That was disappointing!

That was disappointing!

Things started out very exciting as we opened the S&P at 1,704 and ran all the way to 1,705 for a second there, just after noon but then reality stepped in and ruined the mood. The Dollar had bottomed out at 81.13 but bounced back 0.5% to 81.55 and that, of course, took the S&P down 0.5% (because they have that kind of relationship) and we had a sad little close.

On Dave Fry's SPY chart, it's 170 but, on the Index itself, we're testing 1,690 in the Futures this morning, down from 1,703.75 at yesterday's highs – pretty much the same thing but our goal for the index is 1,709.67 – that's the August 2nd high and that's what needs to be cracked on this run or the next time we test our +5% line at 1,680, it may not hold.

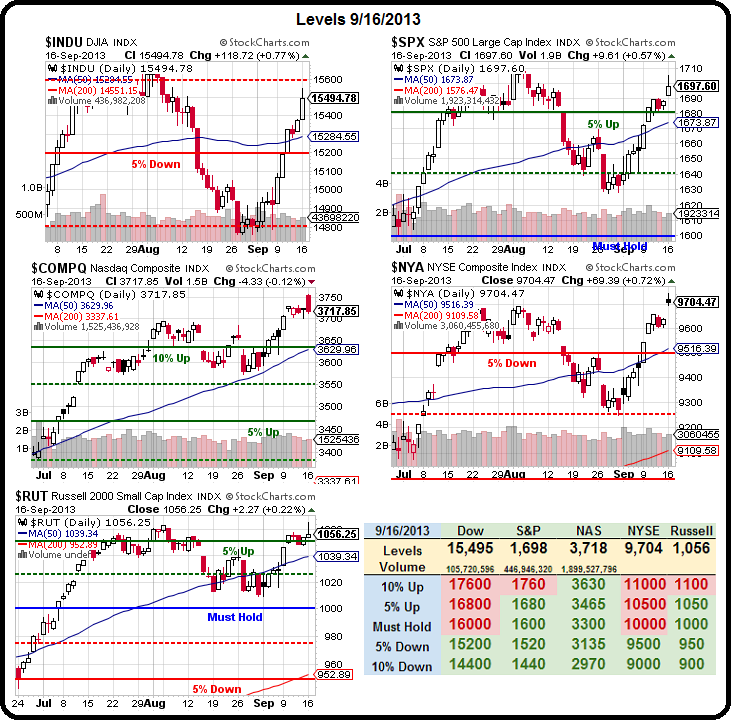

Speaking of lines, it's no surprise, looking at our Big Chart, that the Nasdaq pulled back hard yesterday, dropping about 40 points (1%) from it's silly open to the more realistic close at 3,718. As you can see from our spreadsheet (which is the real Big Chart, the rest is just illustration) the invisible string between the Nasdaq, the NYSE and the NYSE (both still below the Must Hold lines) was stretched more than 10% and either they had to go up or the Nasdaq had to come down.

Of course AAPL tends to warp the Nasdaq but AAPL is DOWN $50 since the August highs and that's 10% so it SHOULD have a 1.4% drag (now 14% of the Nasdaq) on the Nasdaq but the Nasdaq is HIGHER than it was in August, when it was just below 3,700. So, if AAPL is dragging the Nasdaq 1.4% lower but the Nasdaq is, in fact, 2% higher – then QCOM (7%), MSFT (5.5%), ORCL (4%) GOOG (4%), INTC (3%), RIMM (3%), CSCO (2.5%), AMZN (2.5%) as well as ATVI, EBAY, BIDU, COST, FSLR, NWSA, SBUX, PCLN, etc (1%ish) must be MORE than pulling their weight.

That means the SQQQ ETF (ultra-short Nasdaq) is a nice way to protect yourself from a broad-market pullback. SQQQ is $21.66 after bouncing off $21 in the morning on the opening spike. As we KNOW we can pop .70 per day and as there are 31 days between now and October's expiration, a fairly cheap way to hedge is the October $23/26 bull call spread at .45, which pays $3 (up 566%) if SQQQ moves up 10% (a 5% drop in the Nasdaq to 3,530).

So, if a 5% drop in the Nasdaq is likely to cost you $10,000 in your portfolio, investing $1,000 in a hedge like this with a stop at $500 has a potential of returning $6,667 on a dip – over 10x more than you are risking and enough to mitigate most of your anticipated drop. If you end up stopping out for a $500 loss, then that's simply the cost of your insurance and, if you are being the house, and not the gambler, the short options you sold should be making you much more than $500.

That's all it takes to construct a good hedge. It's not rocket sciece – we simply pick the index that has gotten the farthest ahead and bet it will come back in line with the rest and then find a nice short to play it with. Going up, we do the opposite. Back on 8/29, we were expecting the market to pop and the Dow was lagging the others, so I said to our Members:

If it were not the end of the month, into a long weekend, I'd be wanting to flip more bullish but it just does not seem safe. Still, the cover play for now would be DDM Sept $90/94 bull call spreads at $2.40 which pay $1.60 more (66%) if the Dow gets over 15,000 again (DDM now $92.73). Let's get 40 of those in the STP with a stop at $2 (below 14,850) so we risk $1,600 to make up to $6,400.

Yesterday, at 12:38, one of our Members asked if we should take that money and run on the spread at $3.85 and I said, of course – why risk it when you're already up 60% in just a couple of weeks? $3.85 x 40 contracts is $15,400 from a $9,600 investment for a $5,800 profit – that's the way we make a bull hedge – again, not complicated…

Yesterday, at 12:38, one of our Members asked if we should take that money and run on the spread at $3.85 and I said, of course – why risk it when you're already up 60% in just a couple of weeks? $3.85 x 40 contracts is $15,400 from a $9,600 investment for a $5,800 profit – that's the way we make a bull hedge – again, not complicated…

Our timing isn't complicated either – look how well-defined the DDM range is. Also on Dave's Dow chart, we can see the channel and sure, we might have squeezed .15 more out of the spread but it's time to look for DOWNSIDE protection as we never assume a channel will break – the percentages favor playing for the patterns to repeat themselves (taking fundamentals into account, of course).

Since we already pushed ourselves a bit more bullish as we took out the strong bounce lines last Tuesday, now it's time to look at a downside hedge like the Qs because BALANCE is the key to a portfolio that lasts. And, by the way, if you want to pay for a short hedge today with a long play tomorrow, may I suggest selling the AAPL 2016 $320 puts for $32 for a net $288 entry. What's not to love about owning AAPL at 36% off the current price?

Meanwhile, we're just wating on the Fed and ignoring the horrific 1.6% drop in Retail Store Sales and we'll ignore the 4.9% drop in European Car Sales and we'll just sit back and enjoy the drop in oil (now $105.86!) while we wait to see which 6 words the Fed changes on tomorrow's statement.

Yeah, that will make everything all better… sure it will…