So close – and yet so far.

So close – and yet so far.

All but the Dow have fully recovered from the January drop and the Nasdaq is making up for it by going 50 points over the previous 4,250 high (1.2%). Is it a clear indication of a breakout or a silly spike higher with heavyweights like NFLX, TSLA, GOOG and PCLN acting like 1999-style dot com stocks?

TSLA is priced at 100 times FORWARD earnings, NFLX about the same, PCLN (26) and GOOG (23) are relative bargains by comparison and AAPL (our trade of the year), with a market cap of $465Bn against $40Bn of earnings would seem like a great deal, by comparison (even if you ignore their $180Bn in cash), yet they have, so far, been sitting out the market rally at $520.

This is just what it was like in 1998 and 1999, when people who owned "sensible" stocks like IBM, GE, AT&T, McDonalds, Ford, etc. were punsihed while Webvan (the old Amazon), Microstrategy (survivor), WorldCom (the old MCI), Inktomi (the old Oracle), Lycos (the old Google), Pets.com (the old nothing), Broadcast.com (the old NFLX), etc were valued at 100x earnings and more (the average p/e for the Nasdaq in 1999 was 78 times earnings).

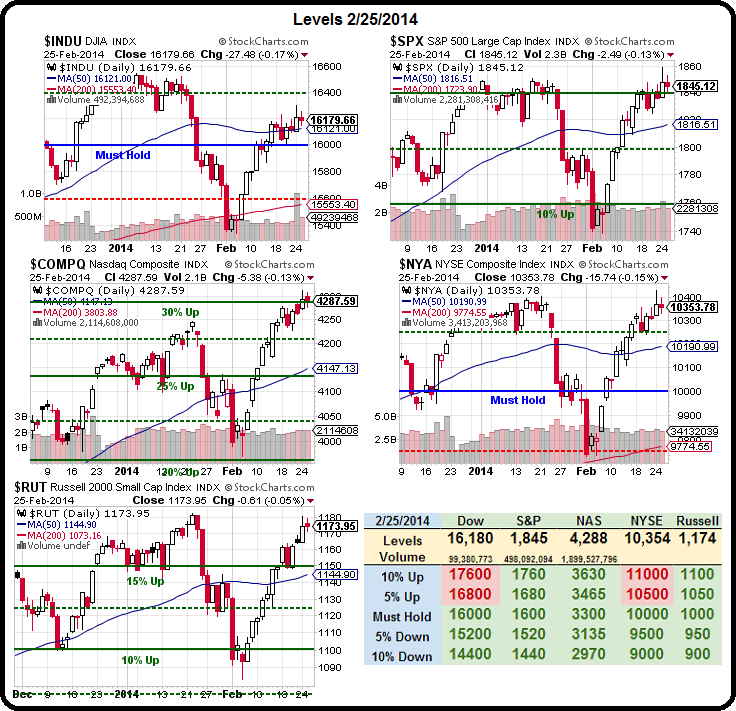

A contrarian investor would have done very well for themselves in the 2000-2003 collapse, but only if they survived the run-up! That's why I called for CASH!!! last week, not shorting, other than a few 500% hedges that are to be pulled with small losses if the indexes do manage to get over their previous highs (3 of 5, and it has to hold for 2 full days) of Dow 16,588, S&P 1,850, Nasdaq 4,250, NYSE 1,0406 and Russell 1,182.

If they can do that, we can get more bullish but, if they can't – why should we? Sometimes, the only winning move is not to play and this is a very good time not to be playing.

If they can do that, we can get more bullish but, if they can't – why should we? Sometimes, the only winning move is not to play and this is a very good time not to be playing.

I THINK the market is not strong enough to get over this hump at this time. I THINK these high-flying momentum stocks are being used to mask a broader exit of the indexes by the Banksters, who cover their tracks with a string of upgrades to excite the Retail Investors while they privately urge their High Net-Worth clients to "diversify" out of equities (after they have dumped their own holding, of course).

That was the game in 1999, as poster-boy Yahoo, got almost daily upgrades from analysts who were happy to explain to investors how they needed to understand the new economy and what a game-changer Yahoo (and, by extension, their whole "space") was and how, while the valuations may seem "stretched" at the moment, it would seem like a relative bargain in retrospect.

Keep in mind that the p/e of Yahoo averaged "just" 78.4, outside of the 1999 spike yet they are only now, 10 years later, back to their 2004 highs. With $1.4Bn in income and a $38Bn market cap (p/e 27), YHOO is now a relative bargain stock compared to TSLA, who have also run up 10x in two years and have a $30Bn market cap on MAYBE $250M in earnings (if all goes well) for 2014. That's a FORWARD p/e of 120 and YHOO topped out at 253x earnings, so maybe TSLA has room to grow – but that's PRICE, never VALUE.

If you are short-term investor – don't worry about value – it's not that important. Yesterday, in our Member Chat Room, we went long on oil and short on oil and long on oil and short on oil and long on oil and short on oil and were hitting about $500 per contract on each swing – value has NOTHING to do with those kinds of trades.

If you are short-term investor – don't worry about value – it's not that important. Yesterday, in our Member Chat Room, we went long on oil and short on oil and long on oil and short on oil and long on oil and short on oil and were hitting about $500 per contract on each swing – value has NOTHING to do with those kinds of trades.

I spoke about VALUE in yesterday's Live Webcast (replay available here) and this morning I found a nice article that summarizes the discussion we were having.

ITMN went up 170% yesterday. There's a reason for that, they had positive Phase-3 data for Ascend (lung disease treatment), which had previously been rejected by the FDA and took them down 95% from the 2011 highs of $50. So the 170% gain is "back on track" and reflect a possible reality (the drug being approved, massive sales) and a situation that has absolutely changed for the company – FOR A FACT.

As you can see from the long-term charts, the stock makes crazy swings but, as VALUE investors, my comment to our Members way back in May of 2010 was an excellent strategy:

ITMN – I like playing them when they are down under $20 (hedged to under $10, I think it was) but once they pop they become ridiculously dangerous, as you see. You can just sell a dozen Oct $12.50 puts on the assumption that they are once again worth about the $15 they were trading at and at least they are 1/2 premium and realistically rollable. Should be less margin too.

At the time (5/5/10), the stock had just tumbled off it's highs and we took advantage to BE THE HOUSE – by selling Oct 2010 $12.50 puts for $4.50 with the stock at $10, which gave us a net $8 entry and $4.50 of upside if ITMN bounce back over $12.50. Since our worst-case was having a long-term position on ITMN at net $8 (where we could sell more options for income) – we liked the VALUE of the trade – even though the chart, at the time, looked like a hopeless disaster. Value investing strategies are only effective if you are willing to ride out the dips (preferably using our scaling strategies) and sell into pops – LIKE THIS ONE!

We have many stocks that we've had to say goodbye to, like IRBT (our Stock of the Century) and TASR (our Stock of the Decade) as their PRICE raced ahead of our VALUE (so no new entries and we take some off the table). If they have a mishap at some point, and get cheap again, we will be ready to BUYBUYBUY more with conviction. Meanwhile, we can find plenty of other bargains with our CASH!!!