Mergers are great market boosters.

Mergers are great market boosters.

They make investors think everything is undervalued in a sector when one company gets bought for high cash premiums and BEAM (Jim Beam) is one of those companies many of us know and love but not, apparently, as much as the Japanese who will be taking over this 110 year-old American Icon. BEAM did not rise 30% last year, making it "cheap" vs other S&P choices and, of couse, the only thing in the World more plentiful than Free Dollars is Free Yen – so why not gobble up some assets while the gobbling's good?

The company’s combined portfolio of brands will include Beam’s Jim Beam, Maker’s Mark and Knob Creek bourbons; Courvoisier cognac and Sauza tequila; plus Suntory’s Japanese whiskies Yamazaki, Hakushu, Hibiki and Kakubin; Bowmore Scotch whisky; and Midori liqueur and, if you went from "yeah, I know those" to "who?" while reading that list, then you can see why Suntory values Beam's distribution network and brand recognition as much as they do the product.

The company’s combined portfolio of brands will include Beam’s Jim Beam, Maker’s Mark and Knob Creek bourbons; Courvoisier cognac and Sauza tequila; plus Suntory’s Japanese whiskies Yamazaki, Hakushu, Hibiki and Kakubin; Bowmore Scotch whisky; and Midori liqueur and, if you went from "yeah, I know those" to "who?" while reading that list, then you can see why Suntory values Beam's distribution network and brand recognition as much as they do the product.

Suntory is a 1 TRILLION Yen Company and a steady, 4% dividend payer in Japan. A move like this is another bullish signal for the markets as this is the proverbial money coming off the sidelines, when foreign companies begin buying up US companies and Japan is a prime candidate as the Nikkei was up 45% last year – making the S&P look pretty cheap to them.

If you want to find other companies that look cheap, I would suggest the S&P's 20 Most Concentrated Hedge Fund Holdings, where BEAM was number 7. These are the companies most favored by hedge funds and it's not the usual suspects:

The Free Money is still out there, as long as you can service a 10-year loan at 3%, any of these companies can be yours and refinancing a decade from now is the next CEOs job – especially if you are a CEO already over 55 and looking to put your stamp on your company with a big move. STZ, for example, is a $15Bn company at $80 a share (expect it to move higher on this news) and a series of acquisitions has run them up 110% in the last 12 months. AN is another roll-up story and JCP may seem an odd choice there but, like SHLD, their 1,104 stores are probably worth more than their $2.2Bn market cap (I still prefer SHLD, which is 50% owned by a hedge fund!).

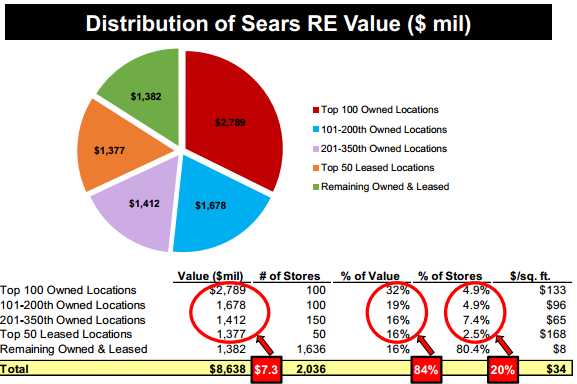

SHLD is making the cut for one of my top 3 picks of 2014, now that it dropped almost 50% since Thanksgiving. Valued at $3.9Bn at $36.71 per share, if we give a $2M valuation to the companies 4,000 stores, we have $8Bn right there along with $2.5Bn worth of brands, a home service business worth $2Bn, Land's End is a standalone at $1.4Bn, Sears Online is new and worth about $1Bn, Sears Canada and Sears Auto are good for another $1Bn and Inventory alone argues for a few Billion on the Retail side (see excellent Baker Street Report).

SHLD is making the cut for one of my top 3 picks of 2014, now that it dropped almost 50% since Thanksgiving. Valued at $3.9Bn at $36.71 per share, if we give a $2M valuation to the companies 4,000 stores, we have $8Bn right there along with $2.5Bn worth of brands, a home service business worth $2Bn, Land's End is a standalone at $1.4Bn, Sears Online is new and worth about $1Bn, Sears Canada and Sears Auto are good for another $1Bn and Inventory alone argues for a few Billion on the Retail side (see excellent Baker Street Report).

At $8Bn, I was hesitant to call Sears a buy but, at $3.9Bn, a Japanese department store could make them an offer next week. We're having a special Live Webinar today at 1pm, where we will discuss my top 3 Trade Ideas for 2014. With SHLD, our intent is going to be playing for a buyout at $6Bn or more ($48+ per share) and it has already been placed in our Income Portfolio (from PSW Member Chat) last Friday at $36.71 with 10 of the Jan 2015 $30/45 bull call spreads at net $6. Our intention is to add short puts (IF) they fall further but, if not, then we're already $6.71 in the money on our $6 spread with a potential gain of $9 more (150%) at $45.

Overall, we're still "Cashy and Cautious" as the Macros are NOT matching up to the markets' performance. Mean reversion can be a real bitch, so there's no harm in us keeping the bulk of our cash on the sidelines, while we wait to see if this discrepancy can hold up through earnings or not (we're betting not).

Overall, we're still "Cashy and Cautious" as the Macros are NOT matching up to the markets' performance. Mean reversion can be a real bitch, so there's no harm in us keeping the bulk of our cash on the sidelines, while we wait to see if this discrepancy can hold up through earnings or not (we're betting not).

Long-term, you can't fight the Fed(s) but we're not really sure how much longer the Fed, the BOJ, the ECB, the PBOC, etc. can keep playing this game. The Financial Times points out this weekend that peer to peer lending in China rose from $940M in 2012 to over $4Bn last year and is expected to hit $7.8Bn in 2015 and 6% of the P2P companies in China went bust last year, with many more in distress.

“The main reasons are the intense competition in the P2P industry, the liquidity squeeze at the end of the year and a loss of faith by investors,” said Xu Hongwei, chief executive of Online Lending House. He estimated that 80 or 90 per cent of the country’s P2P companies might go bust.

the WSJ reports that "China's government is gearing up for a spike in nonperforming loans, endorsing a range of options to clean up the banks and experimenting with ways for lenders to squeeze value from debts gone bad."

the WSJ reports that "China's government is gearing up for a spike in nonperforming loans, endorsing a range of options to clean up the banks and experimenting with ways for lenders to squeeze value from debts gone bad."

Write-offs have multiplied in recent months. Over-the-counter asset exchanges have sprung up as a way for banks to find buyers for collateral seized from defaulting borrowers and for bad loans they want to spin off. Provinces have started setting up their own "bad banks," state-owned institutions that can take over nonperforming loans that threaten banks' ability to continue lending.

China's banks reported 563.6 billion yuan ($93.15 billion) of nonperforming loans at the end of September. That is up 38% from 407.8 billion yuan, the low point in recent years, two years earlier

Fed-fueled inflation in India is likely to cost Prime Minister Singh his job as prices rose 11% in November and 9.87% in December, fueling voter anger in the World's largest Democracy. Despite the big boost from rising prices, GDP in India expanded just 5% last year, the slowest rate since 2003, and will probably grow at that pace in the fiscal year ending March 31, according to central bank estimates.

Fed-fueled inflation in India is likely to cost Prime Minister Singh his job as prices rose 11% in November and 9.87% in December, fueling voter anger in the World's largest Democracy. Despite the big boost from rising prices, GDP in India expanded just 5% last year, the slowest rate since 2003, and will probably grow at that pace in the fiscal year ending March 31, according to central bank estimates.

Our own GDP was boosted in July by a clever recalculation of the value of existing intellectual property, mostly TV and Film assets that added $560Bn to our GDP last year (3.6%). $560Bn is the GDP of Switzerland, ranked 20th in the World. Seinfeld alone added Billions to our GDP under the new rules and much of this fancy new math was predicated on companies like NFLX paying Billions of recurring Dollars for old TV shows. So, as long as NFLX itself, with their p/e of 277, isn't in a bubble – what can go wrong?

Have I mentioned we're Cashy and Cautious?