Up and down the market goes, where she stops – no one knows!

Up and down the market goes, where she stops – no one knows!

As you can see from Dave Fry's SPY chart, we had a wild ride yesterday with volume on the sell side and then the bots taking us back up to finsh the day back where we started. We were fortunate enough to be skeptical in the morning (see yesterday's post) and our Futures shorts (see early morning Tweet) were all massive winners.

We even had fun teaching Futures Trading Techniques in yesterday's Webcast but, as you can see from the chart, our 1-2:15 time-frame was nowhere near as exciting as the morning session had been!

It's a wild market ride in a generally newsless week and earnings are sending us flying every which way. As Dave notes in his morning post:

"There is a battle of pundits taking place as bulls and bears duke it out for headline honors of accuracy. Goldman Sach’s David Kostin maintains his bearish outlook for stocks saying: “The S&P 500 is overvalued by by almost any measure.”

Meanwhile Bank of America M/L’s Macneil Curry tells stock investors to “watch out” as seasonal turn much less construction once February rolls around. Like many others he judges complacency to be near the traditional levels that lead to corrections. In between was

Bloomberg’s Richard Yamarone warns, “It looks like this year’s economic horse will pull-up lame”, adding, “The Bloomberg Orange Book Sentiment Index has been running below 50 for 49 consecutive weeks which implies a stagnant growth rate in GDP in the 2-to-2.5% range.” This, he ventures, implies a lack of desirable growth in real disposable personal incomes."

Nonetheless, we added two new Inflation Fighting Trade Ideas to our list yesterday and that gives us 3 so far and we're still looking for two more candidates. We called a bottom on LULU at $46 on yesterday's dip with a trade idea that has a potential 7,400% upside if they get back to $60 and we added 5 of them to our Income Portfolio for just $200 with a potentail $15,000 payback in just two years.

If you were not in our early morning Member Chat, you missed our call on XCO, which took off like a rocket on no particular news (other than our call, of course). Our pre-market trade idea, which was:

XCO – Back in mid-Dec we liked the stock at $4.92, selling 2015 $5 puts and calls for $3.10 for a net $2.80/3.90 entry. That trade has almost 100% upside if the stock simply holds $5. Those options have dropped a bit now but you can establish a similar trade selling 2016 $5 puts for $1.60 and $5 calls for $1.25 with the stock at $4.88 for a net $2.03/3.52 entry.

If successful, this trade gets called away for $5 for a 146% gain on cash in 2 years and all XCO has to do is hold $5 – not a bad bet! Even if you chase it, it's not so bad but already the spread closed at $2.41 yesterday after giving us easy fills on the morning dip – up 15.8% in a single day – not a bad way to trade! This is the kind of stuff we're teaching in our weekly Webcasts and, of course, in PSW's Member Chat every single day.

Fundamentally, we're still skeptical but the Dollar diving back to 81.10 this morning has kept us from making any bearish bets in the Futures though we're chomping at the bit to short oil, now $95.72 and hopefully we'll get a re-test of $96.50 into tomorrow's inventory reports, which would give us a good reason to go short on USO, long on SCO again.

Fundamentally, we're still skeptical but the Dollar diving back to 81.10 this morning has kept us from making any bearish bets in the Futures though we're chomping at the bit to short oil, now $95.72 and hopefully we'll get a re-test of $96.50 into tomorrow's inventory reports, which would give us a good reason to go short on USO, long on SCO again.

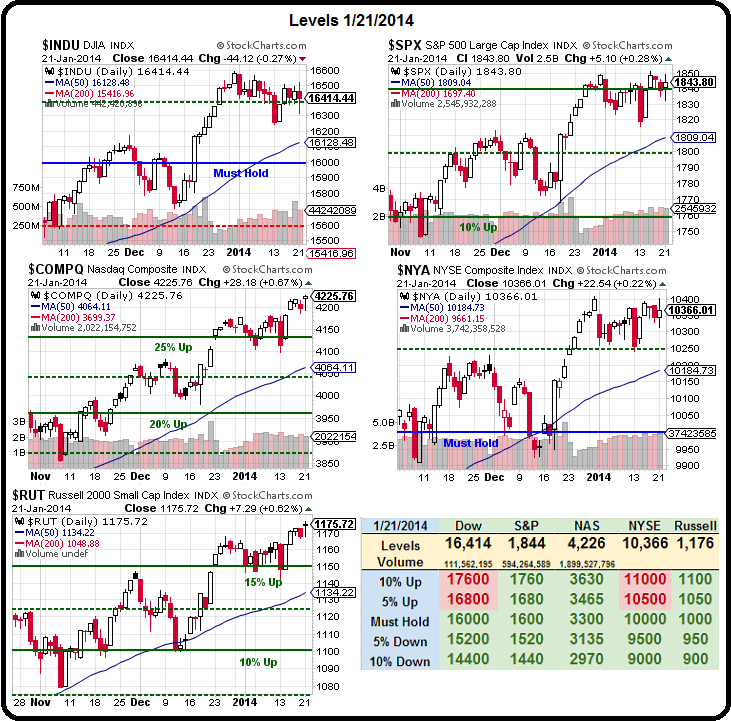

We'll see if the Dollar can find a floor back at 81.10 or, in the very least, 81. The Euro is strong at $1.357 and the Pound even stronger at $1.657 with the Yen at 104.41. A bounce in the Dollar would make Japan happy, but not our own markets but I'm not seeing any major catalyst this week likely to make that happen so the rally seems safe for the moment and we can simply turn our attention back to the same breakout levels we have been watching all year, which are:

- Dow 16,500 (1% higher)

- S&P 1,850 (0.5% higher)

- Nasdaq 4,175 (1% over)

- NYSE 10,400 (0.3% higher)

- Russell 1,070 (on the button)

3 of 5 of those indexes over the line and we'll have to add more bullish plays. Not that we haven't been adding them anyway, we'll just have to be more enthusiastic about it.

Speaking of bullish plays, our LQMT ship came in. That was one of our very rare penny stock picks and we have been in since June 3rd, where we bought 10,000 shares for .11 ($1,100) and then doubled down at .08. Yesterday they popped .28 and of course we're taking profits but we do still like them for the long haul as they are one AAPL announcement away from $1 though also one lack of AAPL announcement away from .20 again so, as a new entry, I'd wait until after earnings.

If the S&P has trouble at 1,840, that's going to be a bearish sign and we expect the Dollar to pop so Oil Futures will be a short below $95.75 (/CL) or off a rejection at $96, whichever comes first. The Russell (/TF) may retest 1,175 again and a failure there is "game on" for the shorts as well (see yesterday's webcast). That trade was a $1,000 per contract winner yesterday morning and worked out better than our Dow (/YM) shorts at 16,350 but those were good for $500 and far less stressful to play.

Be careful out there!