same people that want us to rush in and kill Assad in Syria for allegedly killing children with chemical weapons think it's perfectly OK to starve MILLIONS of American children slowly to death – not through simple indifference – but through legislation they will force down the throats of their opponents to take away what little is already given those children to mitigate their suffeing.

Sick bastards!

But that's just my humble opinion…