What is holding up the Nasdaq?

What is holding up the Nasdaq?

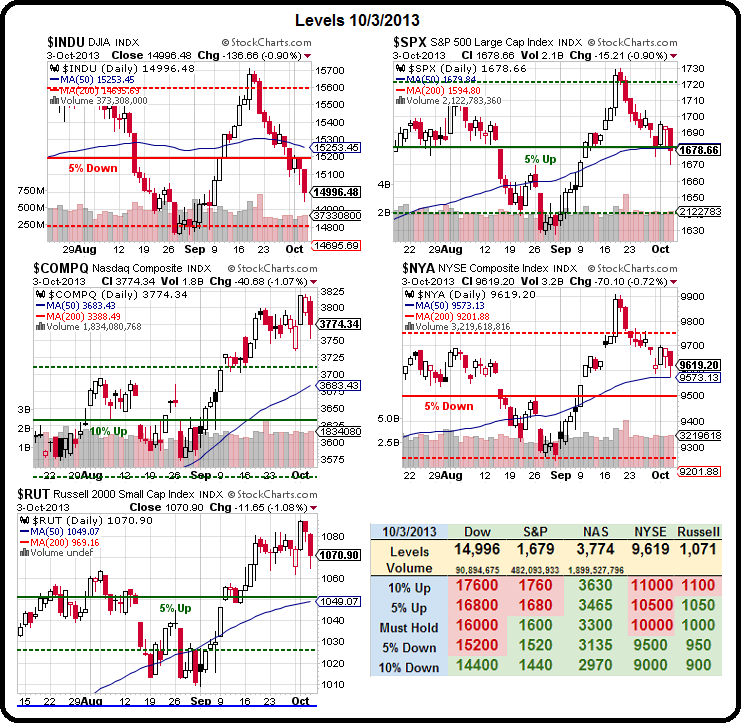

As you can see from the Big Chart, even the Russell is getting realistic and taking a little dip but the Nasdaq keeps chugging along near it's highs. Of course I told you Wednesday morning that the Nasdaq would be jacked up into the close and we didn't quite make a new high that day but boy did we give it right back yesterday (also as expected). Still, not too much damage so far – all things considered.

Those same weekly TZA $21.50 calls that I featured in the morning post came in below our .70 entry target (.64) and closed yesterday at $1.35 (up 92%) after topping out at $1.75 in the afternoon (up 142%). It's not shameful to go back to the well on these, folks!

Yesterday morning, in our Member Chat Room, we added disaster hedges for SPY, using Nov $163 puts at $2 and they gained a quick 10% on the day while the TZA Nov $22/25 bull call spread at $1 was still playable at the bell. Of course our best play of the day was, as it often is, shorting oil at $104 and catching the ride down to $103 for a $1,000 per contract gain. I posted this for FREE in the morning post and, as you can see from the chart, we had all morning to pick it up – including the spike we expected at the 10:30 natural gas report.

An enterprising person shorting all 300,767 contracts that I pointed out were open (and FAKE) in the morning could have pocketed a quick $300,767,000 in profits and been back to cash by 2:30. This is how we like to trade: Get in, make money, get out! In fact, Jon Najarian and I will be giving a Web Seminar ("webinar" to the in crowd) on Tuesday at 5 Central Time (that's 6pm in America) and, as it's our first joint seminar and we haven't practiced together yet – we're doing it for FREE if you SIGN UP HERE. What's our first topic – Why, we're going to teach you to BE THE HOUSE, of course:

Speaking of casinos, there are still some seats available for our LIVE, 2-Day Seminar in Las Vegas on November 10th and 11th that we'll be presenting along with Market Tamer – another one of our education partners. I believe Caesar's rooms are sold out but we still have fantastic rates at Ballys – use the booking code Bally's booking code SBPHI3 (800 358-8777) and mention our conference and Saturday rates are just $125 with $55 on Sunday (other nights available as well).

We have several trade ideas for our Members that are all well on their way to paying for the seminar, and even the entire trip to Vegas (First Class!) on our bigger trades, using CZR, which has been on a wild ride and will continue to be so at least until the 17th, when they plan a $1.8Bn stock sale of a spin-off Caesars Growth Partners, which will handle the on-line gaming and two casinos in exchange for $1.18Bn kicked back to the parent company (who still control the new Co., of course).

The big market-moving news of the day is Boehner pledging last night that he "won't allow a US debt default" and, for the moment, we can take him at his word. The NYTimes has a fantastic graphic (left and click) and article that sums things up so far and it's the hope that we can get some sort of resolution before the World comes to an end (according to Treasury) in 3 weeks.

The big market-moving news of the day is Boehner pledging last night that he "won't allow a US debt default" and, for the moment, we can take him at his word. The NYTimes has a fantastic graphic (left and click) and article that sums things up so far and it's the hope that we can get some sort of resolution before the World comes to an end (according to Treasury) in 3 weeks.

Is the Treasury Department alarmist or are Republicans psychotic? Let's just hope we don't have to find out the hard way…

Anyhow, given the morning dose of sunshine and lollipops, the almost total lack of economic data (great report on what we won't be seeing next week) and the inability of Richard Fisher to spook the markets this morning, we'll be looking for some bounce action in our indexes. Levels had to be adjusted as we hit new lows yesterday and now we have:

- Dow 15,700 to 14,950 is a 750-point drop (4.7%) so we expect a 20% strong bounce of 150 points to 15,100 and a 40% strong bounce to 15,250 if we are to be convinced we're turning back up. Yesterday's close was 14,994.

- S&P 1,730 to 1,670 is 60 points (3.4%) so 1,682 (weak) and 1,694 (strong). Closed at 1,678.

- Nasdaq 3,820 to 3,740 is 60 points (1.5%) so 3,752 (weak) and 3,764 (strong). Closed at 3,774.

- NYSE 9,900 to 9,500 is 400 points (4%) so 9,580 (weak) and 9,660 (strong). Closed at 9,619.

- Russell 1,088 to 1,063 is 25 so 1,068 (weak) and 1,073 (strong). Closed at 1,070.

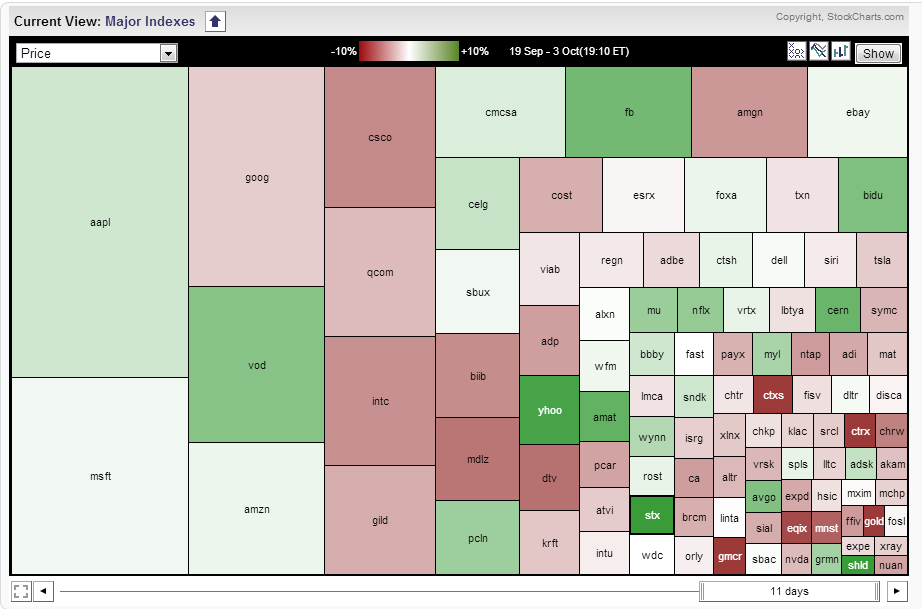

That's two in-between, two under and one over. Simple enough to follow, right? Of course we can't count the Dow too much as it's been messed with recently (GS, V and NKE replaced BAC, HP and AA on 9/23) so how can you possibly make any inferences from the way the chart has moved over the past month or 3 months or 3 years now? Well, that doesn't stop the TA "specialists" on TV – but at least we know better. StJeanLuc had a great way for us to look at the Nasdaq in Member Chat, which is also unduly influenced by a few key components:

Since the market topped out on the 20th (11 sessions) you can see that only 21 of the 100 Nasdaq Composite stocks traded up (green) while about half of the index was clearly in the red (lower). This is what we call propping up the Momenutm stocks so Fund managers can cover their tracks while they dump the rest of the index, especially the smaller issues on the broader Nasdaq. You can also see it in the broader NYSE, where declining volume swamped advancing yesterday in Dave Fry's Markets Diary (and has been for two weeks):

It's just another method of market manipulation to keep the sheeple buying while the "smart money" is running for the exits. As I pointed out yesterday, the also put a suit on Cramer and have him sit there like a carnival barker on the CNBC morning show telling their victims viewers to buy those f'ing dips. This is fine with us, as those are the suckers we, like Cramer's Bankster buddies, are selling premium to. Just try not to be one of them!

Have a great weekend,

– Phil