We got our shorts in – how about you?

We got our shorts in – how about you?

As promised yesterday, we took advantage of the Yellen rally to add more short positions to our Short-Term Portfolio and I sent out an Alert to all of our Members at 10:45, which gave us just enough time to take advantage of what Dave Fry called "sloppy and indecisive trading" on the S&P.

We pressed our short bet on WYNN ($224), FAS ($85) and long on SCO (ultra-short oil) at $29.77 and long on TZA (ultra-short Russell) at $17.90. We also added the SLW/CI bullish spread we discussed in the morning post, as we really didn't have any confidence in the indexes holding those levels. Silver is holding steady this morning while the indexes are plunging – so it looks like we made a good choice.

Of course we used our option strategies for hedging and leverage and, if you are not a Member, you'll be able to read all about them in the next Monthly Trade Review.

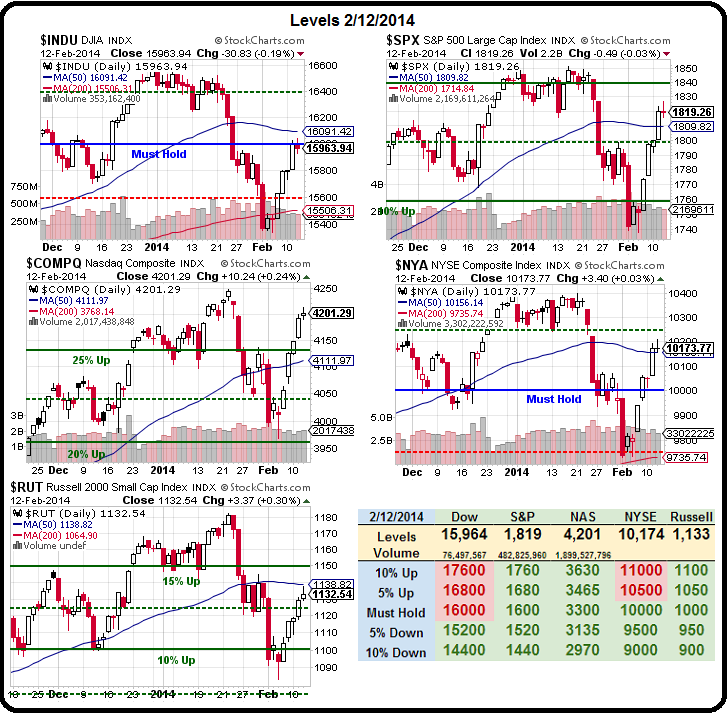

We have been bothered by the light volume all the way up as it's an indicator of a fake, Fake, FAKE market rally that can be quickly undone once real sellers show up again. That worked just great for us because, in the morning post, I said we were shorting the Dow Futures (/YM) at 15,950 and Oil Futures (/CL) at $100.66.

We have been bothered by the light volume all the way up as it's an indicator of a fake, Fake, FAKE market rally that can be quickly undone once real sellers show up again. That worked just great for us because, in the morning post, I said we were shorting the Dow Futures (/YM) at 15,950 and Oil Futures (/CL) at $100.66.

There was a bit of volatility in between but oil is at $99.66 this morning for a $1,000 per contract gain and the Dow is at 1,850 for a $500 per contract gain. We also liked a gold short (/YG) at $1,290 and we did dip to $1,286 but now back to $1,293 on a much weaker Dollar (80.35) and I also told you not to short gold unless the Dollar is over 80.85.

As usual, I can only tell you what's going to happen and how to play it – the rest is up to you.

As usual, I can only tell you what's going to happen and how to play it – the rest is up to you. ![]()

8:30 Update: As we expected, January Retail Sales were HORRIFIC – down 0.4% after being down 0.1% in December. I guess we can still use weather as an excuse, since we still have weather and all… The usual 339,000 people lost their jobs last week but, since NFP tells us we're not actually hiring anyone – shouldn't this be more of a concern than it is?

We'll just have to see how all this plays out into the long weekend (Monday is President's day and today is a blizzard in NY and tomorrow is Valentine's day so very meaningless until next week) and then next week we have a ton of data and the last really big week of earnings.

Be careful out there!