Courtesy of Sabrient Systems and Gradient Analytics

There is no sugar-coating what happened to stocks on Friday. All around the world, stocks really took it on the chin as the usual support mechanisms that bulls have enjoyed failed to materialize. The S&P 500 sliced through firm support at 1800 on high volume like it wasn’t even there. But market participants had become convinced that a long-overdue correction was imminent, so they quite simply were looking for a reason to sell. It can become a self-fulfilling prophecy.

There is no sugar-coating what happened to stocks on Friday. All around the world, stocks really took it on the chin as the usual support mechanisms that bulls have enjoyed failed to materialize. The S&P 500 sliced through firm support at 1800 on high volume like it wasn’t even there. But market participants had become convinced that a long-overdue correction was imminent, so they quite simply were looking for a reason to sell. It can become a self-fulfilling prophecy.

As I mentioned last week, call option open interest on the CBOE Market Volatility Index (VIX) had become quite elevated, and today there is still a lot of February out-of-the-money open interest. Tightening credit conditions in China and the threat of slower growth there seems to have provided the catalyst for market weakness, in concert with expectations of accelerated U.S. Federal Reserve tapering and Japan’s reluctance to increase its stimulus.

The impact on emerging markets has been big, with their stock prices and currencies plummeting and many of those governments struggling to prevent a free-fall in their currencies. The iShares MSCI Emerging Markets (EEM) is down over -8%. Among the ten U.S. business sectors, only Healthcare is still positive for 2014 (by about +1%), while Utilities is flat.

Nevertheless, I expect the pullback in U.S. equities to find some footing soon, since many powerful folks (including the Federal Reserve) are vigilant to do what it takes to keep the fragile U.S. economic recovery on track.

Of course, corporate earnings reports and forward guidance, particularly top-line forecasts, are critically important. Last week, there was some disappointment in this regard from bellwethers like Johnson & Johnson (JNJ) and IBM (IBM). More big-name earnings announcements are due out this week from the likes of Amazon (AMZN), Apple (AAPL), Ford (F), Yahoo! (YHOO), Facebook (FB), QUALCOMM (QCOM), Boeing (BA), Exxon Mobil (XOM), Eli Lilly (LLY), Visa (V), and Google (GOOG). Other big events this week include President Obama’s annual State of the Union address and the FOMC’s policy announcement–the last with Ben Bernanke as chairman.

ConvergEx opined that for the last six years asset correlations have been unusually high, which has made portfolio diversification difficult. But the firm sees correlations subsiding, which is healthier for investors in that they can more comfortably move their cash into diversified assets…and stock-picking should come back en vogue.

In fact, many leading market observers subscribe to the “Great Rotation” theme, i.e., a massive asset shift from bonds and cash into equities that could fuel an extended bull run in equities. Michael Hartnett, chief investment strategist for Bank of America Merrill Lynch, believes investors should be?long?real estate, U.S. and Japanese stocks, and high yield bonds rather than Treasuries, commodities, and emerging markets. His views are based on the results of BAML’s latest fund manager survey that indicated more capital being allocated to equities and a reduction in net bond exposure for a fifth straight month. While there was indeed an historic flow of funds into equity funds in 2013, we really have not yet seen an overwhelming outflow from bond funds, which is supported by the trend in yields.

Notably, the average yield on “junk” bonds (lower quality, higher yielding) recently dropped below 6% for the first time ever, which might portend an imminent reversal (bond selloff). However, according to BAML, while junk bond yields are at all-time lows, the high yield credit spread is still well above its all-time low. So, at its current level around 5%, the high yield credit spread would have to drop another 2.5% before hitting a new all-time low. Moreover, the corporate bond default rate is at an all-time low, as well, around 1.1% (vs. 3.9% historical average), so risk is low, which justifies the lower yields.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Friday at 178.89, which is down a little over 3% since setting another new all-time high just six trading days ago. Everyone seems to be speculating whether this is the “big one,” i.e., the long overdue market correction that, after more than 400 trading days since the last 10% correction, might finally allow the market to work off the accumulated excesses of bullish exuberance. No doubt, oscillators like RSI and MACD have been spending way too much time above the neutral line, and healthy technical behavior dictates more complete cycles from overbought to oversold and back again. Typically, when the Bollinger Bands pinch together as tight as they were last week, it portends a significant move one way or the other, as we saw in August (breakdown) and December (breakout). This time it was to the downside. Last Tuesday-Wednesday, 185 continued to pose formidable resistance as the technical consolidation continued, but Thursday’s action showed that the 50-day simple moving average was prepared to provide solid support. But then Friday was a whole different story, as bulls decided to wait out the turbulence by heading back to the corral, with the 50-day SMA and 180 providing no support at all. Yes, the smell of fear is in the air.

Nevertheless, SPY remains inside its long-term bullish rising channel, which has been in place since November 2012. The oscillators have cycled down sufficiently, although they could fall deeper into oversold territory, of course. Next support should be close by at the 178 level, followed by the 100-day SMA around 177, and then the convergence of the bottom of the rising channel with prior support at 175. Below that is the critical 200-day SMA around 170 (but still rising). We’ll see if the bearish breakdown confirms over the next couple of days–and perhaps leads to a much larger correction–or if this extreme weakness is taken as a welcome buying opportunity.

On Friday, the CBOE Market Volatility Index (VIX), a.k.a. “fear gauge,” rose 32% to close at 18.14, which is its highest level since October and 50% higher than it closed the previous Friday. Despite the huge pop, VIX is below the important 20 threshold and still low on an historical basis. Nevertheless, investors clearly are displaying an elevated level of fear.

Latest rankings:

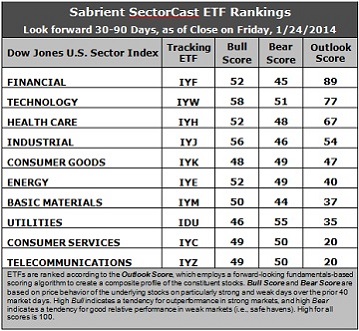

Relative rankings are based on Sabrient’s proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The “Outlook Score” employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting score), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes Sabrient’s Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (“safe havens”) when the market is weak.

Outlook Score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use the ten iShares that represent the ten major U.S. business sectors: Financial, Technology, Industrial, Healthcare, Consumer Goods, Consumer Services, Energy, Basic Materials, Telecom, and Utilities. Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity.

Observations:

1. Financial (IYF) retains the top spot with an Outlook score of 89, while Technology (IYW) scores 77 to stay in second place. The Financial sector displays one of the lowest forward P/Es and the strongest sentiment among both Wall Street analysts (upward revisions to earnings estimates) and company insiders (buying activity). Technology still displays strong factor scores across the board, with a relatively low forward P/E, a solid forward long-term growth rate, the best return ratios, and reasonably good sentiment among both sell-side analysts and company insiders. In third place this week is Healthcare (IYH), which has creeping back up the rankings for the past several weeks, followed by Industrial (IYJ) in fourth.

2. These top four (Financial, Tech, Healthcare, Industrial) are the only ones displaying positive net revisions to consensus earnings estimates among the sell-side analysts. The fundamentals-based rankings still reflect a mostly bullish slant, with economically-sensitive sectors at the top. Only Consumer Services (IYC) continues to show a weak Outlook score among the cyclical sectors.

3. Telecom (IYZ) is in the cellar yet again with an Outlook score of 20, although this score is significantly higher than it has been, and puts Telecom in a tie for the bottom with Consumer Services (a.k.a., consumer cyclicals or consumer discretionary). Telecom scores among the lowest on most of the factors in the model, including the highest forward P/E, lowest return ratios, and a low projected long-term growth rate, although sentiment has noticeably improved among both Wall Street analysts (upward revisions to earnings estimates) and company insiders (buying activity).

4. Looking at the Bull scores, Technology has been the leader on strong market days, scoring 58, followed by Industrial at 56. Utilities (IDU) is the laggard with a score of 46. The top-bottom spread is now at 12 points, reflecting moderate sector correlations on particularly strong market days.

5. Looking at the Bear scores, we finally got a couple of down days to make the scores meaningful. Utilities has been holding up the best (“safe haven”) on recent weak market days, scoring 55, while Materials scores the lowest at 44. The top-bottom spread has widened somewhat to 11 points, which reflects moderate sector correlations on weak market days.

6. Overall, Financial and Technology share the best all-weather combination of Outlook/Bull/Bear scores, while Telecom and Consumer Services are tied for the worst. Looking at just the Bull/Bear combination, Technology displays by far the highest score, indicating excellent relative performance in extreme market conditions (whether bullish or bearish). Basic Materials scores by far the lowest, indicating investor avoidance (relatively speaking) during extreme conditions.

These Outlook scores represent the view once again that Financial and Technology sectors are still relatively undervalued, while Telecom and Consumer Services may be relatively overvalued based on our 1-3 month forward look.

Stock and ETF Ideas:

Overall, the U.S. equity markets seem fine. Although stocks may be headed for a deeper correction, I still believe this pullback is buyable for seeking new highs this year.

Our Sector Rotation Model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or bearish), now suggests holding Technology, Financial, and Healthcare ETFs in the current neutral climate. (The trend moved to neutral when the SPY lost support at its 50-day simple moving average.)

Other ETFs highly-ranked by Sabrient from the Financial, Technology, and Healthcare sectors include the Market Vectors Mortgage REIT Income ETF (MORT), the Technology Select Sector SPDR (XLK), and the Market Vectors Pharmaceutical ETF (PPH).

For an “enhanced” sector portfolio that employs top-ranked stocks rather than ETFs, some long ideas from Financial, Technology, and Healthcare include Ameriprise Financial (AMP), Signature Bank (SBNY), QUALCOMM (QCOM), IAC/InterActiveCorp (IACI), Biogen Idec (BIIB), and Salix Pharmaceuticals (SLXP), all of which are ranked highly in the Sabrient Ratings Algorithm.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.