It's only a little pullback – so far.

It's only a little pullback – so far.

As you can see from Doug Short's S&P chart, we're having a modest pullback on increasing volume as things return to "normal" following the holidays. You can see why we elected to sit out the past two weeks – already the gains have reversed and we're right back to where we were just before Christmas, where we took the opportunity to get to CASH!!!

We've deployed that cash in a very profitable fashion with some great short-term plays, including last Thursday's short on oil. In yesterday's morning Alert to Members, which I also tweeted out at 7:30 am, my trade idea to short oil at $94.50 yeilded a nice $1,250 gain on the day as oil bottomed out at $93.20 with a stop out at $93.25. Those Alerts are usually sent out to our Voyeur and higher subscription levels. Though, for all of our Trade Alerts, you need a Premium Membership, of course.

Once the markets opened, my first idea for a Futures trade in Member Chat was shorting the Russell (/TF) at 1,160 and the Dow (/YM) at 16,450. The Russell fell to 1,142 for a $1,800 per contract gain and the Dow hit 16,340, up $550 per contract. When you can make quick moves like that off a cash position, what's the rush to get "back into" the market?

We haven't re-opened our USO short or SCO long positions as we're hoping for a run back to $95 on oil inventories (tomorrow, 10:30) where we can make a contrary play BUT, if oil hits $94.50 and fails again, we will take that short with tight stops. Meanwhile, the absense of short-term shorts leaves us long-term long with our Dec 2019 contract hedges – so let's hear it for the manipulators today!

Dave Fry's Transport chart shows us a little break-down in that sector, despite FDX's $2Bn share buy-back announcement. Dow theorists watch the Transports carefully, so we should too but part of this may be attributable to the storm conditions in the Northeast – so we're not going to read too much into it until/unless next week continues the trend below the bottom of the channel.

Dave Fry's Transport chart shows us a little break-down in that sector, despite FDX's $2Bn share buy-back announcement. Dow theorists watch the Transports carefully, so we should too but part of this may be attributable to the storm conditions in the Northeast – so we're not going to read too much into it until/unless next week continues the trend below the bottom of the channel.

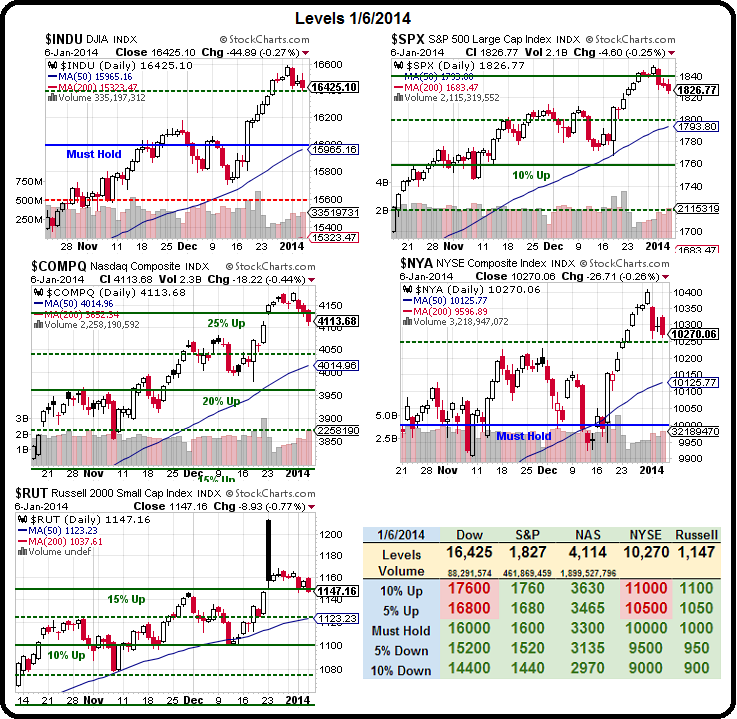

We worked our our expected pullback lines on the indexes yesterday in Member Chat but it will take another day or realistic volume before we can determine if we have a new trend or not, the pullbacks we are looking for, according to our 5% Rule™, are:

- Dow 16,300 and 16,100

- S&P 1,825 and 1,800

- Nas 4,125 and 4,075

- NYSE 10,275 and 10,150

- Russell 1,055 and 1,040

As you can see from our Big Chart, other than the Russell, the -1.25% lines generally held so far and it's not much of a pullback if we can't even get 1.25% out of it, is it? The NYSE finished just below, so we'll be watching them closely but Yellen's confirmation has gotten the Futures off to a good start as we're reminded that the FREE MONEY should keep flowing in 2014.

As you can see from our Big Chart, other than the Russell, the -1.25% lines generally held so far and it's not much of a pullback if we can't even get 1.25% out of it, is it? The NYSE finished just below, so we'll be watching them closely but Yellen's confirmation has gotten the Futures off to a good start as we're reminded that the FREE MONEY should keep flowing in 2014.

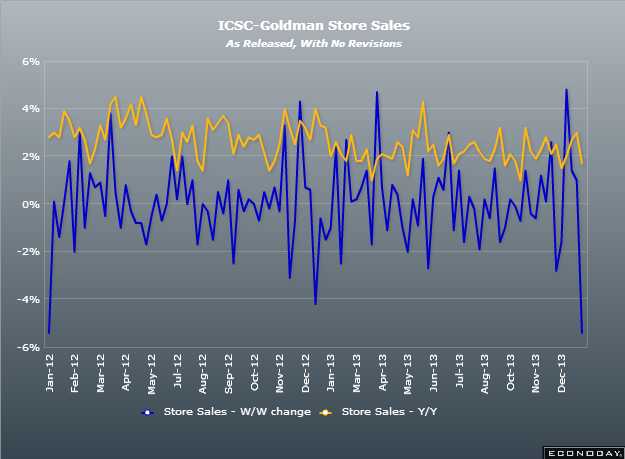

Amazingly, the Futures are still climbing (up 0.4%) despite the fact that ICSC Retail Store Sales were off a whopping 5.4% last week, despite "heavy promotions at most stores." The data for the week ending 1/4 was so bad, it chopped the annual data almost in half, from up 3% to up just 1.7%.

Will this finally cause our XRT short position to pay off or will this become just another data point that is ignored by investors and the media? Just to let you know how far down the rabbit hole investors have gone at this point, try keeping this posted next to your TV while the pundits tell you how great everything is:

That reminds me of another chart people have been ignoring but strangely confirms the Retail Sales numbers (or vice-versa) – it's Doug Short's comparison of the ECRI Leading Economic Indicators and our GDP, which pretty much everyone says is improving in 2014 – even though half of the improvements we saw in 2013 were nothing but unsold inventories piling up in warehouses:

That reminds me of another chart people have been ignoring but strangely confirms the Retail Sales numbers (or vice-versa) – it's Doug Short's comparison of the ECRI Leading Economic Indicators and our GDP, which pretty much everyone says is improving in 2014 – even though half of the improvements we saw in 2013 were nothing but unsold inventories piling up in warehouses:

There's a reason they are called "leading" economic indicators – they tend to lead and tell us which way we're going, not which way we've been. Take it all with a grain of salt because this trend has been in place for all of 2013 and the market popped 30% as bad news has been good news – so far. Earnings season starts on Thursday with AA reporting after the bell and we'll see if bad news is still good new in Q1 '14.

For now, we'll watch our lines and see what sticks.