Wheeeeee – down we go!

Wheeeeee – down we go!

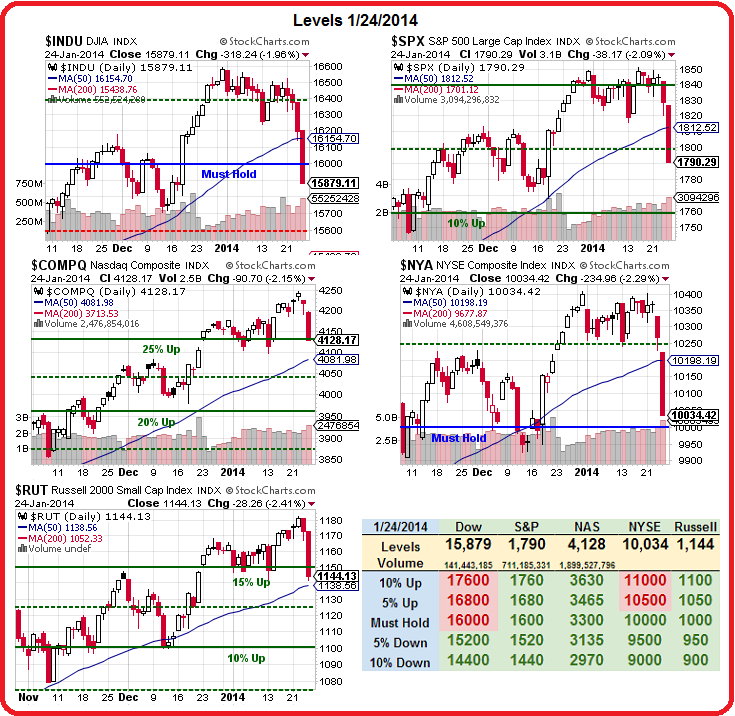

Who could have ever seen this coming (other than us, of course)? The markets have given up, in a single week, all that they've gained since Thanksgiving, when I said (on 11/21): "Stop the Rally, We Want to Get Off!"

If you want a good insight into what I was thinking at the time, you can re-visit that Wednesday's Webcast, which was my first one with the Darwin Investing Network where we decied to initiate a "Cashy and Cautious" position in our newly formed long and short-term portfolios (see this Thursday's Virtual Portfolio Review for updates). In the post I summed up my position by saying:

Enough already!

Look at this chart – there's only 15% of us (bears) left yet still the MSM attacks us – why??? Why indeed? What are they afraid of? Why do Central Banksters Bernanke, Draghi and Kuroda all feel the need to say "What bubble?" in the same week? As a parent, I know when my kids deny something too much – it's a lot more likely that they KNOW they did a bad, bad thing…

Anyway, I am not a bear, I am just a Fundamental Investor who doesn't see anything worth buying BECAUSE IT'S TOO FRIGGIN' EXPENSIVE! Is that bearish? Once upon a time it used to be called rational. And it's not like there's NOTHING to buy, just yesterday, in our fabulous Webinar, we found bullish plays we liked for ABX, FTR and DBA. So, gold, communications and food, interestingly enough, are out of favor enough to be relative bargains in this runaway market. Why? Because they have real earnings that are hard to extrapolate to infinity.

Infinity an beyond is where this market is projected to go as the Yellen Fed promises to be even more doevish than the Bernanke Fed and theSTAWealth chart on the right predits S&P 2,200 in 2015, at a cost of "only" $2Tn more Dollars on the Fed's balance sheet.

Thank goodness we never have to pay that back and… what? Oh, we do? Oh shit!

Well, at least we have a robust US economy that's creating Millions of jobs that will drive our GDP higher faster than the Fed and the Government drive our debt to infinity and beyond and…. what? We don't? Son of a bitch!

Oh shit is exactly what happened this week as some of those Fundamental chickens finally came home to roost. There's much more to that post but, to sum it up, it's where I laid out my case for taking all our bullish bets off the table, sitting out the holidays and coming back in January when the market crashes on earnings. So far, I'd say that plan is going swimmingly!

3 days later, on Monday the 25th, I wrote "Monday Money Maker – 5 MORE Trades that Can Make 500% in a Rising Market" and, as our members are well aware, they made a friggin' fortune! Are we sending mixed signals? Not really. If we have, for example, a $500,000 portfolio and we go to cash, then we're betting cash will be more valuable than stocks.

So it makes sense to HEDGE our cash position with some aggressive upside trade ideas – just in case we were wrong and cash turned out to be worth less (worthless?) than stocks.

Also, there are always opportunities in either direction in the markets and sometimes things are just cheap. Around that time I was pounding the table on ABX ($15.50ish) as gold was beaten down and mining stocks were a huge bargain. My other gold picks were HMY ($2.50ish) and NAK ($1.20ish) as I like them for long-term inflation hedges as well as simple value plays. All 3 stocks are doing quite well already and, of course, our leveraged option plays are performing fantastically.

So, clarification #1 – when you have a lot of stocks, you hedge for a stock crash, when you have a lot of cash, you hedge for a stock rally. Simple enough? I'm not going to go over December as we were mainly in cash and just having fun but I do encourage you to at least go back and check out the headlines and lead paragraphs for the month as it's a good way to review our thinking.

There's an expression called "studying the markets" and if you think you can skip that step and trade successfully, you need to rethink that concept fast! Sure, you can pay a guy like me to do a lot of the thinking for you but you STILL need to put in some effort. For good or bad, you need to have a trading premise before you begin trading. Drifting in and out of random positions with no particular plan is nothing more than a recipe for disaster…

There's an expression called "studying the markets" and if you think you can skip that step and trade successfully, you need to rethink that concept fast! Sure, you can pay a guy like me to do a lot of the thinking for you but you STILL need to put in some effort. For good or bad, you need to have a trading premise before you begin trading. Drifting in and out of random positions with no particular plan is nothing more than a recipe for disaster…

You also have to be flexible. On Dec 7th, for example, the sell-off we expected after Thanksgiving failed to materialize so I wrote "Stock Markets are Exploding Higher – Here's How to Participate 'Safely'" and we added the following right in the morning post:

- ABX 2015 $15/25 bull call spreads at $2.30, selling 2016 $13 puts for $2.25 for net 0.05, now $2.80 – up 5,500%

- 10 SSO March $92/97 bull call spreads for $3.20 ($3.200), selling 5 ISRG April $300 puts for $5.50 ($2,500) for net $700, now net $3,300 – up 371%

That ABX trade is, by the way, merely "on track" up 5,500% as our goal for the trade is a 39,900% return on our nickel cash. The worst case scenario on that trade was owning ABX for net $13.05 so, if you were willing to commit to 10 contracts for $50, the upside would already be $2,750 out of a potential $14,950 gain. This is why we don't mind having our cash on the sidelines – there are so many fun things we can do with it!

And what doe we mean by "safely" – in both cases, the downside was simply owning a stock we WANTED to own for a price that was significantly (more than 20%) below current. When we are PATIENT, opportunities like this present themselves on a regular basis but "regular" means, months, not days! Still, on the whole, aren't you better off making just a few trades that make 371% and 5,500% each quarter than making a lot of trades and hoping to end up better than even?

10 Days later, on 12/17, I wrote "Back to Bull Already", a special Members Only post as it was full of addtional trade ideas, all of which performed magnificently over the next month. By Thursday (19th) it was "Santa's Back in Town, Thanks to the Fed" but by Friday I was warning our Members that "carrot noses and pointy hats do not a witch make" – which is probably one you'll have to read in context, but the gist of it was not to trust the rally – even though we were playing it bullish. I even put up this handy chart, showing how we should stop out of our positions.

10 Days later, on 12/17, I wrote "Back to Bull Already", a special Members Only post as it was full of addtional trade ideas, all of which performed magnificently over the next month. By Thursday (19th) it was "Santa's Back in Town, Thanks to the Fed" but by Friday I was warning our Members that "carrot noses and pointy hats do not a witch make" – which is probably one you'll have to read in context, but the gist of it was not to trust the rally – even though we were playing it bullish. I even put up this handy chart, showing how we should stop out of our positions.

All during this time, we were running our PSW 2013 Holiday Shopping Survey and you can see from the comments on that post why we remained skeptical of the rally and in fact, it formed the premise for us making XRT a big short position in our Short-Term Porfolio. As you can see, we were very wrong at the beginning but then we became very, very right. As I said earlier, having conviction is very important in trading (and so is scaling in!).

That then, takes us all the way to Monday, December 23rd and we'll begin Part 2 of our January Trade Review there, as it's time for more day by day details than the ones we breezed past in December (but again, I urge you to take the time, once in a while, to review old posts in order to keep our trading in context).