Ignition and BLAST OFF!

Ignition and BLAST OFF!

Sure it's low volume (see Dave Fry's SPY chart), but who cares? TSLA jumps 16% in a day, gaining $3Bn in market cap in 5 hours and they tack on another $1Bn overnight – just for good measure. Yes they delivered 20% more cars than expected but that was for one quarter, not the whole year and Musk himself says the long-awaited cheaper Tesla is "about 3 years away" the same 3 years away it was 3 years ago!

I'm not going to use the word "scam" because we shorted TSLA yesterday (Feb $140 puts for $5) and that wouldn't be fair. I also won't say "pump and dump" or anything else derisive other than paying $20Bn for a company that has no earnings and projects, at best, $200M next year (for a p/e of 100) in a sector where the average p/e is in the teens – may be a little overpriced.

We've played this game before with TSLA and we know not to stand in the way of a runaway train. We'll stop out of our Feb puts with a small loss if we have to and then re-short for April and again for July if they keep going higher because that strategy, of followed last year, eventually hit the jackpot as they dove from $195 all the way back to $120 between Oct 1st and Thanksgiving.

Just like a Futures trade (and see Tuesday's Webcast for a good example), the key to success is having tight stops when you are wrong so you have another chance to reload at the next stop. We expect some resistance at $165 and a pullback to $150 but, if not, then we'll see how $180 goes ($24Bn!). While TSLA was crowing about ramping up production to 600 cars a week, TM, who produce 600 cars AN HOUR announced their HYDROGEN fuel cell Prius should be ready next year.

TM has already sold 6M hybrid Prisus', a number TSLA is on pace to hit about 100 years from now! Yet TSLA is already at 1/6th of TM's market cap, despite the fact that TM has $250Bn in sales and $10Bn in profits (p/e 11 at $119) vs. TSLA's $2Bn in sales and no profit at all. Poor F is only worth $65Bn (3x TSLA) with $140Bn in sales and $6Bn in profits (also a p/e of 11 at $16.40). I can certainly argue the F may be a better buy than TM but I don't know what the f*ck TSLA is except my short of the year!

TM has already sold 6M hybrid Prisus', a number TSLA is on pace to hit about 100 years from now! Yet TSLA is already at 1/6th of TM's market cap, despite the fact that TM has $250Bn in sales and $10Bn in profits (p/e 11 at $119) vs. TSLA's $2Bn in sales and no profit at all. Poor F is only worth $65Bn (3x TSLA) with $140Bn in sales and $6Bn in profits (also a p/e of 11 at $16.40). I can certainly argue the F may be a better buy than TM but I don't know what the f*ck TSLA is except my short of the year!

Meanwhile, it's easy enough to cover a short position on TLSA, because they don't believe their own BS. That's why the 2016 $140/200 bull call spread is just $20, with a $60 upside (200% gain). If you REALLY like TSLA long-term, you can sell the 2016 $100 puts for $17 to drop the net to $3 and, at $165, the spread is starting out 833% in the money with a potential upside, at $200, of $57 – a 1,900% return on cash. So, if you want to buy a TSLA Model S for $90,000, you can buy 15 contracts for net $4,500 and, if all goes well and TSLA goes over $200, you get back $90,000.

That may sound crazy but one of our Members, Yodi, made a similar trade last year and won himself a free Model S. In fact, that was one of my three best trade ideas for 2013!

That may sound crazy but one of our Members, Yodi, made a similar trade last year and won himself a free Model S. In fact, that was one of my three best trade ideas for 2013!

That was when TSLA was trading at $43, of course, at $165, I prefer them as a short but so far, so wrong so we may as well hedge that bet. According to ThinkorSwim, the net margin on 15 short $100 puts is just $15,862 but, of course, if TSLA falls, you are obligated to buy 1,500 shares for $100 ($150,000) – so not a game to be taken lightly. Since I'm not liking them long, I'd rather sell AAPL 2016 $450 puts for $44, which is our new stock of the year (see Webcast for details) and we'd only have to sell 7 of those to pay for the whole thing with an $800 credit!

I'd be a lot happier being "forced" to buy 700 shares of AAPL at $450 ($315,000) than 1,500 shares of TSLA at $100 because, if TSLA is at $100, then something is very, very wrong in bubble-land! Maybe half of each is a nice way to hedge our bets on that side!

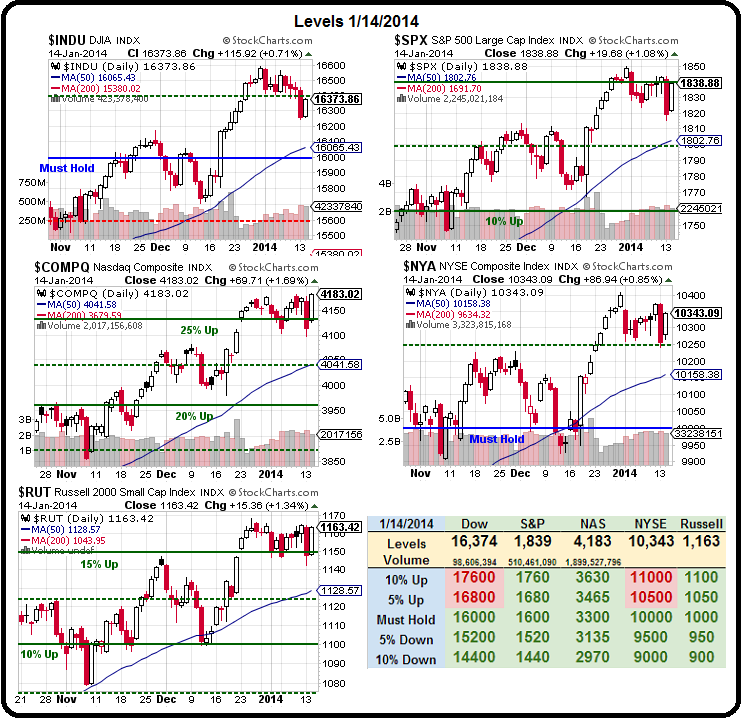

Speaking of reality – we're still waiting for the S&P to confirm the bull is back by popping over 1,850 again and the Dow is pathetic under 16,400 (our 2.5% line). They NYSE is over the 2.5% line at 10,250 so, IF the rally is real, the Dow should have no trouble making that leap today. If not, we'll, these Spitting Cobra chart patterns can be very tricky – you neve know when they are going to strike!

Speaking of reality – we're still waiting for the S&P to confirm the bull is back by popping over 1,850 again and the Dow is pathetic under 16,400 (our 2.5% line). They NYSE is over the 2.5% line at 10,250 so, IF the rally is real, the Dow should have no trouble making that leap today. If not, we'll, these Spitting Cobra chart patterns can be very tricky – you neve know when they are going to strike!

AAPL will continue to drive the Nasdaq today, as will TSLA ($170+ now pre-market, adding over $1Bn with each $10 move, despite the fact there is virtually no volume) so the Nas should lead us out of the gate and we're already over the December highs there so it's up to the Russell to show us the money at 1,170 – but we're still happy to short them (/TF) on a cross back below 1,160. In an interview with Bloomberg TV, Mark Faber said we are in a "gigantic financial asset bubble" that he thinks could burst at any moment.

"I think we are in a gigantic financial asset bubble. But it is interesting that that despite of all the money printing, bond yields didn't go down. They bottomed out on July 25, 2012 at 1.43% on the 10-years. We went to over 3.0%. We're now at 2.85% or something thereabout. But we're up substantially. Now, this hasn't had an impact on stocks yet. In fact, it pushed money into the stock market out of the bond market. But if the 10-years goes to say 3.5% to 4.0%, then the 30-year goes to close to 5.0%, the mortgage rates go to 6.0%. That will hit the economy very hard."

"[The bubble] could burst before. It could burst any day. I think we are very stretched. Sentiment figures are very, very bullish. Everybody's bullish. The reality is they're very bullish because they think the economy will accelerate on the upside. But my view is very different. The global economy is slowing down, because the global economy's largely emerging economies nowadays, and there's no growth in exports in emerging economies, there's no growth, in the local economies. So, I feel that the valuations are high, the corporate profits have been boosted largely because of the falling interest rates."

"We have to distinguish between the financial economy, the financial sector, and the economy of the well-to-do people that benefit from rising asset prices, from rising prices of wines, and paintings and art, and bonds, and equities, and high-end properties in the Hamptons and West 15 here in New York and so forth — and the average person, the typical household, the so-called 'median household', or the working class people. And the Fed's policies have actually led to a lot of problems around the world in the sense that they're not only responsible, but partly responsible that energy prices are where they are, they're up from $10 or $12 in 1999 to now around $100 a barrel. Food prices are up and a lot of other prices are up. So on your income, energy prices have very little impact because you at Bloomberg – you, young man – you make so much money. But for the poor people, it has an impact. Some people in the lower income groups, they spend say 30% of their income on energy, transportation, and so forth, electricity and gasoline."

He said it – not me (I'm just tired of saying it). So I take back what I said last week – there seem to be 2 bears left… Not many people are willing to connect those dots, for fear of looking foolish because, although the Emperor clearly has no clothes, only a fool cannot "see" the fine garments, right? LULU wasn't selling any clothes in Q4, neither were SHLD, EXPR, LB, SSI or M – and those are only the ones who reported so far!

He said it – not me (I'm just tired of saying it). So I take back what I said last week – there seem to be 2 bears left… Not many people are willing to connect those dots, for fear of looking foolish because, although the Emperor clearly has no clothes, only a fool cannot "see" the fine garments, right? LULU wasn't selling any clothes in Q4, neither were SHLD, EXPR, LB, SSI or M – and those are only the ones who reported so far!

And why not? Because people (the ones not in the top 10%) have no money. Usually, for an economy to function, you need the population to prosper. The Fed has broken that cycle by giving money directly to rich people and Corporations but, as Faber notes – how long can it be sustained.

Going by TSLA's BS move – quite a while longer – so we'd better be prepared to BUYBUYBUY, no matter how ridiculous it seems. For the moment though, below S&P 1,850 – we're still Cashy and Cautious.